Reasons Why Semiconductor Support Policies by the Yoon Government

Still Fall Short?

[Asia Economy Reporters Sunmi Park, Chaeseok Moon, Pyeonghwa Kim] Following the promotion of the semiconductor supply chain alliance Chip4 (South Korea, United States, Japan, Taiwan), the United States has passed the Inflation Reduction Act, signaling a full-scale reorganization of core strategic industry supply chains excluding China. This is creating an environment where the hegemonic competition between the U.S. and China over key industries is bound to intensify.

In particular, the U.S. is strengthening control over core semiconductor technologies to prevent China's semiconductor industry from accessing new technologies, while supporting massive subsidies and tax benefits to significantly expand advanced semiconductor production bases domestically. This could mark a turning point where South Korea's competitiveness, which currently holds the lead in memory semiconductors and foundry (semiconductor contract manufacturing) sectors, may weaken.

There are also concerns that domestic semiconductor companies might prioritize the U.S. as their primary production base. Amid rising interest rates and inflation increasing corporate capital expenditure burdens, if direct government subsidies or tax benefits are provided for building or expanding new semiconductor production facilities, there would be little reason to choose South Korea, which has various regulatory barriers.

Semiconductors, often called the "rice of modern industry," are a core industry of the South Korean economy, making it clear why they must be protected. The global semiconductor industry size is about $600 billion, showing a high growth rate of 24.2% last year. During the same period, South Korea's semiconductor exports accounted for 19.9% of the total, reflecting a significant share. Semiconductors have been the top export item in South Korea for nine consecutive years, driving economic growth.

However, despite the large scale, the fundamentals are not solid. South Korea holds 59% of the memory market (71% DRAM, 47% NAND), ranking first globally. Its overall semiconductor market share is 20%, second after the U.S. (50%), ahead of Japan (9%) and Taiwan (8%). Yet, the semiconductor industry ecosystem?including companies, workforce, technology, and materials, parts, and equipment (MPE)?is considered vulnerable.

▲ Insufficient support compared to competitors and various regulations hindering corporate growth ▲ Severe workforce shortages in both quantity and quality that fall short of industry demand ▲ Weakening of the memory chip super-gap status due to competitors' advances and the widening gap with leading countries in the non-memory (fabless, foundry, back-end) sectors are urgent issues that need immediate improvement.

The South Korean government is preparing various support measures to develop the semiconductor industry evenly, recognizing its clear strengths and weaknesses. The new administration's strategy to achieve semiconductor superpower status, the National Advanced Strategic Industry Special Act, and the ruling party's Semiconductor Industry Competitiveness Enhancement Act are emerging as key solutions to nurture South Korea's representative competitive semiconductor industry. However, while the goal and direction to further grow the semiconductor industry through policy support are correct, the general consensus is that the scope of support is insufficient to resolve the practical difficulties faced on the ground.

While the U.S. Provides a Stunning 68 Trillion Won Support, South Korea's Semiconductor Benefits Are 'Meager'

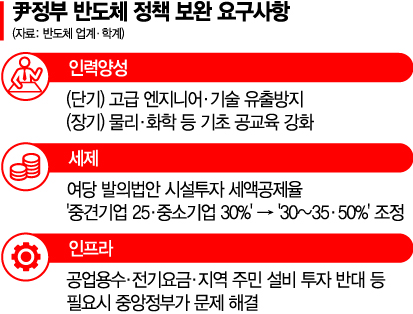

Since the inauguration of the Yoon Seok-yeol administration, South Korea's semiconductor development strategy has been summarized as integrated support for workforce, taxation, and infrastructure. Although the direction is right, the industry complains that the level of deregulation is too low, prompting the political sphere to propose deregulation measures more advanced than the government's plan. However, compared to other countries armed with direct subsidies and exceptional tax benefits, the support is widely regarded as grossly insufficient. There is widespread concern that without supplementing the tax credit level and accompanying substantial deregulation measures, South Korea may fall behind semiconductor competitors.

◆Support Measures Falling Short of Industry Expectations=According to the government and industry on the 9th, the 'National Advanced Strategic Industry Special Act (Semiconductor Special Act)' prepared last year by the opposition party (Democratic Party of Korea) Semiconductor Special Committee came into effect on the 4th of this month. However, it was widely criticized for its low increase in tax credit rates and the omission of semiconductor department expansions, reducing its effectiveness. The insufficient incentives compared to competitor countries were also pointed out as a problem. In response, the ruling party's Semiconductor Industry Competitiveness Enhancement Special Committee recently submitted the 'Semiconductor Industry Competitiveness Enhancement Act' to the National Assembly, which aims to increase the facility investment tax credit rate up to 30%. This bill includes provisions not in the Semiconductor Special Act, such as expanding semiconductor departments and significantly increasing tax credit rates (up to 8-12% for large corporations). Based on the government's plan, the credit rates are 8-12% for large and mid-sized companies and 16-20% for small companies, but the bill proposes raising them to 20% for large corporations, 25% for mid-sized, and 30% for small companies.

The ruling party's bill also includes measures to enhance employment stability for high-level engineers in advanced foundry companies. A representative example is extending the tax reduction period for foreign engineers from 5 to 10 years. The government plan includes nurturing 150,000 bachelor's, master's, and doctoral-level talents over 10 years until 2031, but there have been continuous criticisms about the lack of strong measures to prevent workforce and technology leakage. It is also pointed out as a limitation that only 30% (45,000) of the 150,000 will be filled by expanding enrollment, while 70% (105,000) will be filled through short-term courses and double majors.

The problem is that parliamentary discussions are sluggish, and the tax credit ceiling may be lowered. Due to controversies over preferential treatment for large corporations, even within the ruling party, there are many opinions that a 'maximum 30% tax credit' is difficult to achieve. Professor Jaegun Park of Hanyang University's Department of Convergence Electronics Engineering (Chairman of the Korea Semiconductor Display Technology Society) said, "Within the ruling party, they say large corporations will be raised to 20%, and I think that alone is a good achievement," but he also suggested, "I hope small companies can be raised to 50% and mid-sized companies to 30-35%."

◆Who Provides More Exceptional Support Is the Key=The government announced the 'Semiconductor Workforce Development Plan' and the 'Semiconductor Superpower Achievement Strategy' on the 19th and 21st of last month, just over two months after President Yoon Seok-yeol took office. However, compared to semiconductor competitors that receive massive subsidies and are launching new factories in 2024-2025, South Korea's support measures are widely seen as lagging significantly behind.

In fact, the U.S. passed the Chips and Science Act last month, which includes $39 billion in direct subsidies for semiconductor manufacturing facility construction over five years until 2027, and $11 billion invested in advanced semiconductor R&D such as the National Semiconductor Technology Center and advanced back-end production programs, totaling $52 billion (68 trillion won). The funds required for implementing the Chips and Science Act will be executed through four newly established funds jointly managed by the Department of Commerce, Department of Defense, Department of State, and others. Separately, the Semiconductor Promotion Act applies a 25% tax credit on semiconductor facility and equipment investments. This means that when building semiconductor factories and purchasing equipment in the U.S., companies receive a tax deduction equivalent to one-quarter of their investment, with tax credit benefits amounting to $24 billion over 10 years and available for advance payment.

On the other hand, South Korea's Semiconductor Superpower Achievement Strategy focuses on supporting semiconductor companies to invest more than 340 trillion won by 2026 through infrastructure and regulatory improvements rather than providing large-scale direct subsidies like the U.S. It also includes tax benefits such as raising the tax credit rate for large corporations' semiconductor capital investments, but compared to the U.S. (25%), the credit rate is far too low. Political controversies over tax revenue losses are intense, making passage difficult.

Other Asian countries besides South Korea are offering much more exceptional government support to secure leadership in the semiconductor competition. The Japanese government urgently allocated a large-scale subsidy of 774 billion yen (7.4 trillion won) through a supplementary budget last year to actively support semiconductor companies. Taiwan has operated about 150 government-supported semiconductor production projects over the past decade and applies a 15% tax credit rate for semiconductor R&D. China aims to raise its semiconductor self-sufficiency rate from only 10-30% to 70% by 2025 and exempts corporate tax for advanced process semiconductor companies for 10 years.

Researcher Kyeon Kyung-hee of the Korea Institute for Industrial Economics & Trade advised, "To complement South Korea's weakened policy support due to the U.S.'s massive subsidy support, stronger deregulation measures such as speeding up the approval process for new advanced semiconductor manufacturing facilities should be pursued."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)