Dongtan, Indeogwon, Oido Station Sale Prices Plummet

Prices Soared Last Year Due to Transportation Benefits

Indeogwon Station Area Complex Down 440 Million KRW

Oido Station Area Also Down 330 Million KRW

"Bubble Bursts, Prices Returning to Normal"

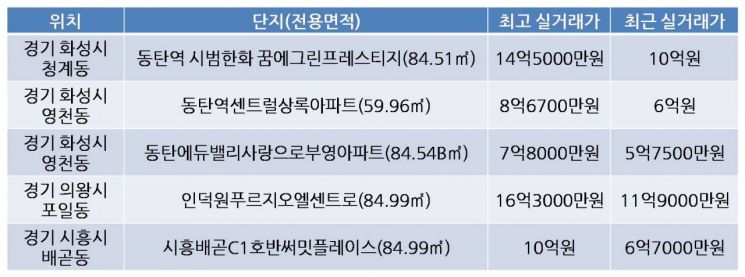

Apartment Complexes in Gyeonggi with Transportation Benefits: Highest Actual Transaction Prices and Recent Actual Transaction Prices / Source: Ministry of Land, Infrastructure and Transport Real Transaction Price Disclosure System

Apartment Complexes in Gyeonggi with Transportation Benefits: Highest Actual Transaction Prices and Recent Actual Transaction Prices / Source: Ministry of Land, Infrastructure and Transport Real Transaction Price Disclosure System

[Asia Economy Reporter Hwang Seoyul] The downward trend in apartment sale prices near Dongtan, Indeogwon, and Oido stations, where prices surged last year, is becoming significant. As the bubble caused by transportation benefits deflates, there was even a case this month where an apartment near Dongtan Station was traded at a price 450 million KRW lower than the highest actual transaction price.

According to the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system on the 10th, 'Dongtan Station Shibeom Hanwha Dream Green Prestige (84.51㎡)' in Cheonggye-dong, Hwaseong-si, Gyeonggi Province, was traded for 1 billion KRW this month. The highest actual transaction price for the same area was 1.45 billion KRW in August last year, marking a drop of 450 million KRW in about a year.

Hwaseong-si, where the complex is located, saw a significant increase in demand due to the GTX-A line benefit at Dongtan Station, causing apartment sale prices to rise sharply last year. According to the Gyeonggi Real Estate Portal, the monthly apartment sale transaction volume in Hwaseong-si hovered around 1,000 cases until August last year. However, despite the transportation benefits, demand sharply declined this year, and there was not a single month exceeding 500 transactions until June. As a result, the sale prices have started to decline. Hwaseong-si's weekly sale price index has been falling for 34 consecutive weeks from the first week of December last year (111.8) to last week (107.9).

In fact, 'Dongtan Station Central Sangnok Apartment (59.96㎡)' in Yeongcheon-dong, Hwaseong-si, also traded last month at 600 million KRW, down 267 million KRW from the highest price of 867 million KRW. This is similar to the level of 610 million KRW traded in June 2020, two years ago. 'Dongtan Edu Valley Sarangro Booyoung Apartment (84.54B㎡)' located in the same neighborhood also traded last month at 575 million KRW, 105 million KRW lower than the highest price of 780 million KRW.

Other transportation-benefited areas in Gyeonggi Province are also experiencing a downward trend. 'Indeogwon Prugio El Centro (84.99㎡)' in Poil-dong, Uiwang-si, near Indeogwon Station, which is known to be included in the GTX-C line stops, was traded last month for 1.19 billion KRW. The highest actual transaction price for this complex was 1.63 billion KRW in June last year, marking a drop of 440 million KRW in just over a year. Similarly, 'Siheung Baegot C1 Hoban Summit Place' located in Siheung-si, where prices rose significantly due to transportation benefits such as the GTX-C Oido Station extension and the Shinansan Line, was traded this month at 670 million KRW, 330 million KRW lower than the highest price of 1 billion KRW.

Experts say that as the bubble caused by transportation benefits deflates, the sale prices in these areas are returning to their proper levels. Lim Byungcheol, Research Team Leader at Real Estate R114, explained, "These areas saw more price increases than general metropolitan areas because they attracted speculative demand due to transportation benefits," adding, "With the situation becoming unstable due to the base interest rate hikes, prices in these areas are falling." Yoon Sumin, Real Estate Specialist at NH Nonghyup Bank, said, "All three areas peaked in sale prices in June last year due to transportation benefits, but commonly, prices have reverted to the levels of January last year."

It seems unlikely that sale prices in these areas will fall further in the second half of the year. Research Team Leader Lim said, "Prices have dropped significantly in the first half, so further declines are unlikely," and added, "Even if prices fall, the decline will not be large, and the trend will generally follow that of other areas." Specialist Yoon also said, "Since the price increases due to transportation benefits have mostly been reversed, further price drops seem difficult." However, Yoon added, "In the case of Dongtan Station, with the GTX opening approaching, prices in nearby areas may rise again after the opening."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.