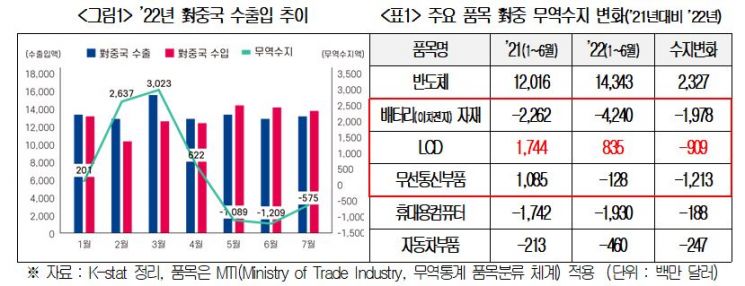

[Asia Economy Reporter Jeong Dong-hoon] The recent trade deficit with China has been analyzed to have resulted from a combination of factors including the deterioration of the trade balance in intermediate goods such as batteries and semiconductors, decreased production in displays, and tariff reductions under the Regional Comprehensive Economic Partnership (RCEP).

The Korea Chamber of Commerce and Industry announced this in a report titled 'Causes and Countermeasures of the Recent Trade Deficit with China' released on the 9th.

Battery Raw Material Imports Doubled in the First Half of This Year

Looking at the raw materials and intermediate goods that influenced the worsening trade balance with China, the import value of 'Other Fine Chemical Raw Materials,' which are raw materials for secondary batteries, nearly doubled from $3.83 billion in the first half of last year to $7.25 billion in the first half of this year. The import value of 'Other Accumulators,' an intermediate battery material, also increased significantly from $1.11 billion in the first half of last year to $2.18 billion in the first half of this year.

Home appliance-related items saw simultaneous decreases in both exports and imports. For 'Other Wireless Communication Device Components,' exports dropped about 90% from $1.82 billion to $180 million during the same period, while imports decreased by 57% from $730 million to $310 million. Imports of 'Other Computer Components' slightly decreased from $510 million to $450 million, whereas exports plunged 79% from $730 million to $150 million. This phenomenon appears to be influenced by reduced consumption due to China's economic downturn.

The semiconductor trade balance, which accounts for the largest share of about 20% in exports and 10% in imports respectively, recorded a surplus of $14.34 billion in the first half of this year. However, 'Other Integrated Circuit Semiconductors' shifted from a surplus of $60 million to a deficit of $90 million during the same period, resulting in a $150 million decrease in the trade balance. Imports increased from $690 million to $1.11 billion.

Jaejin Han, head of the International Cooperation Office at Hyundai Research Institute, said, "China's global trade figures have not changed significantly, but due to lockdown measures caused by COVID-19 within China, trade in consumer goods such as home appliances with Korea has sharply declined." He analyzed, "This trade deficit is due to a decrease in China's imports of intermediate goods from Korea and an increase in China's exports of intermediate goods to Korea, reflecting industrial structural changes affecting bilateral trade."

Restructuring of China-Centered Industries like LCD Also Affects

The trade deficit related to China also appears to be influenced by the restructuring of industries centered on China, such as displays. Due to China's low-price offensive, Korea has been reducing its business in LCD items. Imports in the first half of 2022 increased nearly threefold from $450 million the previous year to $1.29 billion. The trade balance also decreased significantly from $1.74 billion to $830 million, impacting the trade deficit with China.

In the case of 'Portable Computers,' Korea's exports to China in the first half amounted to only $4 million, whereas imports from China increased by about $200 million year-on-year to $1.93 billion in the first half of this year.

Dongsoo Kim, head of the Overseas Industry Office at the Korea Institute for Industrial Economics & Trade, said, "Chinese companies are not only strengthening their low-price offensive in the display market but are also emerging as global companies through this." He added, "As international political risks increase, it is necessary to expand cooperation in low-tech areas to ensure no disruption in supply."

RCEP-Driven Import Increase Also Plays a Role

The RCEP, which came into effect on February 1, has also been found to affect the trade deficit with China. Due to the implementation of RCEP, imports of key battery materials such as 'Lithium Oxide' and 'Lithium Hydroxide' increased, with imports in the first half reaching $1.17 billion, surpassing last year's total imports of $560 million, marking the highest import value ever recorded.

Notably, during the period when the trade deficit occurred, imports in May and June were $290 million and $480 million respectively. These amounts accounted for 26.9% and 40.3% of the total trade deficit in May and June. The tariff rates for lithium oxide and lithium hydroxide were reduced from the standard rate of 5.5% to 0% after RCEP came into effect.

The report explained that while the Korea-China FTA had a well-balanced benefit point for exports and imports between the two countries, RCEP resulted in a short-term increase in imports due to rising raw material prices and inflation.

Due to the recent sharp decline in the Chinese economy, Korea's exports to China have also continued to decrease. Looking at the average forecasts of international organizations such as the International Monetary Fund (IMF), OECD, World Bank, and major investment banks (IBs), a slight economic recovery is generally expected in the second half of the year. If Korea's exports to China also show a slight recovery, the trade deficit with China is expected to improve somewhat.

However, the pattern of the trade deficit with China may continue for the time being due to short-term factors such as the Russia-Ukraine conflict, lockdowns in Chinese cities, supply chain vulnerabilities, and increased imports due to preferential tariffs under RCEP. Meanwhile, the report foresees that if diversification of intermediate goods supply chains, price stabilization, and enhanced utilization of FTAs are difficult in the long term, the trade structure will worsen further alongside the rising competitiveness of Chinese industries.

Need to Upgrade Korea-China FTA and Improve Supply Chain Vulnerabilities

The report emphasized the urgent need to swiftly upgrade the Korea-China FTA. It stated that alongside utilizing the RCEP channel, establishing a cooperation platform between Korean and Chinese companies should be pursued soon to expand practical cooperation channels between the two countries.

To improve supply chain vulnerabilities, the report proposed easing trade regulations on advanced technology items between Korea and China and emphasized expanding support for securing vulnerable raw materials. It also added that a strategy to diversify intermediate goods exports, which are concentrated in China, is necessary.

The report stressed that strengthening technological competitiveness is a key task to prevent the structure of expanding intermediate goods imports due to weakening competitiveness in the future. To this end, it mentioned the need to expand financial support for advanced manufacturing companies as well as increase R&D support related to securing and developing future mineral resources.

Seongwoo Lee, head of the International Trade Division at the Korea Chamber of Commerce and Industry, said, "Semiconductors and battery materials, which account for a large part of the trade deficit with China, have Chinese products that are cost-effective, making it difficult to diversify supply sources." He added, "Since changes in the trade structure with China are not easy due to the global economic slowdown and international political factors, efforts to upgrade the Korea-China FTA, strengthen RCEP utilization, diversify imports, and secure technological capabilities should be pursued simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)