[Asia Economy Reporter Jeong Hyunjin] Due to the ongoing craze for cryptocurrency and stock investments since last year, the amount of multiple debts held by young people under 30 who have borrowed from three or more financial institutions has increased by more than 30% compared to five years ago.

On the 31st, Shin Yongsang, Senior Research Fellow at the Korea Institute of Finance, stated in the report titled "Current Status and Risk Management Measures of Multiple Debtors in the Domestic Financial Sector" that "As the number of multiple debtors in the financial sector and their per capita debt amount have surged, the potential risk of insolvency is increasing."

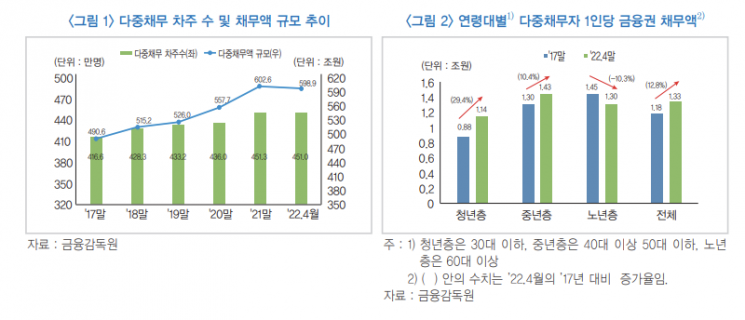

According to the report, as of the end of April, the total number of multiple debtors in the financial sector was 4.51 million, with a debt amount of 598.8 trillion KRW. This represents an increase of 8.3% and 22.1%, respectively, compared to the end of 2017 when the number of multiple debtors was 4.166 million and the debt amount was 490.6 trillion KRW.

Looking at the multiple debt amounts by age group, young people under 30 saw a 32.9% increase to 158.1 trillion KRW. The elderly aged 60 and above also recorded a similar increase, rising 32.8% to 72.6 trillion KRW. The middle-aged group in their 40s and 50s increased by 16.2% to 368.2 trillion KRW. Although the middle-aged group accounts for the largest share of total multiple debt at 61.5%, the growth rate of young and elderly groups was more than twice as fast as that of the middle-aged group.

The per capita debt amount of multiple debtors in the financial sector increased by 12.8%, from 118 million KRW at the end of 2017 to 133 million KRW. During the same period, the young group increased by 29.4% to 114 million KRW, the middle-aged group rose by 10.4% to 143 million KRW, while the elderly group decreased by 10.3% to 130 million KRW.

The problem is that the rate of increase in the number and debt amount of multiple debtors among young and elderly groups is accelerating in the secondary financial sector, where loan interest rates are high, raising the possibility of insolvency. In the savings bank sector, the number of young multiple debtors increased by 10.6% to 503,000, and the debt amount surged by 71.1% to 11.1 trillion KRW. The elderly group increased by 96.6% to 95,000 and their debt amount rose by 78.1% to 2.1 trillion KRW.

Senior Research Fellow Shin said, "To prevent insolvency risks, debtors should adjust the debt funds excessively flowing into asset markets, and financial institutions should expand their loss absorption capacity through provisions for loan losses." He added, "Institutionally, efforts are needed to develop programs that convert multiple debtors' unsecured loans and lump-sum repayment loans into installment repayment methods upon mid-term or maturity, or to switch high-interest products such as those from savings banks to lower fixed-rate products from other financial sectors or policy financial institutions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)