TrendForce Revises Consumer DRAM Price Forecast After Just Over a Month

SK Hynix announced on the 1st that it has developed a 'Compute Express Link (CXL)-based memory semiconductor sample.' CXL is called the next-generation DRAM module. (Photo by SK Hynix) [Image source=Yonhap News]

SK Hynix announced on the 1st that it has developed a 'Compute Express Link (CXL)-based memory semiconductor sample.' CXL is called the next-generation DRAM module. (Photo by SK Hynix) [Image source=Yonhap News]

[Asia Economy Reporter Moon Chaeseok] It is forecasted that memory semiconductor DRAM prices in the third quarter will fall by up to about 18% compared to the second quarter. This is a downward revision of 5 percentage points (p) from the previous estimate of a maximum 13% decline quarter-on-quarter. Since product lines sold by Samsung Electronics, SK Hynix, and others are also affected, concerns about profitability decline due to increased management uncertainty are growing.

According to the industry on the 11th, Taiwanese market research firm TrendForce stated yesterday afternoon, "(Korean suppliers, who are leaders in DRAM) lowered prices as they increased their willingness to compromise on prices to promote purchases by distributors and customers, and other companies had no choice but to significantly reduce their selling prices accordingly," adding, "Consumer DRAM prices in the third quarter are expected to drop by up to 18%."

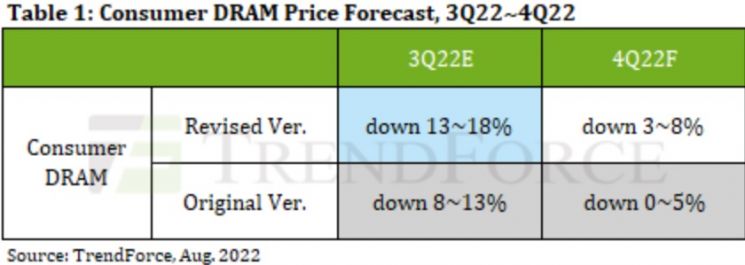

On August 4th, TrendForce forecasted that consumer DRAM prices in the third quarter would be 8-13% lower than the previous quarter. At that time, the decline range was already expanded by 5 percentage points from the previous estimate of 3-8%, and now, just over a month later, the decline range has been raised by another 5 percentage points. Furthermore, they predicted that in the fourth quarter, consumer DRAM prices would fall 3-8% compared to the third quarter, which is also a 3 percentage point increase in the decline range from the August 4th estimate of 0-5%. TrendForce said, "We expect consumer DRAM prices to continue falling until the market oversupply is resolved," and "Therefore, consumer DRAM prices are likely to drop another 3-8% in the fourth quarter, and the possibility of continuous decline cannot be ruled out."

The forecast released by TrendForce this time pertains to consumer DRAM prices for high-performance set-top boxes, gaming consoles, and smart TVs. They did not disclose price forecasts for high value-added DRAMs such as PC, server, mobile, or graphics DRAMs.

TrendForce's analysis drew attention as it came right after American companies such as memory semiconductor company Micron, graphics processing unit (GPU) semiconductor company Nvidia, and comprehensive semiconductor company Intel announced downward revisions of their earnings forecasts. This analysis implies a sluggish semiconductor market due to global demand decline. In particular, Micron, the world's third-largest company following Samsung Electronics and SK Hynix, is a significant competitor, so their lowered earnings outlook is expected to have a considerable impact on the market situation. On the 9th (local time), Micron announced that its Q4 (June-August) revenue forecast under its accounting standards would fall short of the previously predicted $6.8 billion to $7.6 billion (approximately 8.9 trillion to 9.9 trillion KRW). Nvidia revised its Q2 earnings down by 17% the day before, and Intel revealed last month that its Q2 revenue decreased by 22% year-on-year.

The domestic industry responded that this analysis cannot be ignored. Since the server and mobile forecasts were not downgraded, the industry feels somewhat relieved. According to the industry, SK Hynix's sales proportion of server and mobile DRAM is about 80%. An industry insider said, "A 5 percentage point adjustment is a considerable proportion (adjustment)," and added, "This analysis result emphasizes that the DRAM market in the second half will be worse than expected."

However, they did not agree with the interpretation of oversupply. An industry insider explained, "Not all DRAM companies are flooding production to expand market share regardless of market prices, so it is difficult to see this as oversupply."

The industry showed a cautious response, expecting to implement management strategies that control production volume and offer high value-added solution products to defend profitability. An industry insider explained, "In the case of DRAM, rather than reckless sales expansion, we plan to supply flexibly according to demand." Han Jin-man, Vice President and Head of Memory Semiconductor Strategy Marketing at Samsung Electronics, also said during Samsung Electronics' Q2 earnings conference call on the 28th of last month, "Not only DRAM but the overall market volatility is significant," and added, "We will maintain a portfolio optimization policy centered on high value-added, high-capacity solution products based on flexible supply linked to market conditions and customer demand."

In this regard, Samsung Electronics showcased large-capacity petabyte memory solutions and CXL memory semantic SSD solutions consecutively at FMS on the 3rd. SK Hynix also entered the next-generation memory semiconductor market competition by releasing DDR5 (Double Data Rate 5) DRAM-based CXL memory samples on the 1st.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)