3.79 Million Resident Tax (Individual) Cases Imposed 22.8 Billion Won on Household Heads with Seoul Addresses and Foreigners Residing Over One Year

[Asia Economy Reporter Lim Cheol-young] Heads of households residing in Seoul and foreigners who have stayed for more than one year must report and pay their resident tax by the 31st of this month.

According to Seoul City on the 9th, the resident tax (individual portion) per household based on the address as of July 1 is 6,000 KRW (resident tax 4,800 KRW, local education tax 1,200 KRW), and this year, Seoul City imposed 3.79 million cases of resident tax (individual portion), totaling 22.8 billion KRW. Looking at the resident tax (individual portion) imposition status, Songpa-gu, which has the largest population, has the highest number with 255,201 cases (1.5 billion KRW), while Jung-gu, with the smallest population, has the lowest with 54,787 cases (300 million KRW).

For foreigners residing in Seoul, to facilitate tax payment, notices in eight languages including Chinese, English, Vietnamese, Japanese, Mongolian, Hindi, French, and German were produced and sent along with the resident tax (individual portion) bills. Foreigners who have stayed in Korea for more than one year from the date of foreigner registration under the Immigration Control Act until the resident tax (individual portion) taxation standard date of July 1 must pay the resident tax (individual portion) this time.

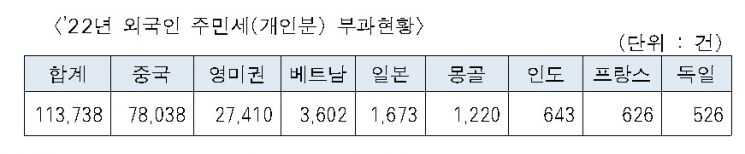

A total of 113,738 cases of resident tax (individual portion) were imposed on foreigners, with Guro-gu having the highest number at 15,671 cases, followed by Geumcheon-gu with 11,872 cases, and Yeongdeungpo-gu with 10,697 cases. Regarding foreign nationalities, China accounted for the largest number with 78,038 cases, followed by English-speaking countries, Vietnam, and Japan.

Meanwhile, as of July 1, individual business owners and corporations with business locations in Seoul must report and pay resident tax (business place portion) by the 31st. The resident tax business place portion is based on the business place and its total floor area, and the tax amount is the sum of the basic tax amount and the amount calculated according to the tax rate on the total floor area.

Due to the revision of the Local Tax Act, from 2021, the resident tax equalization portion paid by corporations and individual business owners in August and the resident tax property portion reported and paid in July were integrated, changing the tax item name to resident tax business place portion, and the payment period was unified to August. Accordingly, business owners using business places exceeding 330㎡ in total floor area, who previously paid the resident tax property portion in July, now have their payment deadline changed to August and must report and pay the resident tax business place portion in August.

Earlier, Seoul City sent 820,000 payment slips totaling 67.8 billion KRW with the tax amount and payment period printed to facilitate payment of resident tax (business place portion). Taxpayers who receive the payment slip and whose tax amount on the slip matches the amount to be reported are considered to have reported and paid if they pay within the deadline without any additional procedures. The resident tax bill includes a barcode for voice conversion for the visually impaired, providing a voice service of the resident tax imposition details accessible via a mobile app.

The resident tax received this time can be paid through ?Seoul City ETAX ?Seoul City STAX ?easy payment apps ?QR code payment on paper bills ?dedicated accounts ?bank ATMs or unmanned payment machines.

Lee Byung-han, Director of the Seoul City Finance Bureau, said, “The resident tax individual portion is a tax imposed on heads of households residing in Seoul, with about 3.8 million taxpayers, accounting for 38.9% of Seoul’s population, so we urge everyone to pay by August 31.” He added, “Seoul City provides various services such as internet (ETAX) and smartphone apps (STAX) to facilitate taxpayers’ payments, and we hope many citizens will use these services.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.