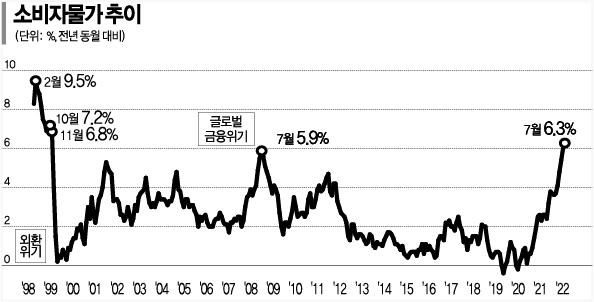

Inflation Rate Hits Highest in 24 Years

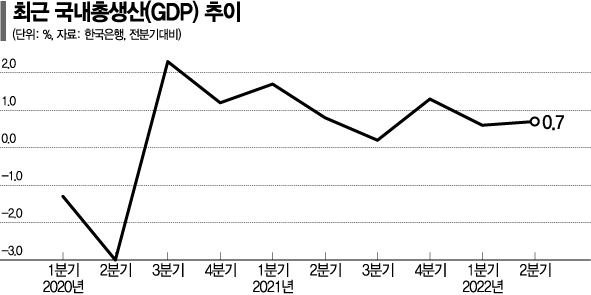

0% Growth Rate for Two Consecutive Quarters

Past Economic Crises Overcome by Exports

High Exchange Rate Situation Also a Burden

Ahead of Chuseok, there is an emergency in the price of dining table staples. According to the National Statistical Portal (KOSIS) of Statistics Korea, the food and non-alcoholic beverage price index in July was 113.12 (2020=100), up 8.0% from a year earlier. Food prices rose the most in one year and five months since February last year. In particular, prices of processed foods such as edible oils (34.7%) and fresh foods such as vegetables and seaweed (24.4%) increased significantly. Citizens are shopping at a large supermarket in downtown Seoul on the 7th. Photo by Moon Honam munonam@

Ahead of Chuseok, there is an emergency in the price of dining table staples. According to the National Statistical Portal (KOSIS) of Statistics Korea, the food and non-alcoholic beverage price index in July was 113.12 (2020=100), up 8.0% from a year earlier. Food prices rose the most in one year and five months since February last year. In particular, prices of processed foods such as edible oils (34.7%) and fresh foods such as vegetables and seaweed (24.4%) increased significantly. Citizens are shopping at a large supermarket in downtown Seoul on the 7th. Photo by Moon Honam munonam@

[Asia Economy Reporter Seo So-jeong] Last month, the inflation rate reached 6.3%, the highest in about 24 years, and with our economy recording growth rates in the 0% range for two consecutive quarters, fears of stagflation (economic stagnation amid rising inflation) are looming over the second half of the year. Economic experts diagnose that amid growing global stagflation concerns and soaring inflation, even exports, which support our economy, are shaking, making it highly likely that the economy will sharply slow down in the second half of the year.

According to Statistics Korea on the 9th, consumer prices last month rose 6.3% compared to a year earlier, marking the highest increase since November 1998 (6.8%). This is the first time in 23 years and 8 months that consumer prices have recorded a 6% or higher increase for two consecutive months since October (7.2%) and November (6.8%) 1998. In particular, last month, agricultural product prices rose 8.5%, significantly exceeding the overall average, while processed food and dining-out prices also increased by 8.2% and 8.4%, respectively, indicating that high inflation is expected to continue for the time being.

◆ Inflation Approaching 5% This Year = Looking at inflation during the two previous economic crises, the inflation rate surged to 9.5% in February 1998 during the foreign exchange crisis due to a sharp rise in the exchange rate. During the global financial crisis in July 2008, the inflation rate rose to 5.9%, which was lower than the current 6% level. From January to July this year, consumer prices rose 4.9% compared to the same period last year, and if prices peak in September to October as predicted, the annual consumer price inflation rate is expected to exceed the government’s forecast of 4.7% and surpass 5%. It has been since 1998, during the foreign exchange crisis (7.5%), that the annual inflation rate exceeded 5%. Considering that the inflation rate was 4.7% in 2008, this year’s inflation situation is unusually high.

As inflation approaches levels close to the peak after the foreign exchange crisis, major economic indicators are weakening, increasing downside risks to the economy. According to the Bank of Korea, real Gross Domestic Product (GDP) in the first half of this year increased by 2.9% compared to the same period last year. With real GDP growing by 0.6% and 0.7% (preliminary) quarter-on-quarter in the first and second quarters, respectively, there is a high possibility of achieving mid-2% growth for the year if there is no negative growth in the third and fourth quarters. However, recent clouds over consumption and exports have become variables.

Consumption, which had revived due to eased quarantine measures, may slow down again due to the resurgence of COVID-19, and the possibility of economic recessions has increased in major trading partners such as the United States and China. The U.S. economy contracted in the first and second quarters, and China’s second-quarter economic growth rate was only 0.4%, significantly lower than the previous quarter (4.8%), triggering warning signals for South Korea’s exports. Looking at GDP during the foreign exchange crisis, there were three consecutive quarters of negative growth: Q4 1997 (-0.5%), Q1 1998 (-6.8%), and Q2 1998 (-0.8%), and during the financial crisis in 2008, Q4 recorded a negative growth of -3.3% before recovering.

Interest rate hikes by major countries are also increasing downward pressure on the economy. The U.S. Federal Reserve (Fed) has implemented consecutive giant steps (0.75 percentage point increases in the base rate), and the European Central Bank (ECB) has also taken big steps (0.5 percentage point increases). South Korea is expected to follow with an additional rate hike at the end of this month after last month’s big step.

◆ Past Crises Overcome by Exports, Difficult This Year = The ongoing high exchange rate situation is also a burden on the economy. During the foreign exchange crisis, the won-dollar exchange rate soared close to 2,000 won, and this year’s exchange rate has also maintained a high level above 1,300 won, pushing up import prices. Professor Ha Jun-kyung of Hanyang University’s Department of Economics pointed out, “The difference is that past economic crises were demand-side or financial market crises, whereas this year’s is a ‘complex crisis’ with significant supply-side factors due to the Russia-Ukraine conflict. Previously, the crisis was overcome through exports amid globalization, including China, but this year’s situation is different, which heightens the sense of crisis.”

Jung Kyu-chul, senior researcher at the Korea Development Institute (KDI), diagnosed, “High inflation continues, the U.S. and Chinese economies are deteriorating, and interest rate hikes are reflected in the economy with a time lag, increasing downside risks.” Joo Won, senior researcher at Hyundai Research Institute, said, “Although our economy has not recorded negative growth for two consecutive quarters, it can be said that it has already entered the stagflation phase.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.