[Asia Economy Reporter Changhwan Lee] Recently, as market interest rates have risen and real estate prices have declined, concerns about the soundness of insurance companies' real estate project financing (PF) loans have also increased. Although the situation is not at the level of the 2008 financial crisis, it is analyzed that insurance companies need to proactively manage risks in preparation for market fluctuations.

According to the Insurance Research Institute's report "Real Estate PF Loans in the Insurance Industry" on the 7th, the scale of corporate loans by domestic insurance companies was 137.4 trillion KRW as of the end of 2021, of which real estate PF loans accounted for 42 trillion KRW, exceeding bank loans by more than 13 trillion KRW.

In particular, the balance of real estate PF loans increased from 15.7 trillion KRW at the end of 2016 to 42 trillion KRW at the end of 2021, and the proportion of insurance companies' real estate PF loans to corporate loans expanded from 20.1% in Q4 2016 to 30.6% in Q4 2021.

The proportion of PF loans to the total loan receivables of insurance companies rose from 8.3% in Q4 2016 to 15.8% in Q4 2021. This amount exceeded the real estate PF loan balance of 29.0161 trillion KRW held by 18 domestic banks (excluding the Export-Import Bank) by 13.0096 trillion KRW.

The report evaluated the risk level of the real estate market by comparing it with the commercial real estate loan delinquency rates of the U.S. life insurance industry and the domestic mortgage loan delinquency rates, concluding that the risk level has significantly decreased compared to the global financial crisis period from 2008 to 2010.

After the 2008 global financial crisis, the delinquency rate of real estate PF loans across the financial sector rose from 4.4% in 2008 to 12.9% at the end of 2010 but then declined from 13.0% in 2013 to 1.9% at the end of June 2019.

According to the Financial Supervisory Service, the delinquency rate of real estate PF loans in the insurance sector increased from 2.4% (loan balance of 5.3 trillion KRW) in 2008 to 8.3% in 2010 but then sharply decreased to 5.4% in 2013 and 0.3% as of June 2019.

The delinquency rate of commercial real estate loans in the U.S. life insurance industry was between 0.01% and 0.05% from 2005 to 2007 but surged more than fourfold to 0.17%?0.19% during 2009?2011 following the 2008 global financial crisis.

However, it gradually declined after 2012, rose to 0.16% in 2020 when COVID-19 began, but fell again to 0.03% in 2021 despite rising market interest rates.

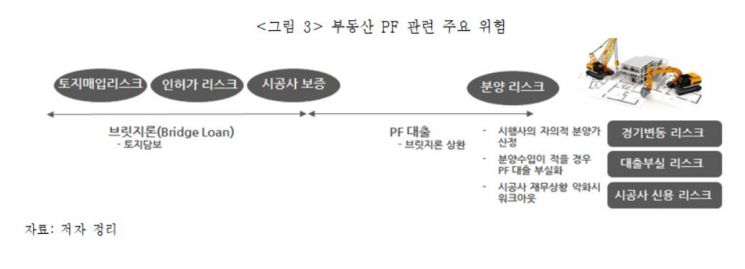

Senior Research Fellow Yongsik Jeon of the Insurance Research Institute stated, "Due to strengthened risk management by borrowers in the real estate PF loan market, the risk exposure of insurance companies is expected to be smaller than in the past," but he also pointed out, "There is still exposure to risks from real estate market deterioration caused by rising interest rates and related pre-sale risks, so management of these risks is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.