Electricity Purchase Price in First Half: 140.1 KRW

Sale Price: 110.4 KRW... 29.7 KRW Loss

Persistent Deficit Structure, Urgent Need for Rate Increase

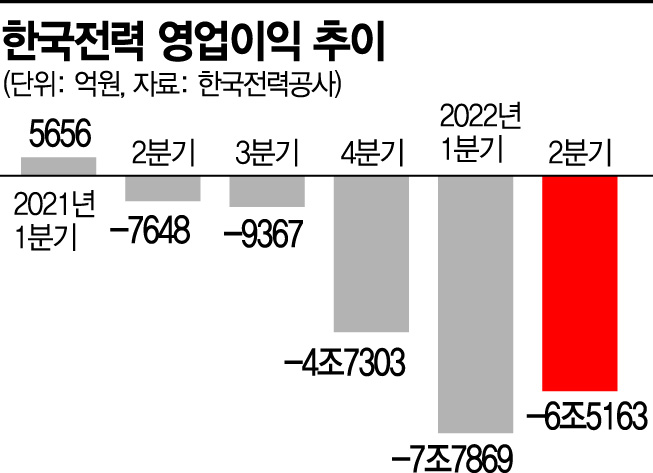

Korea Electric Power Corporation (KEPCO) reportedly sold electricity at a loss of 30 won per kWh in the first half of this year due to the sharp rise in fuel prices such as liquefied natural gas (LNG) and coal.

As KEPCO's deficit management, which results in losses the more it sells, becomes entrenched, additional increases in LNG import prices are also expected from November, when global heating demand peaks. This has led to analyses emphasizing the urgent need for further electricity rate hikes to normalize the power industry ecosystem.

According to KEPCO's recently released Monthly Electricity Statistics Report on the 16th, the average electricity purchase price in the first half of this year was 140.1 won per kWh, up 50.9% compared to the same period last year. In contrast, the selling price rose only 5.5% to 110.4 won. This means KEPCO sold electricity at a loss of 29.7 won per kWh throughout the first half.

The entrenched negative margin structure at KEPCO is due to the delay in actual electricity rate increases despite the sharp rise in fuel prices such as LNG and coal. According to KEPCO, the LNG price in the first half of this year was 1,344,100 won per ton, up 132.7% year-on-year, and the price of thermal coal was $318.8 per ton, up 221.7%.

In contrast, electricity rates were raised twice?in April (6.9 won per kWh) and July (5.0 won)?but these increases have been far from sufficient to normalize KEPCO's management. Although a 4.9 won per kWh increase is scheduled for October, the maximum annual increase is capped at 5 won per kWh, making additional hikes by the end of the year difficult.

The problem is that from November, when global heating demand peaks mainly in the Northern Hemisphere, there are concerns about further rises in international fuel prices such as LNG. In this case, the electricity market price (SMP), which serves as the basis for KEPCO's power purchases from power producers, could break its record high again following April's 202.11 won per kWh, accelerating the deficit structure.

KEPCO requested the Ministry of Trade, Industry and Energy to raise the actual fuel cost adjustment by 14.8 won in the first quarter, 33.8 won in the second quarter, and 33.6 won in the third quarter of this year, but the request was rejected.

The balance of corporate bonds issued by KEPCO, which continues deficit management, is expected to reach its limit in the second half of this year. As of the 12th, KEPCO's corporate bond issuance balance stood at 54.5 trillion won, increasing by 1.3 trillion won in one month. This is why the industry warns that if KEPCO does not normalize rates this year, the deficit could reach up to 30 trillion won.

Yoo Seung-hoon, dean of the College of Creative Convergence at Seoul National University of Science and Technology, diagnosed, "In reality, KEPCO needs to raise rates by at least twice per kWh to escape the deficit structure in the first half. If global heating demand intensifies this winter, KEPCO will reach a situation where it is difficult even to cover power purchase costs such as LNG."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.