Joint Surge as European Gas Prices Soar Due to Russia's Supply Cuts

Trading at 10 Times the Average... Southeast Asia's Power Shortage Concerns Spread

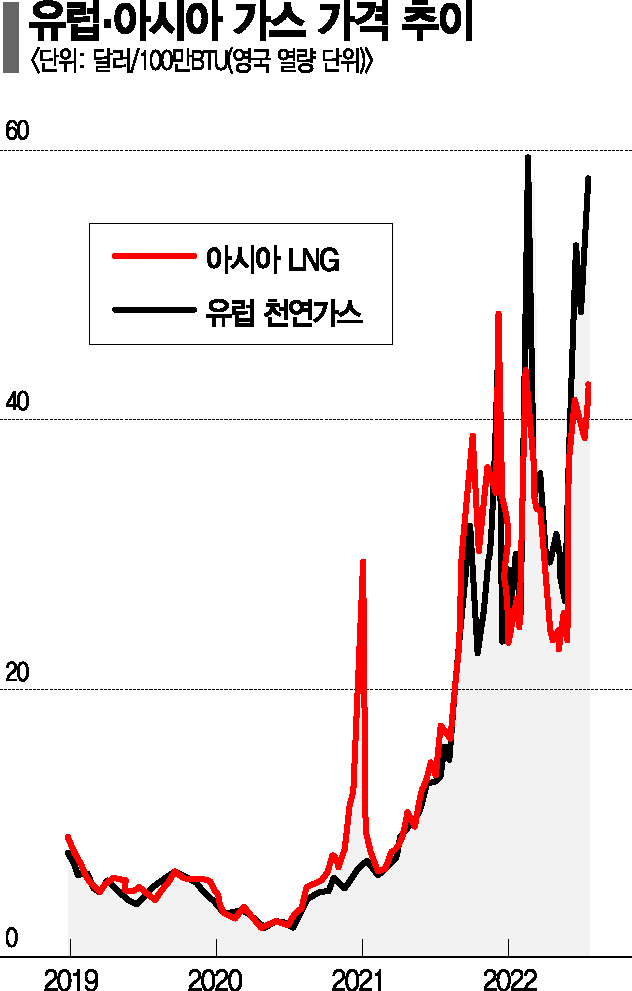

[Asia Economy Reporter Park Byung-hee] As Russia reduces its gas supply, European gas prices have soared, causing liquefied natural gas (LNG) prices in the Asian region to surge as well. There are growing concerns that the sharp rise in LNG prices will lead to power shortages in Asian countries, resulting in economic damage. Russia's weaponization of energy resources is directly impacting Europe and causing a chain reaction in Asia.

According to Japan's Nihon Keizai Shimbun on the 3rd, LNG prices in the Asian region are trading at about 10 times the normal level.

Recently, LNG traded in South Korea, Japan, and other countries is priced in the high $40s per million BTU (British Thermal Units). At the end of last month, prices exceeded $50, marking the highest level since early March, shortly after Russia's invasion of Ukraine. Around this time in 2019, before the COVID-19 pandemic, LNG prices were about $5 per million BTU.

As European natural gas prices have risen nearly tenfold, Asian LNG prices have followed suit. The Dutch TTF exchange's natural gas futures closed at 200.3 euros per megawatt-hour (MWh) on the 2nd. One year ago, the TTF natural gas price was 23.7 euros per MWh.

European natural gas prices surged immediately after Russia invaded Ukraine, then stabilized somewhat below 100 euros per MWh, before soaring again last month. This was due to Russia significantly reducing gas supplies under the pretext of scheduled maintenance on the Nord Stream 1 pipeline connected to Germany in mid-last month. Some in the West speculated that Russia might not resume gas supplies even after maintenance, but fortunately, Russia restarted supply. However, only about 20% of Nord Stream 1's transport capacity is currently being supplied. As a result, major German cities such as Berlin, Munich, and Hanover have implemented energy-saving measures since the end of last month, including reducing nighttime lighting and hot water usage.

In Southeast Asian countries, concerns about power shortages are growing. According to market research firm Kepler, Pakistan's LNG imports through July this year were only 4.25 million tons, an 18% decrease from last year. Pakistan recently abandoned bids for about 700,000 tons of LNG planned for purchase between July and September due to the sharp rise in LNG prices.

According to the International Energy Agency (IEA), as of 2019, gas-fired power generation accounted for 46% of Pakistan's electricity production. There are forecasts that Pakistan could face severe power shortages due to reduced LNG supply. In Bangladesh, gas-fired power generation accounts for as much as 81%. There is growing anxiety that the surge in LNG prices could lead to large-scale blackouts in Asian countries, causing factory shutdowns and production disruptions, resulting in significant economic shocks.

Pakistan's main industry, the textile sector, reportedly saw production drop to less than half in July, causing losses of at least $1 billion. The International Monetary Fund (IMF) revised its global economic growth forecast at the end of last month, lowering the expected economic growth rate for emerging Asian markets this year from 5.4% to 4.6%.

With winter approaching, when electricity demand rises sharply, there are forecasts that natural gas prices could increase further. Bloomberg expects fierce competition among countries such as Japan, South Korea, and European nations to secure gas supplies for winter electricity demand, predicting additional rises in gas prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)