Housing Market Slump Due to Interest Rate Hikes Inevitable for Now

Prepare in Advance for Interest Rate Cut Timing... 'Supply' Is Key

"Foundation for Supply Activation Through Deregulation Such as Urban Maintenance"

"I haven't paid to buy 'VitaXXX' in the past few years. But with no transactions and no visitors like this, I wonder how I'll survive the rest of the year." (Representative of real estate agency A in Mapo-gu, Seoul)

The real estate market is experiencing a freezing winter more terrifying than the heatwave. People who used to visit agencies saying, "Please contact me in advance if good properties come up," have disappeared. This is interpreted as a result of the combined effects of the interest rate hikes that began in earnest in the second half of last year, the resulting loan interest burden, and growing concerns over economic recession. It is expected that the real estate market downturn is inevitable as long as the interest rate hike trend continues. There is also advice that the government should take this downturn period as a golden time to normalize the real estate market.

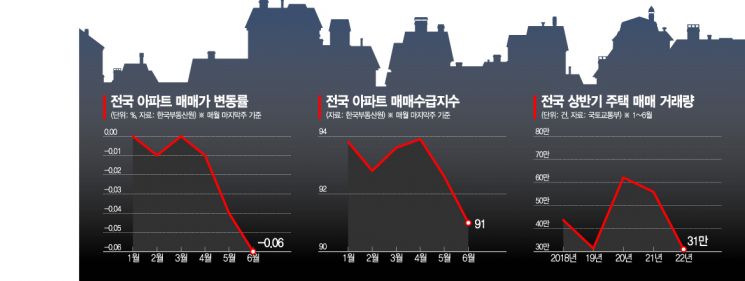

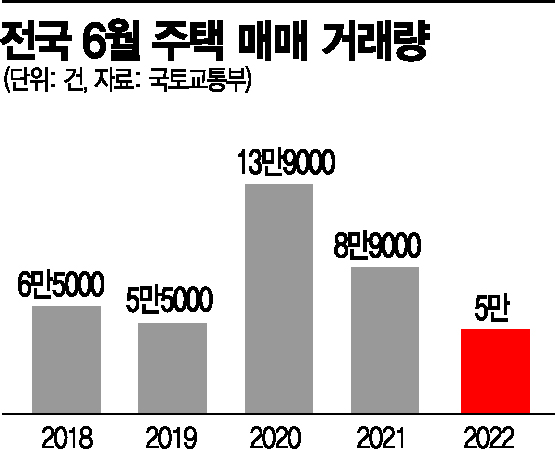

◇Buying sentiment frozen... unsold homes rising= Housing purchase sentiment has been shrinking for three consecutive months. According to the Korea Real Estate Board, this week’s Seoul apartment sales supply-demand index was 85.0, down 0.7 points from last week’s 85.7. This marks 12 consecutive weeks of decline since the temporary exclusion of capital gains tax surcharges was implemented on May 9 (91.0). The sales supply-demand index is calculated by the Real Estate Board based on surveys of member agencies and the number of online listings, quantifying the balance between demand (buyers) and supply (sellers). The lower this index is below the baseline (100), the more sellers there are compared to buyers in the market.

According to data from the Seoul Real Estate Information Plaza, the number of apartment transaction reports in Seoul this month is only 317. Although the reporting deadline is one month away until the end of next month, considering the trend, it is quite possible that this will be the lowest number ever recorded, even less than February this year (815 cases).

Unsold homes are also increasing. As of the end of June this year, the total number of unsold homes nationwide was 27,917, up 2.0% (535 units) from the previous month. ‘Post-completion unsold homes,’ which are called ‘malignant unsold’ because they remain unsold even after construction is completed, numbered 7,130 units, a 4.4% increase from the previous month. In particular, post-completion unsold homes in Seoul surged more than fivefold, increasing 481% from 37 units in May to 215 units in June.

◇"The freezing winter is a golden time for real estate market normalization"= Interest rate hikes are expected to continue, so the transaction cliff and market stagnation are likely to persist for the time being. Since the interest rate hikes are largely due to the global environment, there is little room for government intervention solely based on the real estate market. Experts advise that the ongoing stagnation period should be used as an opportunity to normalize the market. Now, when price responsiveness and volatility to policies are low, is the optimal time to normalize regulations.

Ko Jun-seok, CEO of J-Edu Investment Advisory, said, "The government’s main policy should be to prepare for when interest rates turn to a decline after next year." Once the interest rate factor is removed, the biggest weakness and problem of the real estate market is ultimately supply. Ko emphasized, "This is precisely the time to quickly ease and lift regulations on private redevelopment projects to lay the foundation for supply activation, and to prepare various measures to stabilize the rental market," adding, "We should take the current market stagnation as a golden opportunity to actively improve the system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.