WTI and Brent Crude Hit 6-Month Low

Positive for Commodity Prices and Inflation

Risks Remain from Russian Resource Weaponization and US-China Tensions

International oil prices have returned to pre-war levels amid concerns about a global economic slowdown caused by the Russia-Ukraine war. If the decline in oil prices is reflected in domestic retail prices, the inflation (price increase) situation could stabilize. However, geopolitical risks are becoming more multipolar, with intensified conflicts between the US and China alongside the Russia-Ukraine war, and growing fears of a global economic recession, leaving the industrial sector's sense of crisis far from dissipated.

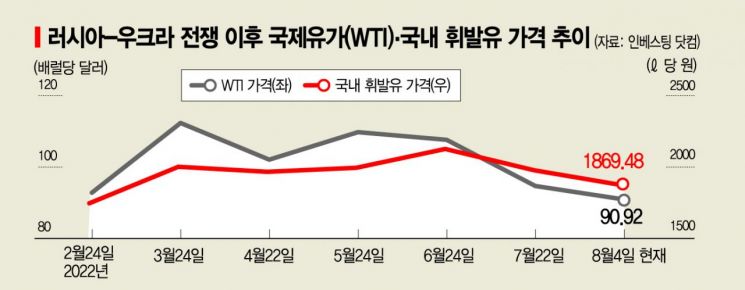

◆International Oil Prices Return to Pre-Russia-Ukraine War Levels= On the 3rd (local time), West Texas Intermediate (WTI) crude oil for September delivery on the New York Mercantile Exchange (NYMEX) closed at $90.92 per barrel (approximately 118,914 KRW), down $3.50 (3.71%). This is the lowest level since February 10. On the same day, Brent crude futures fell 3.7% to close at $96.78 (approximately 126,578 KRW), the lowest since February 21.

This indicates that international oil prices have reverted to levels before the outbreak of the Russia-Ukraine war. The WTI price per barrel was $92.81 on February 24, when the war began, and surged to $130.5 within two weeks. Until just a month ago (July 4), prices hovered around $110 per barrel but have since declined in the second half of this year due to concerns about a global economic slowdown, returning to pre-war levels.

Notably, on this day, the Organization of the Petroleum Exporting Countries (OPEC) and the OPEC+ coalition, which includes major non-OPEC oil producers such as Russia, slightly increased the September oil production by 100,000 barrels per day, raising concerns about a potential rebound in oil prices. This increase is much slower compared to the 648,000 barrels per day increases in July and August, representing only about 15% of the previous two months' pace. Despite international oil prices being in the $90 range per barrel, most oil-producing countries, excluding the US?the world's largest producer?intend to reduce supply further. However, due to concerns over declining global demand and reports of rising US crude oil inventories, prices have fallen back to pre-war levels.

◆High Oil Prices Cooled by Recession Fears... Will Inflation Also Ease?= The decline in oil prices follows the trend of economic contraction. Manufacturing indicators in China and the US have recently shown weakness. According to S&P Global, China's Caixin Manufacturing Purchasing Managers' Index (PMI) for July recorded 50.4, down from 51.7 in June. The official manufacturing PMI released by China's National Bureau of Statistics for July was 49, falling below the 50 threshold, indicating a contraction in manufacturing activity. China's manufacturing PMI had returned to expansion territory at 50.2 in June after four months but reverted to contraction just one month later.

US manufacturing indicators also dropped to their lowest levels in two years. The final July US Manufacturing PMI by S&P Global was 52.2, the lowest in two years, and the Institute for Supply Management (ISM) reported a July US Manufacturing PMI of 52.8, also the lowest in two years.

This year, rising raw material prices, especially oil prices, have been a major cause of inflation that has shaken both industry and households. Stabilization of oil prices is good news in itself. Domestic gasoline and diesel prices are also stabilizing. As of 9 a.m. on the day, the nationwide average gasoline price was 1,869.48 KRW per liter, and diesel was 1,927.90 KRW per liter. Gasoline and diesel prices peaked at the 2,140 KRW and 2,160 KRW levels respectively at the end of June and have been declining since.

However, the risk remains that the downward trend in international oil prices could reverse due to geopolitical risks such as Russia's weaponization of resources and US-China conflicts. Moreover, as the current economic situation is described as a "complex crisis," with factors such as exchange rates and interest rates threatening the economic conditions of companies and households, some argue that the temporary decline in oil prices alone cannot be viewed positively.

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "Although oil prices have recently fallen, the overall price level remains high compared to previous years. The rise in import prices centered on energy prices and the resulting inflationary pressures still appear to persist. Measures such as liquidity withdrawal through interest rate hikes remain valid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.