[Asia Economy Reporter Donghyun Choi] The minimum formation amount for venture investment associations by startup planners (accelerators) will be relaxed from 2 billion KRW to 1 billion KRW. Additionally, even if a company invested in by a venture investment association belongs to a mutually invested conglomerate due to mergers and acquisitions (M&A), stock ownership will be allowed for five years.

The Ministry of SMEs and Startups announced on the 16th that the partial amendment to the Enforcement Decree of the "Venture Investment Promotion Act" (Venture Investment Act), which includes these points, passed the Cabinet meeting. The main points of this amendment are ▲ alleviating difficulties in forming venture investment associations ▲ improving regulations on corporate M&A ▲ limiting the imposition of joint liability on stakeholders of invested companies.

Until now, startup planners, who have relatively smaller capital compared to small and medium enterprise startup investment companies, faced difficulties in forming venture investment associations due to the minimum formation amount standard of 2 billion KRW. From now on, this standard amount will be lowered to 1 billion KRW. The purpose is to facilitate the formation of venture investment associations and promote investment in early-stage startups.

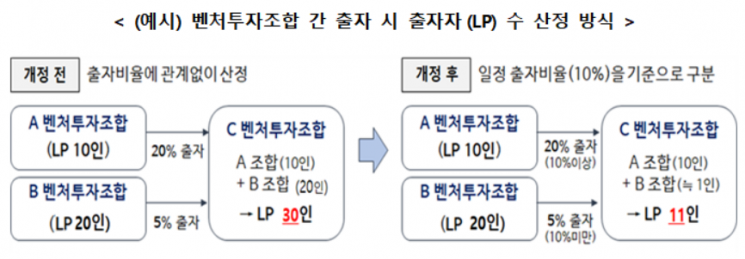

The criteria for counting the number of contributors to venture investment associations will also be relaxed. Previously, when forming a new venture investment association C by receiving investments from venture investment associations A and B, the number of contributors of funds A and B were both counted in calculating the number of contributors for association C. Since the number of contributors to a venture investment association is limited to 49 or fewer, this acted as a constraint on fundraising. However, going forward, if the contribution ratio of each association A and B is less than 10% of the formation amount of association C, that association will be counted as one contributor in association C.

Regulations on M&A for venture companies have also been significantly improved. Previously, if a company invested in by a venture investment association belonged to a mutually invested conglomerate due to M&A, there was a risk of violating stockholding restrictions, which acted as an obstacle to M&A. However, from now on, venture investment associations can hold shares of the invested company temporarily for five years.

Detailed guidelines on restricting the imposition of joint liability on stakeholders of invested companies have also been established. The government has limited investors' demands for joint liability through the revision of the "Mother Fund Standard Bylaws" in June 2018 and the preparation of the "Standard Investment Contract" in May 2021. The Ministry of SMEs and Startups has legalized these matters through this amendment and established grounds for sanctions in case of violations. Going forward, except in cases where stakeholders of invested companies (executives, major shareholders, etc.) cause significant managerial damage resulting in investment losses due to embezzlement, breach of trust, technology leakage, or use of undisclosed information, investors will no longer be able to demand joint liability from stakeholders, and violations will be sanctioned. If violations occur, warning measures and corrective orders will be issued, and failure to comply may result in suspension of business or cancellation of registration.

Additionally, the scope of entities authorized to conduct audits will be expanded from existing accounting firms to audit teams to facilitate easier accounting audits for startup planners and venture investment associations. Audit teams are groups of three or more certified public accountants not affiliated with accounting firms and are registered with the "Korean Institute of Certified Public Accountants."

Moreover, when calculating the investment obligation ratio of startup planners, not only the amount directly invested as capital but also the amount corresponding to the equity share of personal and venture investment associations formed by the startup planner will be included, rationalizing the investment obligation burden of startup planners.

Furthermore, existing regulations have been revised to better reflect the realities of venture investment operations, such as establishing detailed standards to allow exceptions for acquiring non-business real estate for employee training and welfare facilities of small and medium enterprise startup investment companies and startup planners.

Kim Jeong-ju, head of the Venture Investment Division at the Ministry of SMEs and Startups, said, "This amendment to the enforcement decree actively reflects the opinions of venture companies and the venture capital industry," and added, "We will continue to strive for regulatory innovation in the venture investment sector."

The amended "Venture Investment Act Enforcement Decree," which passed the Cabinet meeting on this day, is scheduled to take effect from the 23rd.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)