[Asia Economy Reporter Minji Lee] Coupang turned its overall EBITDA positive in the second quarter, leading to analyses that profitability improvement will accelerate. However, given the intensifying competition in the e-commerce market, it seems necessary to maintain interest from a long-term perspective.

On the 15th, Coupang's stock price stood at $18.87. Over the past month, Coupang's stock price rose by 19.43%, which is analyzed as an expansion of expectations for improved profitability.

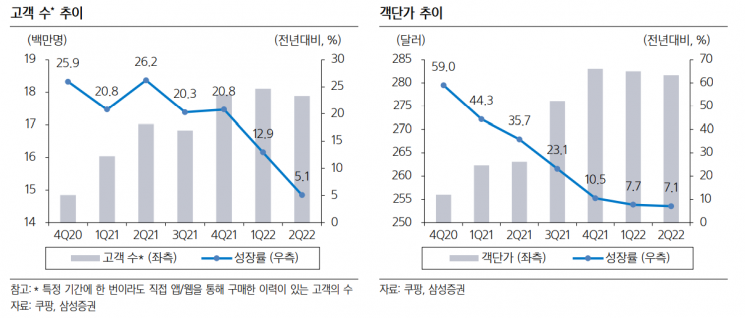

In the second quarter, Coupang recorded consolidated sales of $5.04 billion, a 12.5% increase compared to the same period last year. Operating loss was $67.14 million, exceeding market expectations. Adjusted EBITDA recorded a profit of $66.17 million. Considering that the deficit had been widening since 2014, recording a profit for the first quarter is encouraging. Coupang's sales growth rate in Korean won was 27%, and the PC division, which turned EBITDA positive in the first quarter, showed an increasing trend.

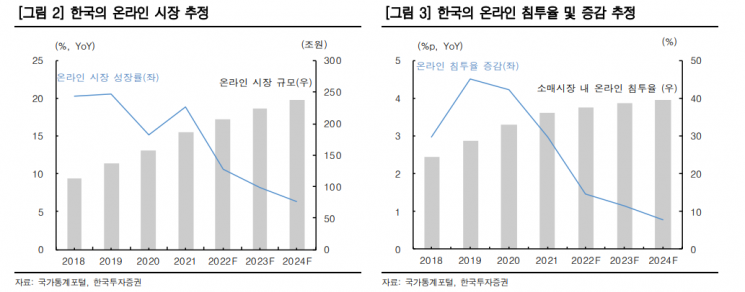

The number of active customers decreased by 1.3% compared to the first quarter, due to increased traffic to offline distribution channels following reopening and a slowdown in online market growth. It is also analyzed that there was some churn due to the price increase of the Wow Membership. Myungjoo Kim, a researcher at Korea Investment & Securities, explained, “Considering that Korea's online market grew by 11.1% year-on-year in the second quarter, the slowdown in Coupang's sales growth rate was expected. The commerce business is positive as the PC division's profit increased with the achievement of economies of scale and a higher sales proportion of profitable advertising and fulfillment fee revenues.”

As of the second quarter, the sales proportion of other revenues (including advertising and overseas business) was around 11%. The 7% decrease in sales of DO (Developing Offering) compared to the previous quarter is a regrettable part. Myungjoo Kim said, “This is due to the sharp slowdown in the domestic delivery market growth following reopening rather than a decline in Coupang platform competitiveness,” adding, “Online food delivery services increased by 2.1% year-on-year.”

The company revised upward the profit and loss guidance presented at the beginning of the year through this earnings announcement. Initially, an adjusted EBITDA loss of $400 million was expected, but now the possibility of turning profitable for the year was mentioned. This is estimated to be due to achieving EBITDA profitability in existing businesses for the first time in the first quarter and overall EBITDA profitability in the second quarter. Eun Kyung Park, a researcher at Samsung Securities, analyzed, “As the burden of COVID-19 quarantine costs decreases, profits are improving faster than expected,” and “The company expects quarterly performance to improve in the second half as well, significantly raising the annual guidance.”

However, as the growth rate of the e-commerce industry slows, competition intensification is expected to be monitored. Researcher Eun Kyung Park said, “The number of market participants has greatly increased, and investment costs are rising due to interest rate hikes,” adding, “Investors’ evaluations of e-commerce operators are becoming more stringent, which should be kept in mind.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.