Purchase of 30 Trillion Won in Non-Performing Loans... 60-90% Principal Reduction

Controversies Over Moral Hazard, Excessive Principal Reduction Rates, and Loss Transfer

[Asia Economy Reporters Song Hwajeong, Lee Eunju] The detailed plan for the New Start Fund, which has been embroiled in various controversies even before its launch, will be announced next week. Financial authorities are continuously consulting with related organizations, and attention is focused on how the structure will be well designed to resolve controversies such as 'debt forgiveness' and 'moral hazard.'

According to the financial sector on the 9th, the financial authorities plan to disclose the detailed plan for the New Start Fund next week, following the Safe Conversion Loan this week.

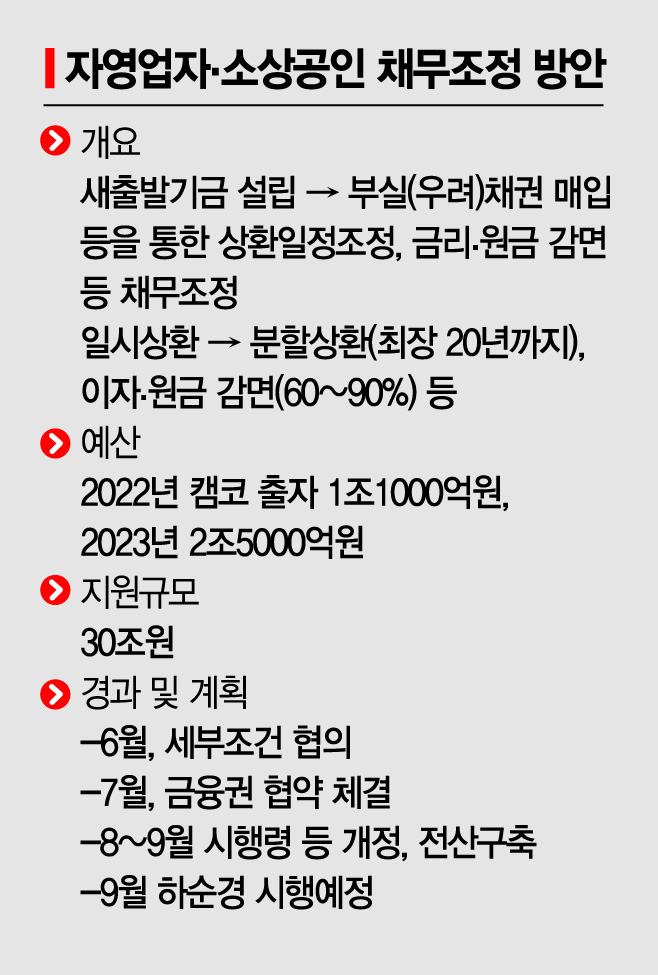

Earlier, the Financial Services Commission introduced the New Start Fund, a debt adjustment program for self-employed and small business owners, ahead of the expiration of the maturity extension and repayment deferral measures for self-employed and small business owners at the end of September. The fund, worth 30 trillion won, aims to purchase non-performing loans and convert lump-sum repayments into long-term, installment repayments for up to 20 years, reduce interest rates, and provide principal reductions of 60-90% for borrowers delinquent for more than 90 days.

The New Start Fund has faced continuous controversy, including negative views that it encourages moral hazard, and recently local governments and financial companies have also expressed reluctance. In particular, banks and regional credit guarantee foundations are cautious about the possibility of Korea Asset Management Corporation (KAMCO), which operates the New Start Fund, purchasing non-performing loans.

On the 2nd, at the Policy Finance Institution Heads Meeting held at the Financial Services Commission in the Government Seoul Building, Jongno-gu, Seoul, Chairman Kim Ju-hyun (fifth from the left) and other attendees are posing for a commemorative photo. From left to right: Choi Jun-woo, President of the Korea Housing Finance Corporation; Kim Tae-hyun, President of the Korea Deposit Insurance Corporation; Yoon Hee-sung, President of the Export-Import Bank of Korea; Yoon Jong-won, President of the Industrial Bank of Korea; Kim Ju-hyun, Chairman of the Financial Services Commission; Kang Seok-hoon, Chairman of the Korea Development Bank; Yoon Dae-hee, Chairman of the Korea Credit Guarantee Fund; Kwon Nam-joo, President of the Korea Asset Management Corporation; Lee Jae-yeon, President of the Korea Inclusive Finance Agency. Photo by Kim Hyun-min kimhyun81@

On the 2nd, at the Policy Finance Institution Heads Meeting held at the Financial Services Commission in the Government Seoul Building, Jongno-gu, Seoul, Chairman Kim Ju-hyun (fifth from the left) and other attendees are posing for a commemorative photo. From left to right: Choi Jun-woo, President of the Korea Housing Finance Corporation; Kim Tae-hyun, President of the Korea Deposit Insurance Corporation; Yoon Hee-sung, President of the Export-Import Bank of Korea; Yoon Jong-won, President of the Industrial Bank of Korea; Kim Ju-hyun, Chairman of the Financial Services Commission; Kang Seok-hoon, Chairman of the Korea Development Bank; Yoon Dae-hee, Chairman of the Korea Credit Guarantee Fund; Kwon Nam-joo, President of the Korea Asset Management Corporation; Lee Jae-yeon, President of the Korea Inclusive Finance Agency. Photo by Kim Hyun-min kimhyun81@

The financial sector is wary of the possibility that bonds may have to be forcibly transferred or that KAMCO might purchase non-performing loans at a 'bargain price' lower than the market price. The official position of the Financial Services Commission is that "bonds will be purchased based on fair value evaluation grounded on market prices to alleviate concerns of participating institutions." However, the financial sector is concerned that related institutions may bear excessive burdens in some form during the adjustment process of the New Start Fund, especially regarding the possibility of low-price purchases of guaranteed loans from policy financial institutions such as regional credit guarantee foundations.

In May, the National Assembly Budget Office pointed out in its "Analysis Report on the 2nd Supplementary Budget Bill" that "careful review is necessary for the purchase of guaranteed loans established by contracts among three parties: creditors, guarantors, and debtors." Guaranteed loans refer to loans where policy financial institutions like the Korea Credit Guarantee Fund repay loans on behalf of financial institutions when loans are delinquent for more than three months (subrogation). In other words, when loans guaranteed by policy financial institutions become delinquent for over three months, the policy financial institutions receive non-performing loans from banks or other financial institutions and then claim reimbursement from the debtors themselves. During the reimbursement claim process, the guarantor calculates and claims not only the principal but also 'losses' that the guarantor had to bear. From the perspective of the guarantor, there is inevitable resistance to the government policy that requires them to transfer these reimbursement claims to KAMCO in bulk.

What the guarantors particularly worry about is the possibility of having to transfer bonds to KAMCO at a 'bargain price.' According to business data submitted by KAMCO to the National Assembly's Political Affairs Committee, the annual purchase price ratio of non-performing loans purchased from 2017 to the first quarter of this year was only between 3.45% and 39.5%. Accordingly, the Budget Office mentioned, "If bonds with high recovery potential are sold, guarantors may incur losses," and "For subrogated reimbursement claims, it is necessary to establish a separate (reasonable) bond valuation method considering recovery rates and appropriate purchase price ratios."

There are also opinions that the principal reduction rate of 60-90% is excessive. Regarding this, the Financial Services Commission stated that the basic structure and debt adjustment principles of the New Start Fund are the same as existing debt adjustment programs such as the Credit Recovery Committee's workout or court personal rehabilitation, and that the reduction rates for principal and interest were partially adjusted considering the COVID-19 damage situation and government financial support. They argue that claims to lower the reduction rate stem from a misunderstanding of the New Start Fund. The current principal reduction limit of the Credit Recovery Committee is 0-70%, and there is no separate limit for court personal rehabilitation. The average reduction rates are 44-61% for the Credit Recovery Committee and 60-66% for court personal rehabilitation. The 90% principal reduction rate is effectively applied only to vulnerable groups who have no ability to repay the principal, and it is the same program currently operated under the Credit Recovery Committee's workout system.

The Financial Services Commission expects misunderstandings surrounding the New Start Fund to be resolved as it continues consultations with related institutions and the financial sector. At a briefing on the previous day's work report, Financial Services Commission Chairman Kim Joo-hyun said, "There was insufficient promotion for accurate understanding of the system, which caused misunderstandings," adding, "Discussions are ongoing with the financial sector, the Korea Credit Guarantee Fund, local governments, and the Ministry of SMEs and Startups, and these discussions are expected to resolve misunderstandings." Chairman Kim added, "The purpose of the New Start Fund is to quickly resolve the difficult situations of vulnerable groups, not to increase the forgiveness rate compared to other programs, but to operate within the scope recognized by other rehabilitation systems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.