[Asia Economy Reporter Jeong Hyunjin] Due to global concerns over economic recession and soaring inflation, more than 350 companies have postponed or canceled funding-related plans such as initial public offerings (IPOs) and bond issuances, Bloomberg reported on the 1st (local time). The total amount exceeds $250 billion (approximately 326.7 trillion KRW).

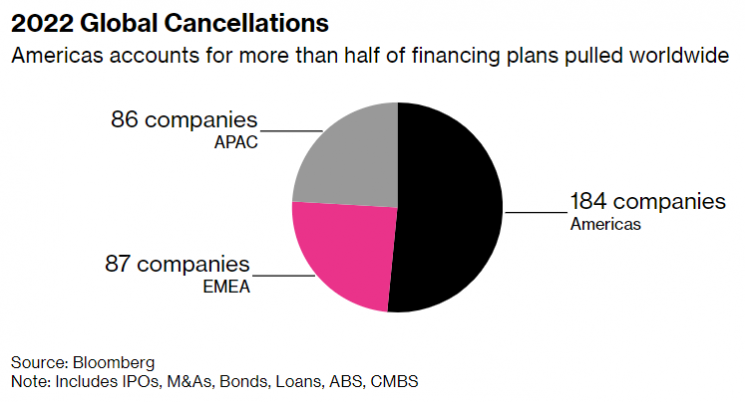

Bloomberg stated that at least 358 companies worldwide have postponed or canceled funding transactions including IPOs, loans, bonds, and acquisitions. By region, the United States had the highest number with 184 companies, followed by Europe and Africa with 87, and the Asia-Pacific region with 86.

Bloomberg explained that the reason many companies in the U.S. canceled or postponed funding plans is because "due to the stock market decline, 136 companies, which is about two-thirds of the companies scheduled worldwide, withdrew their IPOs since January this year."

In the loan market, 103 transactions worth $64 billion have been postponed or canceled from the beginning of the year until now, causing lenders difficulties in securing funds. Bloomberg added that the bond market has already surpassed the total number of postponed contracts during the peak of the pandemic or last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.