Shinhan Investment "Focus on sectors and industries with concentrated demand such as Shipbuilding, Automotive, and Defense"

[Asia Economy Reporter Myunghwan Lee] As the theory of an 'inflation peak' emerges, a fresh breeze is blowing through the domestic stock market after a long time. This comes as the U.S. Consumer Price Index (CPI) for July showed a lower-than-expected figure, slowing the pace of increase. Securities firms say there is ample room for further rebound in the domestic stock market but advise focusing on differentiation by detailed sectors and individual stocks going forward.

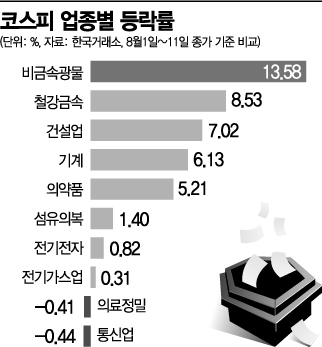

According to the Korea Exchange on the 12th, the KOSPI closed at 2,523.78, up 1.73% from the previous day, marking a rise of over 1% for the first time in about a month since June 18. Most sectors also rose. Non-metallic minerals surged 13.58%, showing a double-digit increase, while steel and metals (8.53%) and construction (7.02%) also soared. Only two indices, telecommunications (-0.44%) and medical precision (-0.41%), saw slight declines.

Securities firms forecast that thanks to the optimistic sentiment that inflation has peaked, the KOSPI may stabilize above the 2,500 level and aim for further rebounds. Jung-hoon Seo, a researcher at Samsung Securities, analyzed, "The rebound in the domestic stock market that has continued since mid-last month has sufficient justification, and the possibility of extending the rally has also increased," adding, "With the KOSPI settling above 2,500, it is also possible to challenge the next resistance level."

However, experts unanimously agreed that after the index rebounds to a certain level, it is necessary to respond to a market environment differentiated by individual companies' earnings. Jung-bin Lee, a researcher at Shinhan Financial Investment, advised, "If there are no major variables until the end of August and September, the favorable stock price trends of earnings stocks and growth stocks are likely to be maintained," and added, "It is important to look at sectors and industries where recent capital inflows are concentrated." He suggested shipbuilding, automobiles, defense industry, secondary batteries, and healthcare as sectors that have recently recorded excess returns and attracted market capital inflows.

Researcher Seo also noted, "Selective rises in stocks with earnings momentum are possible, but growth stocks with weak profit resilience are likely to briefly rise during the simultaneous rise phase and then fall behind," emphasizing, "If a short-term rebound has occurred, it is appropriate to consider active rebalancing at this point." He further advised paying attention to stocks that had weak foreign investor inflows over the past year but have seen notable foreign buying since July and whose earnings forecasts were revised upward during the second-quarter earnings season.

There is also advice to increase weightings in growth stocks now that the price index has passed its peak. Dong-chan Yeom, a researcher at Korea Investment & Securities, said, "If the low profit growth rate continues a bit longer, stocks and sectors with growth potential will receive a premium," adding, "At the current point, it is necessary to maintain interest in growth stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.