[Asia Economy Reporter Hwang Yoon-joo] The return on exchange-traded funds (ETFs) investing in crude oil production companies has attracted attention by recording 20% despite the downward trend in international oil prices.

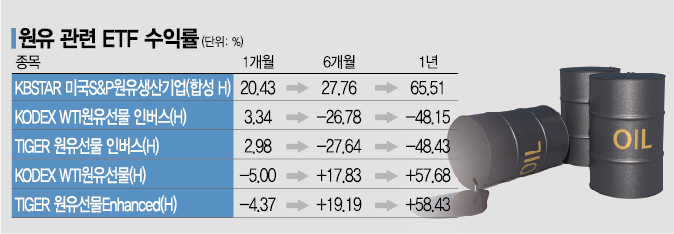

According to the Korea Exchange on the 16th, the 1-month (July 12 to August 12) return of the ‘KBSTAR US S&P Crude Oil Production Companies (Synthetic H)’ ETF was 20.43%.

The KBSTAR US S&P Crude Oil Production Companies (Synthetic H) primarily invests in US upstream oil companies that are relatively sensitive to oil price fluctuations. It is a product designed to benefit from rising oil prices without rollover costs.

ETFs investing in crude oil futures cannot fully profit from oil price increases (or decreases) and may incur additional costs when there is a price difference between near-month and far-month contracts. This can even lead to losses. However, investing in oil companies avoids rollover costs, allowing investors to maximize benefits from rising oil prices. Although international oil prices have recently declined, they remain at a high level of $80 to $90 per barrel, which explains the double-digit returns.

Recently, returns on crude oil futures ETFs have been mixed. Over the past month, ‘KODEX WTI Crude Oil Futures (H)’ and ‘TIGER Crude Oil Futures (H)’ recorded -5.00% and -4.37%, respectively. This contrasts with their 6-month returns of 17.83% and 19.19%, respectively.

On the other hand, crude oil inverse ETFs betting on falling oil prices turned positive. The 1-month returns of ‘KODEX WTI Crude Oil Futures Inverse (H)’ and ‘TIGER Crude Oil Futures Inverse (H)’ were 3.34% and 2.98%, respectively.

The sharp change in crude oil ETF returns over six months is attributed to the decline in international oil prices due to demand uncertainty. Major energy agencies such as the US Energy Information Administration (EIA), the Organization of the Petroleum Exporting Countries (OPEC), and the International Energy Agency (IEA) recently revised their 2022 demand growth forecasts slightly in their August energy outlook reports.

The IEA raised its demand growth forecast from 1.7 million barrels to 2.1 million barrels this year, considering increased power generation demand due to heatwaves and high natural gas prices. Conversely, OPEC lowered its demand growth forecast from 3.4 million barrels to 3.1 million barrels, reflecting the impact of COVID-19 lockdowns and geopolitical risks. This is interpreted as reflecting weaker-than-expected oil demand in July compared to OPEC’s projections.

The market is more inclined to expect a sideways or downward trend in international oil prices rather than an increase. This is due to China’s economic indicators performing worse than expected. The Chinese government announced that industrial production in July increased by 3.8% year-on-year, falling short of experts’ forecast of 4.3%. Retail sales in July also rose by only 2.7% year-on-year, significantly below the forecast of 5% and the previous month’s 3.1%.

However, it is unlikely that international oil prices will settle firmly in the $80-per-barrel range even if they decline. Sim Soo-bin, a researcher at Kiwoom Securities, analyzed, "Depending on economic indicators and the US Federal Reserve’s monetary policy, oil prices may fall below $90 per barrel again, but it will be difficult to maintain fluctuations in the $80 range."

Researcher Sim explained, "With the EU’s ban on Russian oil imports set to take effect by the end of the year, additional disruptions in Russian oil production may occur, and the EIA expects the spread between WTI and Brent crude to widen further due to these developments."

Meanwhile, on the 15th (local time) at the New York Mercantile Exchange (NYMEX), September delivery WTI closed at $89.41 per barrel, down 2.9% ($2.68) from the previous trading day. During the session, the $87 level was breached, marking the lowest price in six months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.