Shanghai Stock Market Declines for Second Day

South Korea, Japan, and Taiwan Close with Rebounds

"Impact Limited Due to Short-Term Investment Sentiment Factors," Forecast

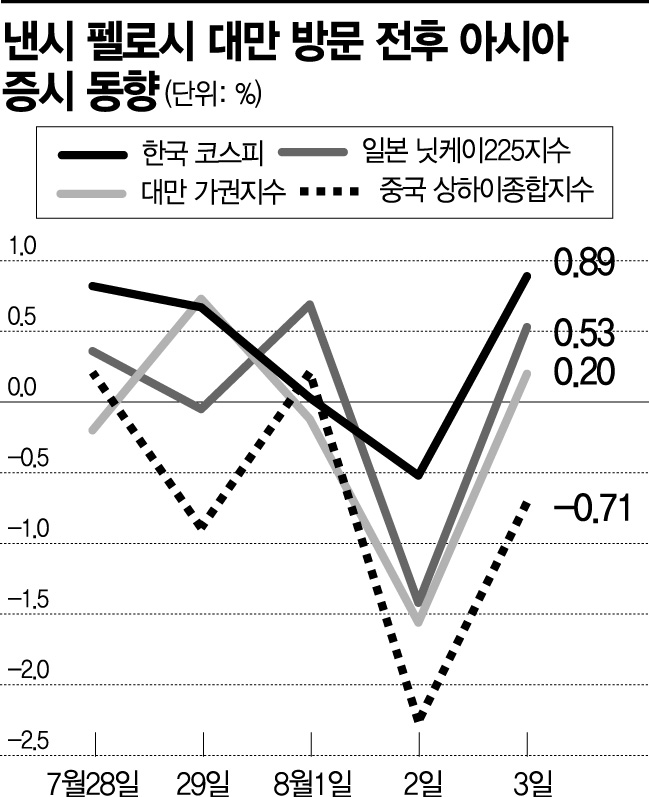

[Asia Economy Reporter Myunghwan Lee] Nancy Pelosi, Speaker of the U.S. House of Representatives, made a sudden visit to Taiwan, intensifying U.S.-China tensions and putting "Jung-hwa Gaemi" investors on high alert. There are concerns that the escalation of geopolitical risks and economic retaliation measures will negatively impact stock markets across Asia, including China. However, the securities industry forecasts that the actual impact on the stock markets will be limited and short-term.

According to the financial investment industry on the 4th, the Chinese stock market closed lower the previous day. The Shanghai Composite Index ended at 3,163.67, down 0.71% from the previous day, continuing a two-day decline. Pelosi's visit to Taiwan the day before triggered an immediate backlash from China, which responded with economic retaliation, acting as a negative factor. China's Ministry of Commerce announced a temporary suspension of natural sand exports to Taiwan starting the previous day, and the customs authority, the General Administration of Customs, also announced the suspension of imports of Taiwanese citrus fruits and refrigerated hairtail fish from the same day.

However, except for the Chinese stock market, Asian markets all closed higher. The KOSPI closed at 2,461.45, up 0.89% from the previous trading day, and Japan's Nikkei 225 index rose 0.53% to close at 27,741.90. Taiwan's Weighted Index also rose 0.20% to 14,777.02, partially recovering from the decline on the 2nd. Hong Kong's Hang Seng Index closed at 19,767.09, up 0.40% from the previous day, partially recovering from the over 2% sharp drop the day before.

The securities industry expects the impact on Jung-hwa Gaemi investors to be short-lived. Samsung Securities Research Center stated, "The influence is limited as a short-term investment sentiment factor," and predicted, "After short-term volatility expansion, the market will return to a fundamental phase driven by the economy and policies." Jeong Jeong-young, a researcher at Hanwha Investment & Securities, also said, "It is a good material to justify short-term volatility expansion in the Chinese stock market," but analyzed, "Since the Taiwan issue is a problem that cannot be easily resolved, it is reasonable to see a low possibility of extreme developments."

There is also analysis that the impact on the real economies of China and Taiwan will be limited. Choi Seol-hwa, a researcher at Meritz Securities, said, "Taiwan's dependence on exports to China is as high as 42%, but the proportion of semiconductor exports, which cannot be substituted within China, is 39%," and added, "The actual shock to the real economy is less significant, but the long-term impact such as worsening trade environment between China and Taiwan and withdrawal of Taiwanese funds from China could be greater."

However, concerns remain that the intensification of U.S.-China conflicts could affect the global economy in the long term. Researcher Choi pointed out, "Pelosi's visit to Taiwan violates the 'One China' policy, further deepening the decoupling between the U.S. and China," and said, "This will ultimately accelerate the establishment of supply chains by various countries and could act as a factor delaying the easing of supply-driven inflationary pressures." In fact, China's CATL postponed its North American factory investment plan announcement due to instability in U.S.-China relations immediately after Pelosi's visit.

According to the Korea Securities Depository, as of that day, the custody amount of stocks in the Greater China region (China, Hong Kong, Taiwan) was $4.62846 billion (approximately 6.05 trillion KRW), accounting for about 5% of the total overseas stock custody amount.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)