Electric Vehicle Subsidies, 480 Trillion Investment in Clean Energy

South Korean Battery Companies Expected to Benefit from North American Production Bases

[Asia Economy Reporter Oh Hyung-gil] The U.S. Senate has passed the 'Inflation Reduction Act (IRA),' which includes massive investments in climate change response and wealth tax increases, placing the Korean industrial sector at the center of change. The IRA contains a plan to invest $369 billion (approximately 480 trillion KRW) in energy security and climate change response to reduce greenhouse gas emissions by 40% by 2030.

In Korea, industries related to automobiles, batteries, and energy will fall under the influence of the IRA. While significant benefits are expected due to expanded tax credits for electric vehicle buyers and large-scale budget support for solar panels, wind turbines, and battery manufacturers, there are concerns that strict requirements on raw materials, components, and parts could potentially undermine competitiveness.

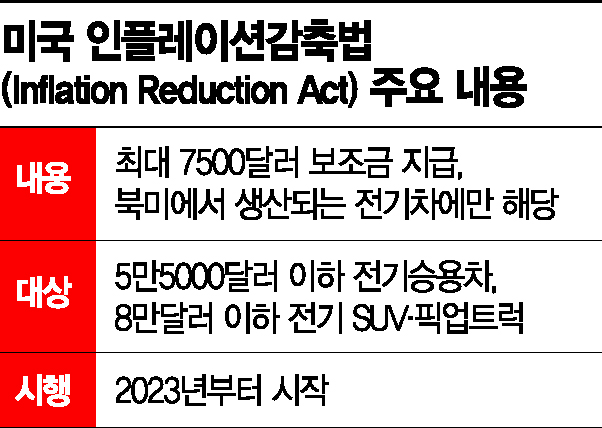

According to the industry on the 14th, the IRA passed by the U.S. Senate on the 7th (local time) includes provisions that subsidies will be provided only if electric vehicles finally assembled in North America meet certain battery-related percentage requirements.

In particular, battery components must be manufactured and assembled in North America, and minerals for batteries must be extracted and processed in the U.S. or countries with which the U.S. has a Free Trade Agreement (FTA), or recycled in North America.

Specifically, to receive subsidies, electric vehicles must be produced in the U.S., and the countries involved are limited to those with which the U.S. has an FTA. Additionally, the proportion of key battery components manufactured in North America must be at least 50%.

China, an emerging battery powerhouse, is expected to suffer significant damage immediately. China’s CATL (Contemporary Amperex Technology Co. Limited), the world’s largest electric vehicle battery company, currently has no production bases in North America, and China has not signed an FTA with the U.S.

Although CATL is recently scouting locations to build a battery factory in Mexico, even if it secures a production base, it will face the challenge of lowering the proportion of Chinese-made materials and components. This means the advantages it enjoyed in the Chinese domestic market will disappear.

This is why there are expectations that domestic battery companies will enjoy a windfall. Domestic companies have been focusing on securing production bases in North America. They have expanded local production capabilities by establishing joint ventures with GM, Ford, and Stellantis.

However, resolving the challenge of reducing the proportion of Chinese raw materials is not expected to be easy. Although supply chains for raw materials are expanding to Latin America and ASEAN, the proportion of Chinese materials remains dominant.

According to the Korea Institute for Industrial Economics and Trade, last year, the import dependence on China for finished secondary batteries was as high as 92.3%, with anode materials at 85.3%, semi-finished products at 78.2%, cathode materials at 72.5%, and separators at 54.8%, all exceeding 50%. Additionally, over 90% of battery precursors are imported from China.

Accordingly, the government recently requested the U.S. government to ease the electric vehicle subsidy requirements in the IRA, which has passed the U.S. Senate and is awaiting a vote in the House of Representatives.

On the 11th, under the chairmanship of Trade Negotiations Director Ahn Deok-geun, a confidential meeting was held with domestic industries to discuss the electric vehicle subsidy regulations in the IRA. Attendees included electric vehicle manufacturer Hyundai Motor Company and the three battery companies LG Energy Solution, SK On, and Samsung SDI.

Industry representatives attending the meeting requested the government to actively support ensuring that domestically manufactured electric vehicles are not placed at a disadvantage in competition within the U.S. market due to the legislation.

Director Ahn said, "We conveyed concerns to the U.S. side that this law may violate trade norms such as the Korea-U.S. FTA and World Trade Organization (WTO) agreements," and added, "We also requested the U.S. trade authorities to relax the requirements for final assembly and battery components defined as 'within North America.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.