[Asia Economy Reporter Changhwan Lee] In the first half of this year, disputes over insurance claim payments between insurance consumers and non-life insurance companies reached an all-time high. It is understood that related disputes have surged as insurance companies increasingly refuse to pay indemnity medical insurance claims due to excessive cataract treatments. With lawsuits also underway, it is expected that the disputes will be prolonged.

According to the Financial Supervisory Service and the Korea Non-Life Insurance Association on the 17th, the number of dispute mediation applications received by domestic non-life insurers in the first half of this year was 18,571, the highest ever for the same period. This is a 42% increase compared to 13,068 cases in the first half of last year. The number of lawsuits filed in court during disputes was 50, about 11% more than last year's 45 cases.

Complaints also increased significantly, with 23,800 complaints received by domestic non-life insurers in the first half of the year, up 23% from 19,298 in the same period last year.

Insurance consumers can apply for dispute mediation or file complaints with the Financial Supervisory Service if conflicts arise with insurance companies over claim payments or calculation methods. The Financial Supervisory Service classifies the cases as dispute mediation or complaints depending on the degree of conflict and encourages parties to reach an agreement. Consumers dissatisfied with dispute mediation may also file lawsuits in court.

The significant increase in insurance-related disputes in the first half of this year compared to previous years is analyzed to be due to insurance companies strengthening their review of indemnity insurance claims, resulting in more cases of claim refusals.

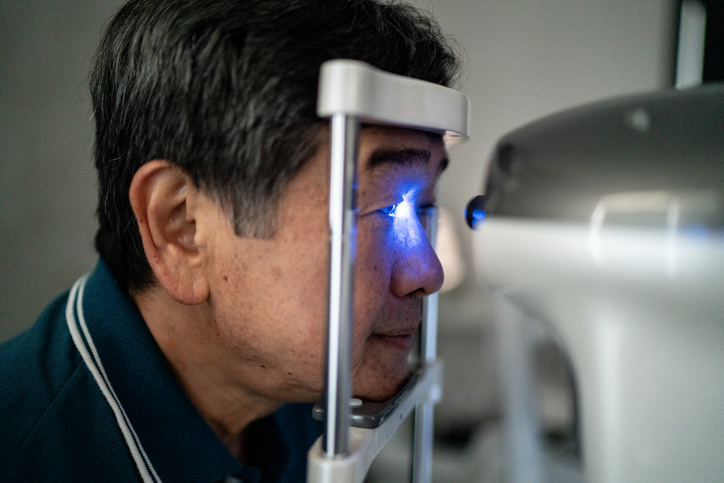

Insurance companies particularly strengthened the review of payments related to cataract surgeries. This is because excessive treatment for cataracts increased mainly in ophthalmology clinics and hospitals in Gangnam, causing an abnormal surge in indemnity insurance claims.

In the first quarter of this year, indemnity insurance payments for cataract surgeries reached 457 billion KRW, the highest ever on a quarterly basis. Last year, the average loss ratio of indemnity insurance for domestic insurers was 131%, raising concerns that the loss ratio could soar further due to cataract surgeries.

In response, the Financial Supervisory Service, the National Police Agency, and the Insurance Association operated a special reporting system for cataract insurance fraud with rewards, cracking down on excessive cataract treatments at ophthalmology clinics and hospitals.

Concerns are also emerging that conflicts will be prolonged as disputes escalate to lawsuits. The Citizens' Coalition for the Recovery of Indemnity Insurance Rights (Silsoyeon) gathered about 300 people who did not receive indemnity insurance payments from insurers and filed a joint lawsuit against 10 insurance companies that refused to pay indemnity insurance claims in June.

Silsoyeon stated, "As the proportion of cataract surgery costs in indemnity insurance increases, insurance companies are unfairly refusing to pay claims by unilaterally strengthening claim reviews that are not stipulated in the policy terms."

Silsoyeon plans to recruit more plaintiffs and continue with a second lawsuit, so the number of lawsuit participants is expected to increase significantly. An industry insider said, "As the number of lawsuits related to cataract insurance payments is increasing, it is inevitable that the conflicts will be prolonged."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.