[Asia Economy Reporter Jeong Hyunjin] Following Samsung Electronics and SK Hynix, Micron, the third-largest company in the memory semiconductor DRAM market in the U.S., issued a bleak semiconductor market outlook on the 9th (local time). It warned that semiconductor demand weakness due to decreased consumer consumption in PCs and smartphones is gradually spreading to data centers and the industrial sector, and that earnings are expected to fall short of market expectations. Concerns about the semiconductor winter becoming full-fledged have caused the stock prices of global semiconductor companies, including Samsung Electronics, to drop sharply.

According to Bloomberg News and others, Micron, in a document submitted to the U.S. Securities and Exchange Commission (SEC) on the same day, forecasted that its revenue outlook for the fourth quarter of fiscal year 2022 (June to August) is expected to fall short of the previously estimated $6.8 billion to $7.6 billion (approximately 8.9 trillion to 9.9 trillion KRW) announced at the end of June. Micron stated, "Due to recent macroeconomic factors and supply chain constraints, customers have expanded inventory adjustments. Since the earnings announcement in June, demand expectations for DRAM and NAND flash have decreased," adding, "The market environment is expected to be difficult in the fourth quarter of fiscal year 2022 and the first quarter of fiscal year 2023 (September to November)."

Sanjay Mehrotra, CEO of Micron, said in an interview with Bloomberg TV, "Compared to the previous earnings announcement, we are seeing further weakening of demand as adjustments are spreading not only in the consumer sector but also in other market areas including data centers, industrial, and automotive sectors." Mark Murphy, CFO of Micron, also said at an investor event on the same day, "The market has deteriorated more than we thought," and "We are clearly witnessing the spread of weakness in the semiconductor market."

Micron's gloomy semiconductor market outlook aligns with those of other global semiconductor companies such as Intel, AMD, and Nvidia. Earlier, Intel lowered its annual revenue target for this year by more than 14 trillion KRW compared to its initial forecast during its earnings announcement on the 28th of last month. AMD and GlobalFoundries also evaluated that the market is adjusting, citing more conservative sales forecasts than expected in the PC and general consumer electronics markets.

The Philadelphia Semiconductor Index, which reflects the stock prices of major semiconductor companies, fell 4.57% in a single day. On an annual basis, it has dropped 27%. Micron's stock price also closed down 3.74% after the announcement on the same day. Other semiconductor stocks such as Intel (-2.43%), AMD (-4.53%), Nvidia (-3.97%), and Qualcomm (-3.59%) also plunged consecutively.

Korean semiconductor companies also saw their stock prices fall sharply in early trading due to worsening semiconductor investment sentiment. Samsung Electronics traded at around 58,000 KRW on the Korea Exchange in the morning, down about 2% from the previous trading day. Samsung Electronics' stock price fell below 60,000 KRW during intraday trading for the first time in 17 trading days the previous day and has continued in the 50,000 KRW range. SK Hynix also traded at around 92,000 KRW, down about 3%.

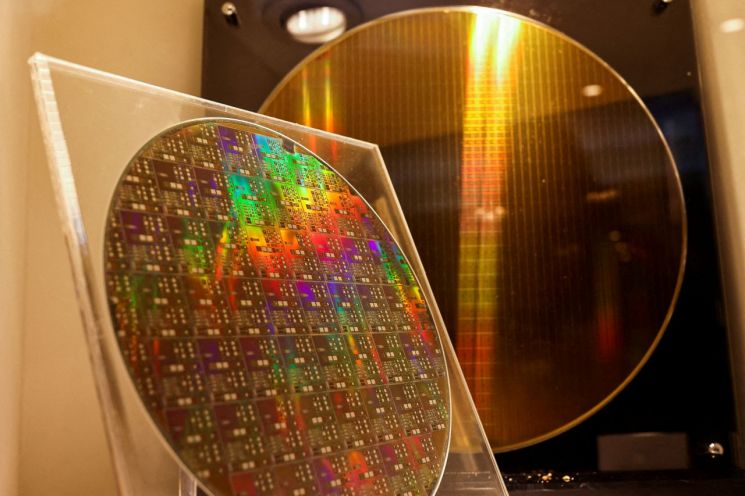

Meanwhile, considering this outlook, Micron announced plans to reduce capital expenditures for new factory construction in fiscal year 2023. However, taking into account the signing of the U.S. Semiconductor Support Act on the same day, it announced plans to build a cutting-edge memory semiconductor manufacturing plant in the U.S. worth $40 billion as part of its 10-year investment plan. CEO Mehrotra also attended the signing ceremony with President Biden. The Wall Street Journal (WSJ) reported, "While semiconductor companies are cutting short-term spending, the White House has pledged to expand the U.S. semiconductor industry in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.