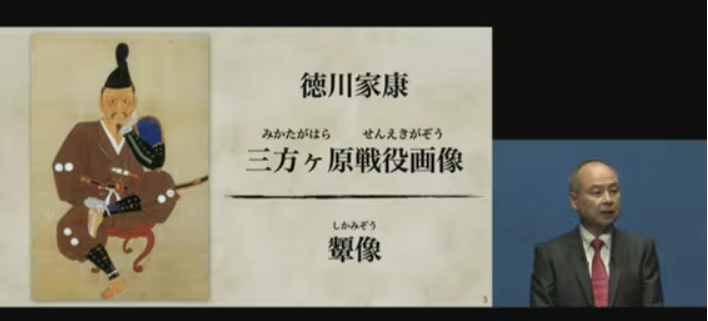

SoftBank Chairman Masayoshi Son (right) is speaking while displaying a portrait of Tokugawa Ieyasu on the screen during the earnings announcement on the 8th. (Photo by Nihon Keizai Shimbun)

SoftBank Chairman Masayoshi Son (right) is speaking while displaying a portrait of Tokugawa Ieyasu on the screen during the earnings announcement on the 8th. (Photo by Nihon Keizai Shimbun)

[Asia Economy Reporter Jeong Hyunjin] On the 8th, at SoftBank headquarters in Tokyo, Japan, a portrait of Tokugawa Ieyasu, who unified the Sengoku period in the 1600s and established the Edo Shogunate, appeared on the screen before the earnings announcement. It was a painting called ‘Ugeoji-sang,’ which he left behind to remember and reflect on his miserable appearance after being defeated in past battles. SoftBank Chairman Masayoshi Son said, "I want to remember the lesson of posting such a large deficit for two consecutive times and recording a loss of 5 trillion yen (about 48.4 trillion KRW) in six months since SoftBank’s founding." On that day, Chairman Son repeatedly bowed his head, saying, "I am ashamed" and "I am reflecting."

According to the Nihon Keizai Shimbun on the 9th, SoftBank recorded a net loss of 3.1627 trillion yen (about 30.569 trillion KRW) in the first quarter (April to June) of the 2022 fiscal year, marking the largest deficit since its founding in 1981. SoftBank posted losses in the previous quarter as well, resulting in two consecutive quarters of net losses for the first time in 17 years. The sharp decline in IT company stocks worldwide caused significant investment losses in its core business, the Vision Fund, which impacted overall performance. The Vision Fund’s investment loss from April to June reached 2.9 trillion yen.

Chairman Son, who had shown an aggressive investment style until now, has begun to liquidate held stocks. In the current situation where concerns about an economic recession are growing, rather than increasing new investments in the Vision Fund, the focus seems to be on reducing costs and nurturing companies that were previously invested in. Nihon Keizai analyzed this as a move toward ‘defensive management.’

According to CNBC, SoftBank sold all its shares in the ride-sharing company Uber at an average price of $41.47 per share (about 54,000 KRW) in April and July. Bloomberg News cited documents SoftBank submitted to the U.S. Securities and Exchange Commission (SEC) on the 5th, reporting that the company also sold 5.4 million shares of fintech company SoFi at an average price of $7.99 per share. In this earnings announcement, Chairman Son also left open the possibility of selling Fortress Investment Group, a U.S. private equity fund affiliated with SoftBank.

Earlier, in June, SoftBank disposed of its stake in Alibaba, China’s largest e-commerce company, through a prepaid forward contract, and partially sold shares in online real estate company Opendoor, healthcare company Guardant, and Chinese real estate firm Beike. CNBC interpreted this as a move to raise cash amid increasing investment losses.

Future investments by the Vision Fund are expected to focus more on the growth of existing portfolio companies rather than new investments. Chairman Son said, "I believe companies equivalent to the future Alibaba and ARM will emerge," noting that the Vision Fund currently invests in 473 companies, and even without new investments, there are many golden eggs to nurture properly. He also mentioned that internal cost-cutting measures, including workforce reductions at SoftBank, are inevitable, stating, "We will engage in cost reduction without any sacred cows."

Chairman Son, who had expressed ambition to make SoftBank a ‘300-year kingdom,’ is expected to significantly change his investment style going forward. At the announcement on the 8th, he said, "Since we have posted losses, we must be very selective when making new investments." He emphasized, "Although there may be a desire to invest amid a volatile stock market, we must not bear irreversible pain."

Chairman Son reflected, "I was happy when we made big profits," and admitted that looking back now, their past valuations were in a bubble state. Until last year, they poured investments into promising future technology companies during the stock market boom, but the higher the peak of these tech companies, the greater the recent stock price declines, which hurt SoftBank’s performance.

In fact, among the Vision Funds, Vision Fund 2 (SVF2), which mainly invested in unlisted U.S. companies, recorded investment losses of 1.3 trillion yen as of the end of June. Chairman Son confessed, "If we had made fewer investments and chosen properly, we would not have suffered such a blow," adding, "It is all my responsibility as the commander." He forecasted that the winter could last for an uncertain period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.