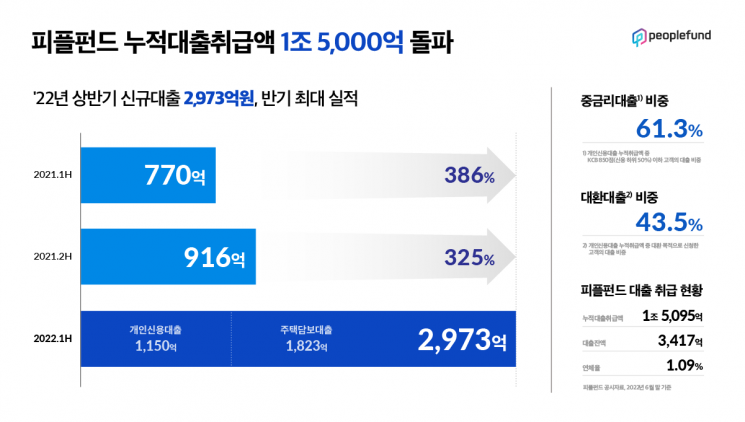

[Asia Economy Reporter Song Seung-seop] PeopleFund recorded a performance of 297.33 billion KRW in new loans in the first half of 2022, an increase of 386% compared to the same period last year. This was due to the surge in credit loan applications reaching 75 trillion KRW in just one month, mainly from customers seeking to refinance high-interest loans, drawing attention as an alternative lending source.

According to PeopleFund on the 29th, as of the end of last month, the cumulative loan amount was 1.50953 trillion KRW, and the outstanding loan balance was 341.66 billion KRW, the largest in the industry. Among newly issued loans, personal credit loans amounted to 115.02 billion KRW. The cumulative scale of personal credit loans reached 316.55 billion KRW.

Among personal credit loans, loans issued to borrowers classified as medium credit accounted for 61.3%, a majority. Loans intended to refinance loans from secondary financial institutions such as savings banks and card loans accounted for 43.5%. The market share of personal credit loans was 68.4%, and the overall delinquency rate recorded was 1.09%.

Real estate secured loans newly issued in the first half amounted to 182.33 billion KRW. The outstanding loan balance reached 216.38 billion KRW, achieving a cumulative loan amount of 595.41 billion KRW. Real estate secured loans grew rapidly compared to personal credit loans, as individual and corporate investors preferred real estate bond-type products with solid collateral.

The scale of personal credit loans received by PeopleFund was identified to reach up to 75 trillion KRW per month. However, since mid-interest loans can only be supplied within the scope of the raised investment funds, it is necessary to devote great effort to recruiting individual and corporate investors. Accordingly, PeopleFund plans to focus more on marketing to raise investment funds in the second half of the year.

Kim Dae-yoon, CEO of PeopleFund, stated, “In the second half of the year, we plan to launch new products and services so that medium-credit customers can conveniently use high-quality loan products,” adding, “We will do our best to achieve second-half performance that surpasses the first half.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.