Goldman Sachs and Nomura Lower This Year's China Economic Growth Forecast to Below 3%

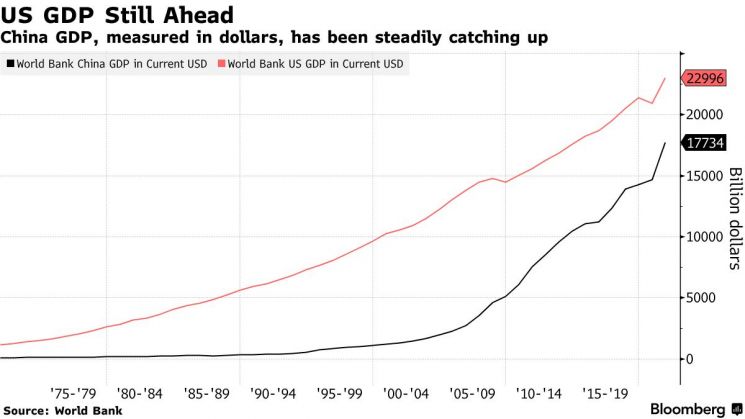

[Asia Economy Reporter Park Byung-hee] Former U.S. Treasury Secretary Larry Summers said that the prediction that China's economic size will surpass that of the United States will turn out to be a mistaken forecast, similar to past cases involving Japan and Russia.

According to Bloomberg News on the 17th (local time), former Secretary Summers appeared on Bloomberg TV that day and said, "Just six months or a year ago, it was taken for granted that China's gross domestic product (GDP) would eventually surpass that of the U.S., but now it has become much more uncertain."

As Summers mentioned, last year there were numerous forecasts that China would overtake the U.S. around 2028. This was because, amid the global economic turmoil caused by COVID-19, China was the only major economic power experiencing 'solo growth.'

The U.S. think tank Brookings Institution predicted in January last year that China's economy would surpass the U.S. economy by 2028, and in February, Bank of America (BOA) forecasted that China would overtake the U.S. around 2027-2028. Nomura Securities of Japan also anticipated 2028 as the year China would become the world's largest economy, noting that if the yuan strengthens, this timing could be brought forward to 2026.

However, former Secretary Summers pointed out that there were past predictions that Russia and Japan's economies would surpass the U.S., but all of those were wrong, and he expects the same situation to repeat this time. Summers said, "Someday, people will look back at the 2020 forecasts for China's economy in the same way they looked back at the 1960 forecasts for Russia's economy and the 1990 forecasts for Japan's economy."

Former Secretary Summers pointed out that the Chinese economy is facing an all kinds of challenges. He cited excessive debt, the absence of clear growth drivers to lead the future economy, increased interference by the Communist Party in corporate management, demographic changes such as an aging population and a declining labor force as risks facing the Chinese economy. According to Bloomberg's data, as of the second quarter of this year, China's total debt-to-GDP ratio reached 271%, surpassing the previous record high of 270.3% set in the third quarter of 2020.

In fact, concerns about the Chinese economy are growing as recent economic indicators such as July retail sales and industrial production have shown weakness. The National Bureau of Statistics of China released data on the 15th showing that retail sales and industrial production growth rates were 2.7% and 3.8%, respectively, both falling short of Bloomberg's compiled expert forecasts of 4.9% and 4.3%.

CNBC reported that Goldman Sachs and Nomura Securities lowered their forecasts for China's economic growth rate this year to below 3%. Goldman Sachs revised its forecast down from 3.3% to 3.0%, and Nomura lowered it from 3.3% to 2.8%.

Goldman Sachs cited the weak July economic indicators and the expected short-term energy shortage as reasons for the downward revision. Goldman Sachs predicted that the unusual heatwave would cause energy supply shortages, disrupting factory operations. Nomura pointed out that the zero-COVID policy is expected to continue until March next year, which will burden the economy. Both Goldman Sachs and Nomura commonly noted that China's stimulus measures could be much more limited than expected, which is also a negative factor.

Summers explained that the current slowdown in China's economy is lowering commodity prices, which in turn helps reduce some of the inflationary pressures in the U.S. He attributed the recent decline in long-term U.S. inflation expectations to the drop in commodity prices such as crude oil. However, he predicted that core inflation expectations, excluding food and energy items, would not fall rapidly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.