August Economic Trends

[Asia Economy Sejong=Reporter Kim Hyewon] The Korea Development Institute (KDI) recently diagnosed that while our economy continues a moderate recovery trend, downside risks to the economy are intensifying due to high inflation and worsening external conditions.

In the 'August Economic Trends' report released on the 7th, KDI stated, "Although the manufacturing sector's slump, centered on semiconductors and automobiles, has somewhat eased, downside risks to the economy are expanding as consumer sentiment rapidly deteriorates and major countries' economies slow down."

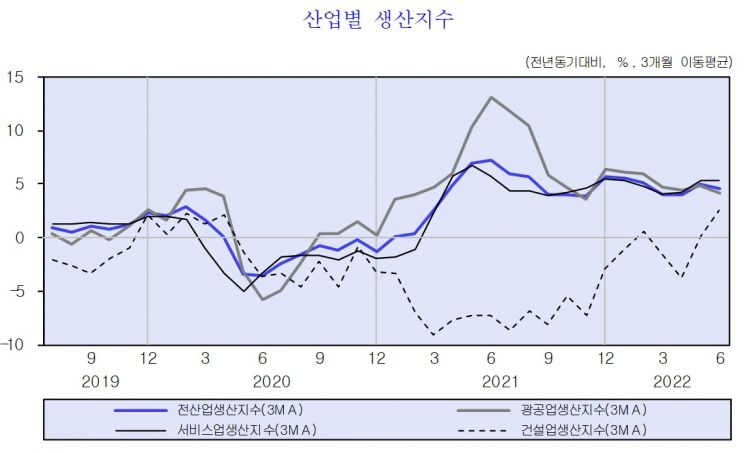

Industrial production in all sectors for June recorded a growth rate of 2.1%, lower than the previous month's 7.1%, due to a reduction in working days (-2 days). The increase was smaller than the previous month (1.4%) because of a sharp decline in electronic components (-21.5%) caused by the suspension of LCD production in the mining and manufacturing industries, and sluggish retail and wholesale trade (0.8%).

Although the average operating rate in manufacturing rose to 76.5%, shipments (-4.5%) decreased and inventories (17.5%) increased significantly, expanding the inventory ratio from 114.3% to 124.6%.

Jung Kyu-chul, head of KDI's Economic Outlook Office, evaluated, "Retail sales are sluggish as manufacturing shipments have sharply decreased due to temporary intensification of logistics disruptions, and high inflation continues."

KDI's assessment is that downside risks to the economy are increasing as domestic consumer sentiment is also significantly weakened due to the steep rise in inflation amid worsening external conditions.

Recently, China's growth has sharply slowed, leading to sluggish exports to China. Meanwhile, the U.S. economy recorded negative growth for two consecutive quarters, and the global economic slowdown trend continued, centered on major trading partners of our economy. The consumer sentiment index in July (86) also dropped significantly, showing a rapid weakening of consumer sentiment. The consumer sentiment index fell below the baseline of 100 for the first time in one year and four months since June (96.4). A value below 100 indicates pessimistic consumer sentiment.

Accordingly, the business sentiment index (BSI) remained at a low level across most industries following the previous month, indicating that business sentiment is contracted. The August BSI outlook for manufacturing business conditions was 80, marking a decline for three consecutive months.

The coincident index cyclical component (102.4), which indicates the current economy, continued a slight upward trend following the previous month, while the leading index cyclical component (99.4), which predicts future economic conditions, remained at the same level as the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.