July US Consumer Price Index Released on the 10th

US Fed Faces High-Intensity Tightening Crossroads... Market in Wait-and-See Mode

Impact on This Month's BOK Base Rate Hike

Big Step Voices Amid Baby Step Forecasts

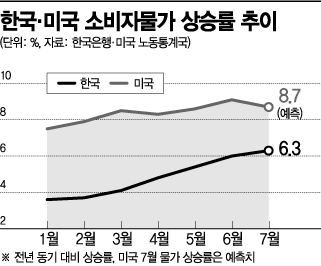

The domestic financial market is closely watching the U.S. Consumer Price Index (CPI) for July. If the U.S. inflation rate eases compared to June as expected by the market, the Federal Reserve's (Fed) tightening stance may weaken, allowing the Bank of Korea to reduce the magnitude of its base rate hike. However, if the opposite occurs, the call for a ‘big step’ (a 0.50 percentage point increase in the base rate) by the Bank of Korea is expected to grow stronger.

According to the financial market on the 9th, there is growing caution in domestic and international stock markets and the won-dollar exchange rate ahead of the release of the U.S. Department of Labor’s July CPI on the afternoon of the 10th. The U.S. inflation rate is one of the key indicators, along with the employment report, that the Fed uses to decide the size of the rate hike at the Federal Open Market Committee (FOMC) meeting next month.

Last week’s July employment report showed that U.S. nonfarm payrolls increased by 528,000, more than twice the expected figure, strengthening the view that the Fed’s aggressive monetary tightening will continue. The stronger-than-expected U.S. labor market is interpreted as meaning the Fed may raise the base rate further to curb inflation.

However, if the July inflation rate comes in lower than expected, the atmosphere could change. The market strongly anticipates a slowdown in U.S. inflation. The U.S. consumer price inflation rate hit 9.1% in June, marking the highest level in about 41 years, but Wall Street experts predict it will fall to 8.7% in July, citing factors such as the recent decline in international oil prices.

If the U.S. inflation rate peaks and then declines, the possibility of the Bank of Korea taking a ‘baby step’ (a 0.25 percentage point increase in the base rate) rises. At the beginning of this month, Lee Chang-yong, Governor of the Bank of Korea, appeared before the National Assembly’s Planning and Finance Committee and stated, "If the trends in inflation and growth do not deviate significantly from the existing forecast path, it is appropriate to gradually raise the base rate by 0.25 percentage points." Although variables such as international oil prices remain, Governor Lee also expressed the view that these should be monitored until October.

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), is testifying at the House Financial Services Committee hearing on March 2 (local time). [Image source=Yonhap News]

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), is testifying at the House Financial Services Committee hearing on March 2 (local time). [Image source=Yonhap News]

Despite improvements in U.S. employment indicators, forecasts of a global economic recession support monetary policy easing. Im Hye-yoon, a researcher at Hanwha Investment & Securities, said, "Despite strong U.S. employment, it is necessary to keep in mind the downside risks to the economy," adding, "If inflation and monetary policy burdens increase, psychological contraction and downward pressure on the real economy may also intensify."

However, there is still analysis that the Fed will continue its steep rate hike policy until it confirms signals of price stability, so opinions that the Bank of Korea must take another big step are not insignificant. Currently, the U.S. base rate is 2.25?2.50% per annum, 0.25 percentage points higher than Korea’s. If the Bank of Korea takes a baby step at the Monetary Policy Committee meeting on the 25th of this month and the Fed executes a giant step next month, the interest rate gap between Korea and the U.S. will widen to 0.75 percentage points.

The Bank of Korea and the government emphasize that the impact on the domestic financial market was limited even when the Korea-U.S. interest rates were inverted in the past, but if the interest rate gap widens further, side effects such as capital outflows cannot be ruled out. Lee Jung-hoon, a researcher at Eugene Investment & Securities, said, "If the inflation indicators for July and August do not slow down as expected, the Fed is highly likely to take a giant step at the September FOMC," adding, "Although recession debates are growing, the stance that ‘employment is good, so it is not a recession’ will likely be maintained for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.