Major Listed Pharmaceutical and Bio Companies

Q2 Average Operating Profit Down 12.4%

Performance Improvement Outlook Amid COVID-19 Resurgence

Exchange Rate Also Has Significant Impact... Profitability Worsens with High Import Ratio

Export-Oriented Companies 'Smile'

[Asia Economy Reporter Lee Chun-hee] Since the Omicron wave peaked last March, the spread of COVID-19 slowed down from April to June, resulting in significantly mixed second-quarter earnings among major pharmaceutical and bio companies. Variables such as the sharp rise in exchange rates and the fourth round of vaccinations in preparation for a resurgence this summer have also influenced the performance outcomes.

Profitability Deteriorates as Omicron Wave Rapidly Declines

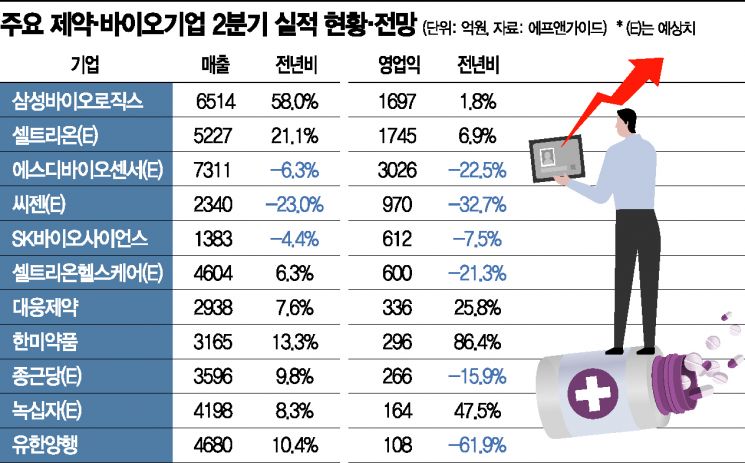

According to related industries and financial information provider FnGuide on the 29th, the average operating profit of 11 listed pharmaceutical and bio companies?including Samsung Biologics, Celltrion, SD Biosensor, Seegene, SK Bioscience, Celltrion Healthcare, Daewoong Pharmaceutical, Hanmi Pharmaceutical, Chong Kun Dang, Green Cross, and Yuhan Corporation?is expected to decrease by 12.4% compared to the same period last year in the second quarter.

First, diagnostic kit companies such as SD Biosensor and Seegene, which experienced rapid sales growth during the COVID-19 pandemic, saw their operating profits sharply decline. The expected operating profits for the second quarter for these two companies are 302.6 billion KRW and 97 billion KRW respectively, representing decreases of 22.5% and 32.7% compared to the same period last year.

SK Bioscience, which achieved nearly 1 trillion KRW in annual sales last year through COVID-19 vaccine contract development and manufacturing (CDMO), also saw its second-quarter sales drop by 4.4% year-on-year to 138.3 billion KRW, with operating profit falling 7.5% to 61.2 billion KRW. The decline in performance is attributed to the easing of COVID-19 spread in the second quarter after daily new cases surged to 620,000 in the first quarter.

However, as a global resurgence of COVID-19 is occurring in the third quarter, there is analysis that these companies’ performances will improve again. In particular, SK Bioscience, which succeeded in developing Korea’s first domestic vaccine ‘Skycovione,’ has started overseas expansion by applying for approval from the UK Medicines and Healthcare products Regulatory Agency (MHRA). Researcher Lee Dal-mi from SK Securities said, "Skycovione is expected to generate sales starting in the second half of the year," adding, "As forecasts suggest that COVID-19 vaccines will need to be administered annually like flu vaccines, vaccine demand will continue steadily."

Exchange Rate Variables Bring Mixed Fortunes Depending on Export-Import Ratios

The sharp rise in exchange rates has also become a major variable affecting pharmaceutical and bio companies’ earnings. The won-dollar exchange rate soared 7.3% from 1,213.5 KRW at the end of March to 1,301.5 KRW at the end of June, causing significant divergence in fortunes depending on business types. Pharmaceutical companies with a high import ratio of raw materials or many imported drugs see profitability worsen when the exchange rate rises, whereas CDMO companies or those with large export and overseas business proportions benefit. In particular, CDMO companies face less risk from price fluctuations because customers bear the cost of raw materials, and since customers usually pay in dollars, sales growth effects occur.

Samsung Biologics projected that if the exchange rate rises 10% to around 1,330 KRW as of the first quarter, pre-tax net profit would increase by about 63.9 billion KRW. In the second quarter, continuous growth in the CDMO business, along with the completion of the Samsung Bioepis merger, led to the company achieving over 1 trillion KRW in sales for the first half of the year. Samsung Biologics’ combined sales including Bioepis reached 1.1627 trillion KRW, with operating profit of 346.1 billion KRW.

Daewoong Pharmaceutical recorded sales of 293.8 billion KRW and operating profit of 33.6 billion KRW in the second quarter, as its botulinum toxin product ‘Nabota’ gained momentum in the US market and the exchange rate provided a boost. Notably, operating profit exceeded consensus estimates by 12%, growing 25.8% year-on-year. Nabota generated sales of 37.1 billion KRW, with exports alone reaching 29.2 billion KRW. Researcher Kim Seung-min from Mirae Asset Securities said, "Nabota’s rapid growth is due to increased exports to the Americas and the exchange rate effect," adding, "With the full-scale export of Nabota and the July launch of Pexuclu, sales from in-house developed products will increase, sustaining margin improvements."

Hanmi Pharmaceutical was driven by steady growth from its Chinese local subsidiary Beijing Hanmi Pharmaceutical. Beijing Hanmi recorded sales of 78.6 billion KRW and operating profit of 17.1 billion KRW in the second quarter. The operating profit accounted for 58% of Hanmi Pharmaceutical’s total operating profit of 29.6 billion KRW. The company explained, "Our improved and new drugs developed with proprietary technology continued steady growth, and the strong performance of Beijing Hanmi Pharmaceutical, which has shown rapid growth since last year, contributed significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.