Hanwha Solutions, Korea Zinc, etc. ↑

ESG Investment Activation Expected

[Asia Economy Reporter Myunghwan Lee] As U.S. President Joe Biden signed the so-called Inflation Reduction Act (IRA), companies listed on the domestic stock market are expected to benefit, especially those in the green energy industry and secondary batteries. This is because the law includes tax benefits for the green energy sector. However, there are concerns that domestic automakers producing electric vehicles may be disadvantaged as they could be excluded from subsidy support.

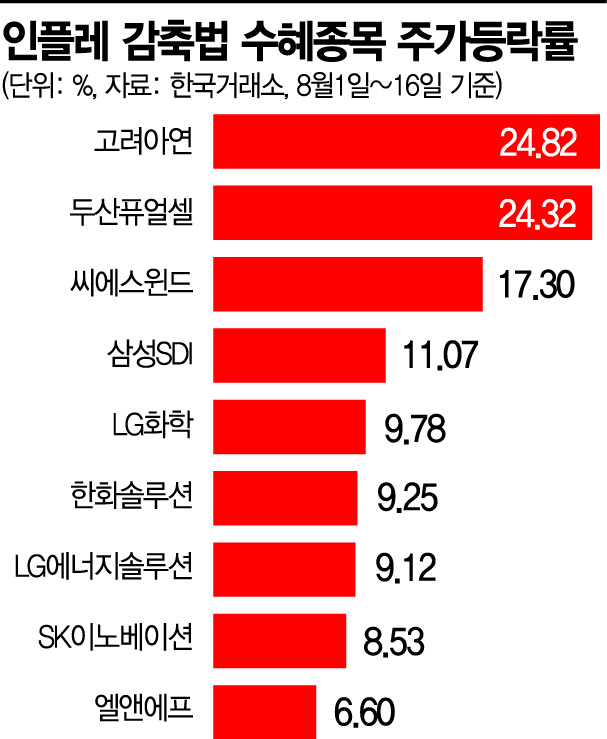

According to the Korea Exchange on the 17th, stock prices of companies expected to benefit have been rising continuously following the passage of the Inflation Reduction Act through both houses of the U.S. Congress.

Hanwha Solutions’ stock price, which was 43,800 KRW on the 1st of this month, closed at 47,850 KRW on the 16th, marking a 9.25% increase. During the same period, Korea Zinc rose from the 480,000 KRW range to 596,000 KRW, recording a 24.82% increase. Secondary battery-related stocks such as Samsung SDI (11.07%) and LG Chem (9.78%) also showed upward trends.

The securities industry analyzed that the passage of this reduction law has secured growth momentum for domestic green energy companies. Byung-hwa Han, a researcher at Eugene Investment & Securities, said, "The U.S. is already the largest market for domestic green industry companies, but with the confirmation of this green stimulus plan, the benefits will increase further in the future," and advised, "We recommend mid- to long-term investment in domestic green industry-related stocks overall."

Secondary battery companies are also expected to benefit in the long term. Cheol-hee Jo, a researcher at Korea Investment & Securities, said, "Among the three domestic secondary battery companies (LG Energy Solution, SK On, Samsung SDI), both benefits and disadvantages exist, but it will be more difficult for Chinese secondary battery companies such as CATL to enter the U.S. market, so the long-term benefits are greater," adding, "Excluding China’s CATL, the quality and supply stability of the three domestic companies’ secondary batteries are the highest, and joint ventures (JVs) and long-term supply contracts with major manufacturers in North America, Europe, and Japan preparing to sell electric vehicles will continue."

However, the fact that electric vehicles from domestic automakers such as Hyundai Motor and Kia are excluded from subsidy support could work against them. Only electric vehicles produced in the U.S. that use batteries and key minerals manufactured in the U.S. above a certain ratio are eligible for benefits. Eun-young Lim, a researcher at Samsung Securities, said, "Hyundai Motor and Kia urgently need to secure local production of electric vehicles, finalize battery joint ventures, and procure raw materials," and predicted, "Competition for securing materials within North America among automakers is expected to intensify."

There is also a view that ESG (Environmental, Social, and Governance) investment will be activated. Hwa-jin Lee, a researcher at Hyundai Motor Securities, said, "(The Inflation Reduction Act) will benefit companies in electric vehicles, solar power, wind power, and other renewable energy sectors," and diagnosed, "It is also expected to influence the change in market participants’ awareness of ESG and climate change response, which seemed to have retreated due to the Russia-Ukraine war."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.