Macroeconomic Environment Also a Burden... Gap Between the Rich and Poor May Widen

[Asia Economy Reporter Minwoo Lee] The second-quarter earnings of major payment-related companies such as Kakao Pay are expected to slow down somewhat this year. While the economic slowdown delays consumer recovery, the continued rise in interest rates is leading to a decrease in payment amounts and a deterioration in loan brokerage business performance. However, since this situation could present opportunities for large financial platforms that have established economies of scale, some analysts view it as a chance to distinguish the 'wheat from the chaff.'

2Q Earnings Expected to Falter

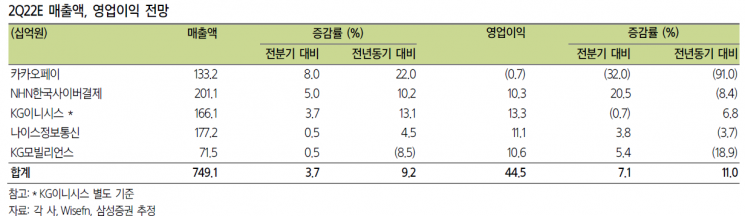

On the 30th, Samsung Securities made this outlook regarding the business prospects of payment companies. The second-quarter earnings of major payment companies such as Kakao Pay, NHN Korea Cyber Payment, NICE Information & Telecommunication, and KG Mobilians are expected to falter. Samsung Securities predicted that, except for KG Inicis, all would see a decline in operating profit compared to the same period last year. In the case of KG Mobilians, sales are expected to decrease by 8.5% year-on-year.

In fact, for the representative company Kakao Pay, the market consensus for second-quarter earnings compiled by financial information analysis firm FnGuide showed sales of 132.5 billion KRW and an operating loss of 5.2 billion KRW. While sales are expected to increase by 21.3% compared to the same period last year, the deficit is also anticipated to grow more than sixfold.

Researcher Jo Ahae of Samsung Securities explained, "This is because the pressure from the decline in payment commission rates triggered in March is reflected in the second quarter," adding, "However, considering the agreement reached earlier this month between card companies and the electronic payment gateway (PG) industry on commission rate increases, a gradual recovery can be expected from the third quarter."

Greater Competition Ahead... Macroeconomic Conditions Also a Burden

Simple payment companies are expected to face even greater competition. In May, the Financial Supervisory Service issued guidelines for the disclosure of payment commission rates for simple payment companies such as Naver Financial, Kakao Pay, and Toss. The guidelines require semi-annual disclosure and the separation of merchant fees into payment-related fees and other general commerce-related fees. This measure is seen as an effort to address the burden on merchants caused by the high payment commission rates of simple payment companies, which surfaced since September last year, and the resulting negative impact passed on to consumers. Researcher Jo diagnosed, "This is particularly a burden factor in setting payment commission rates for Kakao Pay," adding, "With over 100 PG companies registered as electronic financial operators and 46 simple payment providers, this measure is expected to induce price competition, thereby intensifying the competition among payment companies to lower fees."

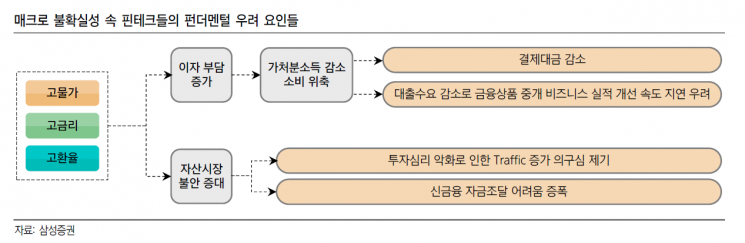

Macroeconomic variables also pose a burden. The rise in interest rates increases household interest burdens, leading to reduced disposable income and weakened consumer sentiment, which could result in a decline in payment amounts. Furthermore, as loan demand shrinks, concerns about deteriorating performance in financial product brokerage businesses, such as reduced loan brokerage commissions, are emerging.

Sorting the Wheat from the Chaff... Opportunities for Large Financial Platforms

Ultimately, the sorting of the wheat from the chaff is expected to accelerate. Payment companies that have evolved into financial platforms have continued their businesses by increasing market share mainly through large-scale paid-in capital increases despite ongoing losses. Kakao Pay raised capital through an initial public offering (IPO), and Toss Bank and Toss (Viva Republica) also continued paid-in capital increases. However, this structure is advantageous in a low-interest-rate environment but is difficult to sustain during periods of rising interest rates. Corporate investment has already begun to shift conservatively. Under stagflation conditions where economic recession and high inflation overlap, fintech payment companies that emphasize external growth over profitability may face bankruptcy risks due to rising funding costs.

On the other hand, this structure can present opportunities for large financial platforms that have established economies of scale. Large payment companies, which already have sufficient financial resources and a vast customer base, can strengthen their market dominance and increase market share through mergers and acquisitions (M&A). Researcher Jo said, "In the mid to long term, financial platforms have sufficient growth potential amid changes in the financial environment, but the recent domestic and international macroeconomic environment should be considered as one of the factors determining the sorting of the wheat from the chaff among companies," adding, "In the process of increasing consolidation pressure within the industry, large financial platforms will play a key role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)