Demand for Shareholder Returns and Stock Price Support

306 Treasury Stock Acquisition Disclosures This Year

More Than Double Compared to Last Year

Stock Price Fluctuations Around 2% After Disclosure

Generally Positive for Stock Price but

Effectiveness Limited Due to Unclear Utilization

Burning Shares Needed for Long-Term Support

[Asia Economy Reporter Lee Myunghwan] The number of public disclosures regarding treasury stock acquisitions by listed companies has nearly doubled compared to last year. This increase appears to be driven by mounting demands from individual investors for shareholder returns and stock price support, leading companies to acquire more treasury shares. However, the securities industry points out that treasury stock acquisitions must lead to cancellations to truly function as shareholder return policies.

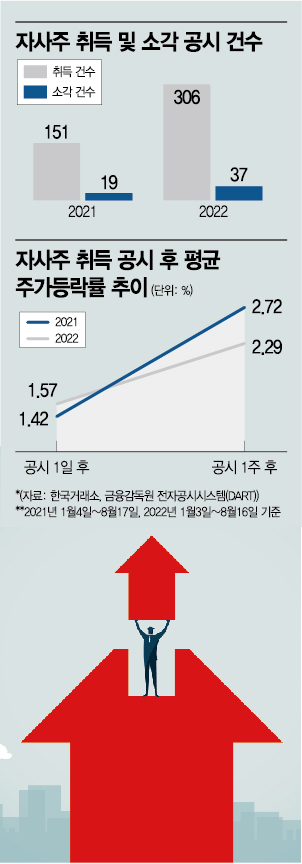

According to the Korea Exchange on the 18th, from January 3 to August 16, a total of 306 treasury stock acquisition disclosures were recorded among companies listed on the KOSPI, KOSDAQ, and KONEX markets. This figure is about twice the 151 disclosures during the same period last year (January 4 to August 17).

Generally, treasury stock acquisitions by companies are perceived as positive news in the market. The reduction in the number of outstanding shares due to the acquired treasury stock can be expected to have a stock price boosting effect. There is also a view that treasury stock acquisitions demonstrate a company's strong cash mobilization capability. Companies often state that the purpose of their treasury stock acquisitions is to enhance shareholder value and stabilize stock prices in their disclosures.

However, the number of cases where acquired treasury stock is canceled is not as high as the number of acquisitions. An analysis of disclosures from the Financial Supervisory Service's electronic disclosure system (DART) by Asia Economy shows that there were 37 disclosures of treasury stock cancellations this year. Although this is an increase from 19 cases during the same period last year, considering that the number of treasury stock acquisition disclosures roughly doubled during this period, the proportion of cancellations remains similar to last year.

The stock price boosting effect of companies that disclosed treasury stock acquisitions also does not appear to be significant. The average stock price fluctuation rate of companies that disclosed treasury stock acquisitions this year was around 2%. The average stock price fluctuation rate the day after the acquisition disclosure was 1.57%, and one week after the disclosure, it was 2.29%. Similar figures were observed last year, with an average fluctuation rate of 1.42% one day after disclosure and 2.72% one week later.

The securities industry emphasizes that companies must proceed from treasury stock purchases to cancellations for these actions to serve as shareholder return policies. The reason domestic companies' treasury stock acquisition announcements do not immediately lead to stock price increases is that shareholders find it difficult to understand exactly how these acquisitions will be utilized. Lee Sangheon, a researcher at Hi Investment & Securities, said, "If treasury stock repurchases lead to cancellations, it can be the most important factor to overcome undervaluation of stock prices," adding, "Since treasury stock must be canceled to see a definite mid- to long-term stock price boosting effect, whether or not treasury stock is canceled in the future could be the most decisive variable in shareholder return policies."

There is also an analysis that treasury stock repurchases are widely used as a means of defending management rights domestically. Treasury stocks usually have limited voting rights, so acquiring treasury stock reduces the number of shares with voting rights. This relatively strengthens the voting power of controlling shareholders' holdings. There is also the possibility that companies might hold the acquired treasury stock without canceling it and later sell it to groups friendly to the controlling shareholders. The researcher noted, "When treasury stock repurchases lead to cancellations, it can reduce the possibility of controlling shareholders abusing treasury stock and allow corporate governance improvements to take full effect."

Meanwhile, the disposal of treasury stock, where companies release their held shares back into the market, has decreased. The number of treasury stock disposal disclosures, which was 50 cases in 2021 (January 4 to August 17), dropped to 18 cases as of August 16 this year. Since treasury stock disposal increases the number of outstanding shares by putting company-held shares back into the market, it is perceived as negative news for stock prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.