Overall Performance Growth Despite Global Economic Recession Concerns

Improvement Centered on Secondary Batteries and Semiconductors

[Asia Economy Reporter Lee Myunghwan] The earnings of companies listed on the KOSDAQ market in the first half of this year showed a significant increase compared to the same period last year. By industry, IT components such as secondary batteries and semiconductor companies showed the largest improvement in performance.

On the 18th, the Korea Exchange analyzed the consolidated financial results of companies listed on the KOSDAQ market for the first half of the 2022 fiscal year. Their consolidated sales and operating profit for the first half of this year grew by 22.3% and 16.74%, respectively, compared to the same period last year. Net profit also increased by 5.55% during the same period.

The Korea Exchange explained that while KOSDAQ-listed companies achieved strong performance, the IT components and semiconductor sectors, represented by the secondary battery field, led the increase in earnings. In particular, operating profit margins improved, enhancing profitability. In the first half of this year, adverse factors such as the Russia-Ukraine war, interest rate hikes, and sharp rises in raw material and oil prices occurred consecutively. Concerns about a global economic recession also arose as a result.

By KOSDAQ industry, ▲IT components ▲semiconductors ▲metals ▲medical and precision instruments ▲pharmaceuticals led the improvement in earnings. Among them, sales in IT, manufacturing, and other industries showed an average growth rate of over 20%.

The sales growth rate of the IT sector was 22.54% and 21.49% in the second quarter and the first half, respectively. The operating profit growth rates were 15.33% and 25.69%. Looking at detailed sectors, sales and operating profit of IT components increased by 34.62% and 198.56%, respectively. The semiconductor sector also showed growth with sales up 14.53% and operating profit up 23.29%.

In manufacturing, sales and operating profit increased by 19.58% and 19.50%, respectively, compared to the same period last year, but net profit decreased by 2.36%. Among manufacturing sectors, the metal industry saw sales and operating profit increase by 33.69% and 59.14%, respectively. Net profit also rose significantly by 109.91%.

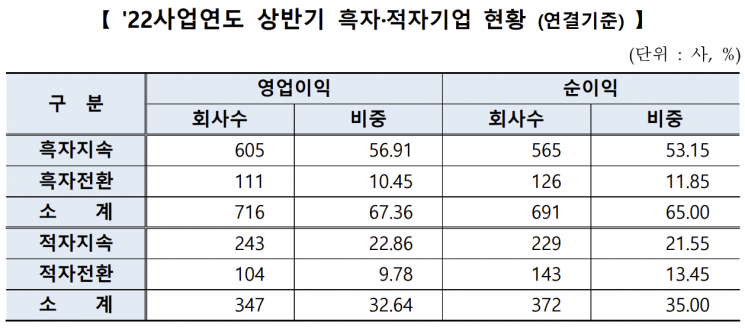

Among companies that reported consolidated financial results, 65%, or 691 companies, posted profits in the first half of this year. On the other hand, 35%, or 372 companies, recorded losses. Among the profitable companies, 53.15% (565 companies) maintained profits, and 11.85% (126 companies) turned profitable in the first half of this year. Among the loss-making companies, 21.55% (229 companies) continued to incur losses, and 13.45% (143 companies) turned to losses.

However, listed companies engaged in the financial industry posted somewhat disappointing results. Operating profit and half-year net profit of 47 financial industry listed companies decreased by 118.55% and 117.08%, respectively, compared to the same period last year. The Korea Exchange explained that the main cause appears to be the reflection of valuation losses on investment assets such as listed stocks due to the overall recession in the international financial market. However, unlike pure financial industry listed corporations, other financial industries including general holding companies such as Harim Holdings and Haesung Industry showed performance linked to the operating companies' results.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)