Acquisition of Shares in Succession After 7 Years Since 2015

Approximately 370,000 Shares Purchased on the Market Over 25 Transactions in the Last Two Months

Sale Considered in 2019... "No Intention to Sell" This Month

New Business Started Last Year... Operating Profit Up 151%

[Asia Economy Reporter Choi Seoyoon] Interest is focused on the background as Hyosung Group Chairman Cho Hyun-joon has been consecutively buying shares of Galaxia SM, which he had attempted to sell, after 7 years. Galaxia SM is one of the so-called ‘Galaxia Group’ affiliates independently managed by Chairman Cho in a small group form. Chairman Cho holds 80% of the shares of Trinity Asset Management, the largest shareholder of Galaxia SM, and the structure is Chairman Cho → Trinity Asset Management → Galaxia SM.

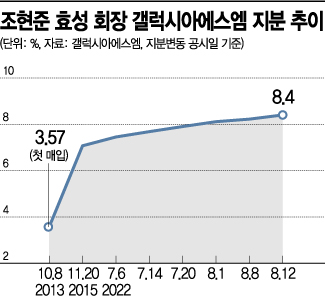

According to the Financial Supervisory Service’s electronic disclosure system on the 22nd, Chairman Cho purchased Galaxia SM shares listed on the KOSPI market 25 times from June 29 to the 12th of this month, amounting to 680 million KRW (365,913 shares). Chairman Cho’s stake increased from 7.07% to 8.4%. The stock price of Galaxia SM, which had fallen to 1,475 KRW in June, began to rise as Chairman Cho acquired shares, increasing by 14% to 2,035 KRW as of the 19th.

Galaxia SM is a company whose shares were acquired 17.84% by Trinity Asset Management, wholly owned by the three brothers Cho Hyun-joon, Hyun-moon, and Hyun-sang, in November 2008, and later increased its stake to incorporate it as an affiliate of Hyosung Group in 2011. Trinity Asset Management, holding 22.41%, is the largest shareholder, followed by Chairman Cho, Shindongjin Co., Ltd., and Hyosung Vice Chairman Cho Hyun-sang in order of shareholding.

Chairman Cho first became a shareholder in 2013 by purchasing 700,000 shares over-the-counter from Lee Hee-jin, president and co-founder of IB Worldwide. On the same day, his younger brother Vice Chairman Cho Hyun-sang also purchased shares, and in November 2015, the company changed its name to Galaxia SM.

Due to continued deficits, there have been rumors of a sale for the past three years. In July 2019, when the sale rumors were at their peak, the stock price rose to the daily limit (29.95%). However, in a disclosure on the 16th, the company stated, "The largest shareholder considered selling shares but ultimately confirmed no intention to sell," making the sale a non-issue.

After years of poor performance, results have recently improved. As of last year, sales reached 28.9 billion KRW with an operating profit of 3.5 billion KRW, increasing by 48% and 151% respectively compared to the previous year. Net profit rose 274% to 3.7 billion KRW. The strong performance has continued into the first half of this year. The company explained that the improvement in results was due to successful health equipment sales and golf-related businesses (such as golf practice range operations) benefiting from COVID-19 special demand.

Galaxia SM used to generate 100% of its sales from sports marketing, but after signing an exclusive domestic distribution contract with Technogym, the world’s number one fitness equipment company from Italy, in January last year, it started the health equipment sales business. As of the first half of this year, the sales ratio changed to 54% sports marketing and 46% health equipment sales.

Professor Kim Woo-chan of Korea University Business School said, "Chairman Cho is personally increasing his direct stake in the company, which is improving its performance through new businesses, rather than Trinity Asset Management, the largest shareholder of the company, buying the shares." He added, "This appears to reflect Chairman Cho’s intention to maximize future profits by increasing his personal ownership in the company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.