[Asia Economy Reporter Song Hwajeong] The government will introduce a new fixed-rate policy loan product worth 6 trillion won to ease the financial burden on small and medium-sized enterprises (SMEs). Considering the increased interest burden on SMEs during periods of rising interest rates, the product will offer preferential rates at variable interest levels and allow switching between fixed and variable rates every six months.

On the afternoon of the 8th, Financial Services Commission Chairman Kim Joo-hyun held a briefing at the Presidential Office under the theme "Proactive Crisis Response + Supporting the Financial Industry and Our Economy's Leap Beyond the Crisis."

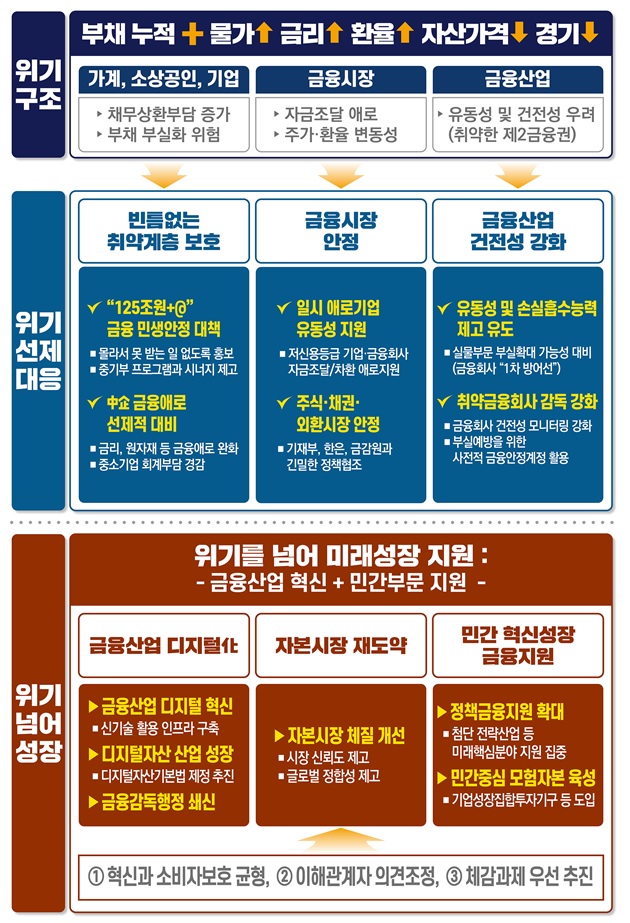

The Financial Services Commission plans to proactively respond to the crisis by ▲thoroughly protecting vulnerable groups ▲stabilizing financial markets ▲strengthening the soundness of the financial industry, and to support future growth beyond the crisis through ▲digitalization of the financial industry ▲revitalization of the capital market ▲financial support for private sector innovation-led growth.

In particular, the report includes an additional measure for SMEs: the introduction of a new fixed-rate policy loan product worth 6 trillion won. This product offers up to a 1 percentage point preferential rate at variable interest levels to reduce interest rate rise risks and allows switching between fixed and variable rates every six months depending on the interest rate situation. This measure aims to alleviate the increased burden on SMEs caused by interest rate fluctuations.

Chairman Kim explained, "Since SMEs generally choose variable interest rates because they are lower, they face increased difficulties when rates rise later, which led to the creation of this product. All SMEs can benefit from this support, including new applicants and those who have previously applied for other products." The required funds will be self-financed by the Korea Development Bank and the Industrial Bank of Korea without additional budget allocation.

Additionally, companies with a high proportion of raw material imports or those facing difficulties due to global supply chain disruptions will receive preferential interest loans and guarantees. Next year, internal accounting management external audit obligations will be exempted for listed companies with assets under 100 billion won, adjusting accounting burdens for small SMEs to a reasonable level. Furthermore, an additional corporate restructuring fund will be established to support companies capable of business normalization.

To respond to risks in the financial sector, financial companies will be required to enhance liquidity and loss absorption capacity (capital + reserves). A financial stability account and other support systems will be established to prevent financial company insolvency and block crisis contagion.

For digital innovation, regulations hindering financial companies' digital new business initiatives will be improved and supplemented. The exclusivity principle will be relaxed to activate platform financial services such as digital universal banks. Data opening and integration among financial, non-financial, and public sectors will be expanded, and data infrastructure will be built to promote AI utilization in finance, including a financial AI data library. Financial-related permits and approvals for new businesses will be processed swiftly, and inspection and sanction practices will be modernized by strengthening the right to rebuttal for those subject to sanctions.

To promote responsible growth of the digital asset industry, the government will push for the enactment of the "Digital Asset Basic Act." Even before legislation, it will encourage industry self-regulation and supervise virtual asset operators and protect consumers through the Special Act on Reporting and Using Specified Financial Transaction Information (Special Act on Reporting and Using Specified Financial Transaction Information, commonly known as the Special Act on Reporting and Using Specified Financial Transaction Information), as well as investigations by prosecutors and police.

Support for private innovative growth finance will be strengthened. Policy finance will minimize overlap with private finance and focus on future core areas such as digital and super-gap technologies. New investment funds will be established to help ventures and startups grow into unicorns. A Business Development Company (BDC) investing mainly in promising unlisted companies will also be introduced to enhance liquidity through listing. This will expand investment opportunities for general investors in promising unlisted companies. In this regard, a revision bill to the Capital Market Act was submitted to the National Assembly in May. Chairman Kim said, "Due to market changes such as high-interest rate transitions, there are concerns that innovative and venture companies will face difficulties in fundraising, so we will strengthen the role of policy finance and foster venture capital."

The Financial Services Commission will promptly implement a 125 trillion won + α financial livelihood stabilization plan and install a digital platform to enable one-stop online services for the New Start Fund and refinancing of high-interest loans at low interest rates for smooth field execution. Regarding the youth debt adjustment program, a dedicated counseling window will be established, and counseling will be combined with job linkage services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)