[Asia Economy Reporter Minji Lee] There is an analysis that the trend of improvement in banks' net interest margin (NIM) will continue until early next year.

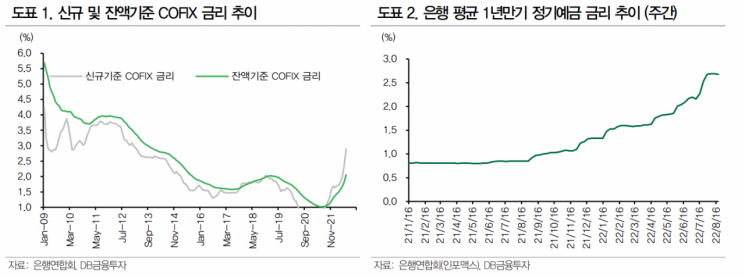

On the 18th, the Korea Federation of Banks announced that last month's new standard COFIX rate rose by 52 basis points (1bp=0.01 percentage point) from the previous month to 2.9%. This was because, despite long-term interest rates already reflecting a high level of expectations for rate hikes, the time deposit interest rates sharply increased after the Financial Monetary Policy Committee raised the base rate by 50bp on the 14th of last month.

The COFIX rate corresponds to the average funding cost of banks, and generally, the new standard COFIX rate, which is the average new funding cost for the current month, is used as the benchmark interest rate for loans. The new standard COFIX rate is most influenced by time deposit interest rates, which have continued to rise reflecting the base rate hikes.

Generally, the outstanding balance-based COFIX rate reflects the increase in the new standard COFIX rate over a considerable period, so the widening gap between new and outstanding COFIX rates is expected to continue until August. Lee Byung-geon, a researcher at DB Financial Investment, estimated that "banks' NIM rose by about 3bp last month," and added, "Since the time deposit interest rates that rose until the end of July have not yet been fully reflected in COFIX, the COFIX rate will rise in August as well, leading to an additional increase in banks' NIM." The banks' NIM in the third quarter is predicted to expand by more than 5bp compared to the same period last year.

With further base rate hikes expected, the trend of NIM improvement is projected to continue until the end of this year or early next year. The magnitude of the increase is also expected to be higher than currently anticipated. Once the upward trend concludes, NIM is expected to decline by about 5 to 10bp and stabilize. Researcher Lee Byung-geon stated, "Considering the current steep rise, the level at which NIM stabilizes will be higher than the NIM in the second quarter," and added, "This supports a positive investment judgment for banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.