Estimated Combined 1.2 Trillion KRW in Q2

5G Subscriber Growth Drives Strong Performance

Future Performance Variable: 'Intermediate Plan'

Competition for Subscriber Acquisition Expected to Intensify

[Asia Economy Reporter Lim Hye-sun] The combined operating profit of the three major mobile carriers?SK Telecom, KT, and LG Uplus?exceeded 1 trillion won for the second consecutive quarter in Q2. The increase in 5G service subscribers, strong performance in new businesses, and reduced marketing expenses are cited as the reasons behind the profit improvement.

Increase in 5G Subscribers, Operating Profit Surpasses 1 Trillion Won

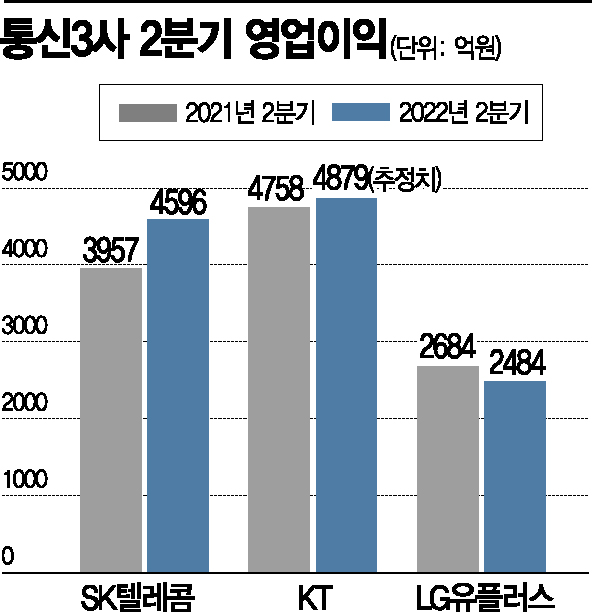

According to the telecommunications industry on the 9th, the combined operating profit of the three carriers in Q2 is estimated at about 1.2 trillion won. SK Telecom announced that its Q2 sales reached 4.2899 trillion won, with an operating profit of 459.6 billion won, marking increases of 4.0% and 16.1%, respectively. Previously disclosed figures for LG Uplus showed sales and operating profit of 3.3843 trillion won and 248.4 billion won, respectively. Adding KT’s estimated operating profit (487.9 billion won) brings the total operating profit of the three carriers above 1 trillion won. Although this is lower than the combined operating profit of 1.3202 trillion won in Q1 (January to March), it is higher than the same period last year (Q2 2021: 1.1413 trillion won). The three carriers surpassed a combined operating profit of 4 trillion won for the first time in 10 years last year.

The strong performance is interpreted as being driven by an increase in 5G service subscribers who use relatively expensive plans. According to statistics from the Ministry of Science and ICT, as of the end of June, the number of 5G subscribers reached 24.58 million, an increase of 8.13 million compared to 16.45 million at the end of June last year. The number of 5G subscribers is expected to exceed 30 million within the year. SK Telecom’s Q2 wireless business revenue rose 3.2% year-on-year to 3.1182 trillion won. LG Uplus’s wireless business revenue also increased by 2.2% to 1.541 trillion won. Qualitative growth factors such as net additions of wireless subscribers and achieving the lowest churn rate for two consecutive quarters were effective. New businesses including media, subscriptions, smart home, and enterprise infrastructure also continued to grow. Compared to the past, marketing expenses were relatively reduced, which also had an impact.

Will Mid-Tier Plans Become a Variable in H2 Business Performance?

It is uncertain whether the strong performance of the three carriers will continue in the second half of the year. As 5G subscribers increase, there is growing pressure to diversify plans and expand investments. In particular, the launch of mid-tier 5G plans could act as a variable in H2 business performance. Mid-tier 5G plans provide data amounts between existing low-cost plans (monthly data under 10GB) and high-cost plans (over 100GB). SKT launched a new plan on the 5th offering 24GB of data for 59,000 won per month. KT and LG Uplus are also expected to release plans offering around 60,000 won and 30GB of data within this month. The government expects the competition in launching mid-tier 5G plans to lead to a reduction in average communication costs.

Since users who previously used high-cost plans may switch to mid-tier plans, this could negatively affect carriers’ profitability. Wireless revenue may decrease as the average revenue per user (ARPU) declines. However, there is also a view that the impact is not entirely negative, as low-cost plan users, estimated to be 20-30% of all users, might choose the more expensive mid-tier plans.

Competition among the three carriers to attract subscribers is expected to intensify in the second half of the year in line with new device launches. An industry insider said, "We expect plan switching to become active once the new device, the Galaxy foldable phone, is released."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)