Total Revenue of Top 3 Telecom Companies in H1 Reaches 5.2366 Trillion KRW, Down 5% YoY

[Asia Economy Reporter Oh Su-yeon] As the cash and cash equivalents of the three major mobile carriers have decreased, concerns are deepening over a potential decline in sales due to the introduction of a mid-tier plan in the second half of the year. They are actively fostering non-telecom new businesses to reduce the proportion of telecom sector performance, but while there are many expenses such as additional investments in 5G base stations, their coffers are running low.

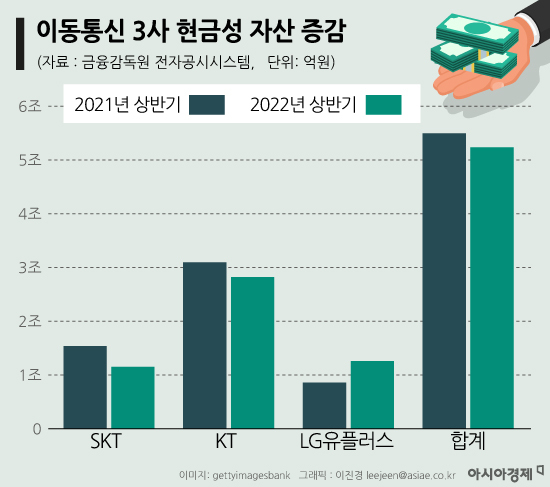

Cash and Cash Equivalents Decreased by 5% in the First Half

According to the Financial Supervisory Service's electronic disclosure system on the 17th, the total cash and cash equivalents of the three major mobile carriers in the first half amounted to 5.2366 trillion KRW, down about 4.7% from 5.4973 trillion KRW in the same period last year.

SK Telecom's cash and cash equivalents stood at 1.1529 trillion KRW, down about 25.1% from 1.5393 trillion KRW in the same period last year, marking the largest decrease among the three carriers. KT recorded 2.8217 trillion KRW, down 8.9% from 3.097 trillion KRW during the same period. LG Uplus increased to 1.2619 trillion KRW, up 46.6% from 861 billion KRW in the same period last year, the only increase among the three, but this is merely a temporary phenomenon due to corporate bonds.

Cash and cash equivalents represent a company's capacity to invest immediately in new businesses or mergers and acquisitions (M&A) without needing to take out loans.

Although it is the fourth year since the introduction of 5G, the investment burden on the three carriers remains heavy. They must establish 5G networks in 85 administrative districts and major towns nationwide by this year. Massive investments in base stations and other facilities are required to fulfill the promised base station investments to the government. In addition, they must also invest in new businesses to find new revenue sources amid stagnation in the telecom business. The three carriers are expanding investments in new businesses across various fields such as artificial intelligence (AI), big data, cloud, and media.

Despite these efforts, about 58% of KT’s revenue still comes from wired and wireless telecom sectors. LG Uplus’s wireless business accounts for 45.6% of its total revenue. SK Telecom, which spun off its non-telecom business into SK Square last November, derives most of its revenue from wired and wireless telecom business income.

5G Mid-Tier Plan Introduction Expected to Lower ARPU

The three carriers are worried about a decline in sales due to the impact of the 5G mid-tier plan in the second half. With the introduction of the mid-tier plan, the decline in average revenue per user (ARPU) has become a foregone conclusion, meaning incoming revenue is decreasing while expenses are increasing.

Since last year, political circles and civic groups have raised the need for various pricing tiers, including mid-tier plans. The three carriers have delayed launching the mid-tier plans as long as possible to reduce the impact on their performance, engaging in a waiting game. SK Telecom launched a 59,000 KRW/24GB mid-tier plan on the 5th. KT filed for a 61,000 KRW/30GB mid-tier plan on the 11th and plans to launch it on the 23rd. LG Uplus plans to file within this month.

The CEOs of the three carriers have also expressed financial concerns over the introduction of the mid-tier plan. KT CEO Koo Hyun-mo said to reporters after a meeting with Minister Lee Jong-ho of the Ministry of Science and ICT last month, "It is true that profitability will worsen." LG Uplus CEO Hwang Hyun-sik also stated, "We will face significant financial pressure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)