Launch of KEPCO Financial Soundness Committee... First Meeting Held Late Last Month

Vice President Park Heon-gyu Appointed Chairman... Leading 'Slimming Down' Efforts

14.3 Trillion Won Deficit in First Half... Corporate Bond Issuance Exceeds 17 Trillion Won

Emergency Management Office Also Fully Operational... Asset Sales Expected to Accelerate

The lobby of the Korea Electric Power Corporation headquarters located in Bitgaram Innovation City, Naju-si, Jeollanam-do. [Image source=Yonhap News]

The lobby of the Korea Electric Power Corporation headquarters located in Bitgaram Innovation City, Naju-si, Jeollanam-do. [Image source=Yonhap News]

[Asia Economy Sejong=Reporter Lee Jun-hyung] It has been confirmed that Korea Electric Power Corporation (KEPCO), which recorded a deficit exceeding 14 trillion won in the first half of this year alone, has formed a Financial Soundness Committee that includes private sector experts. This move reflects the judgment that KEPCO must accelerate tight management as the government has demanded strong reforms. The committee is expected to lead KEPCO's financial structure improvement strategy alongside the 'Emergency Management Promotion Office,' which began full-scale operations last month.

According to a comprehensive report from our coverage on the 12th, KEPCO recently established the Financial Soundness Committee and held its first meeting on the 27th of last month. The committee consists of four internal members from KEPCO and four external members, including professors and executives from accounting firms. The chairperson is Park Heon-gyu, KEPCO's Vice President of Future Strategy Planning. The committee plans to deliberate and decide on KEPCO's 'slimming down' efforts, such as asset sales and workforce optimization. A KEPCO official stated, “The committee was created to ensure objectivity and reliability in the process of improving the financial structure in accordance with government policy,” adding, “Regular meetings will be held once a month.”

KEPCO's formation of such a committee is largely influenced by its designation as a 'financially at-risk institution.' Earlier, the Ministry of Economy and Finance designated 14 public institutions, including KEPCO, as financially at-risk in June this year and announced the 'Public Institution Innovation Guidelines' at the end of last month. According to the guidelines, KEPCO must gradually reduce its workforce and reform its compensation system, tightening its belt. It is also reported that KEPCO formed and launched the committee immediately after being designated as a financially at-risk institution because the Ministry of Economy and Finance instructed that external members be included in the financial structure improvement process to ensure fairness.

A Deficit of 14.3 Trillion Won in the First Half... Accelerating Asset Sales

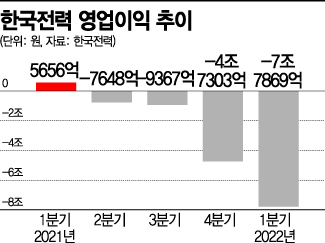

KEPCO's financial structure is already on a downward spiral. KEPCO posted a deficit of 14.3033 trillion won in the first half of this year alone. This amount is more than twice the total deficit of last year (about 5.9 trillion won), which was the largest operating loss on record on an annual basis. Industry insiders predict that KEPCO could incur a deficit exceeding 30 trillion won this year.

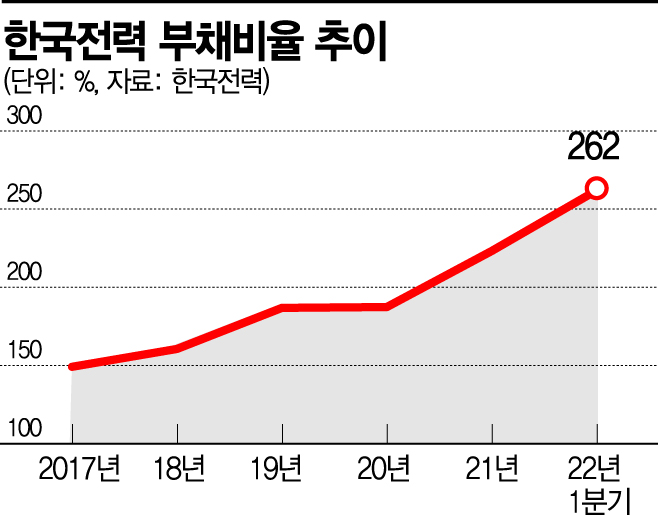

Issuance of corporate bonds has also reached its limit. KEPCO has issued approximately 17.4 trillion won in corporate bonds from the beginning of this year until the 11th of this month. This already exceeds last year's total issuance amount (11.77 trillion won) by about 6 trillion won. The power industry expects KEPCO's corporate bond issuance this year to surpass 30 trillion won. The limit on KEPCO's corporate bond issuance is restricted to no more than twice its capital and reserves, so the practice of using debt to cover operating funds, known as 'rolling over,' may soon reach a critical threshold.

This is why attention is focused on the committee's future actions. The committee is expected to accelerate asset sales together with KEPCO's internal organization, the Emergency Management Promotion Office, which began full operations last month. There is also a high possibility that the committee's opinions will be actively reflected in deciding which assets KEPCO will sell in the future. KEPCO has already put up shares of Korea Electric Power Technology and the Cebu power plant in the Philippines for sale as part of its self-help measures. KEPCO is also considering selling its largest overseas project, the coal power project in Shanxi Province, China.

"Self-help Measures Have Limits... Electricity Rate Hikes Are Inevitable"

However, there are criticisms that KEPCO's self-help efforts, such as asset sales, cannot be a fundamental solution. The ballooning deficit at KEPCO is due to soaring fuel costs, including international oil prices, while electricity rates have not been raised in a timely manner. In fact, KEPCO's fuel and power purchase costs in the first half of this year increased by 16.5 trillion won compared to the same period last year. Meanwhile, KEPCO's electricity sales revenue during the same period increased by only 2.5 trillion won.

KEPCO also acknowledges that there are limits to improving performance through internal self-help measures alone. Another KEPCO official explained, “The proportion of costs that can be reduced through self-help efforts is very low,” adding, “Moreover, the cost savings from adjusting investment timing and the proceeds from asset sales cannot immediately reduce operating losses due to their nature.”

However, with the ongoing high inflation situation, the government’s dilemma is considerable. Raising electricity rates, which are directly linked to inflation, could not only impact the livelihoods of ordinary citizens but also provoke public backlash. Accordingly, Lee Chang-yang, Minister of Trade, Industry and Energy, emphasized the need to minimize electricity rate hikes. In a recent press briefing, Minister Lee stated, “Since people's livelihoods are difficult, the government should minimize electricity rate increases within the scope of possible cooperation,” adding, “If possible, I believe inflation should be stabilized.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)