Foreign Investors Turn to Net Buying

Focus on Whether Stock Market Direction Will Shift

Short Selling Attacks Expected to Decrease Next Month

Potential Policy Shift Noted in Sell Korea

Photo by Getty Images Bank

Photo by Getty Images Bank

[Asia Economy Reporter Hwang Junho] The movements of foreign investors are becoming unusual. Since mid-this month, foreigners have been net buyers of over 2 trillion won in the KOSPI, leading the stock market rally. There are also forecasts that foreign investors' short-selling attacks will shift starting next month. The market is holding its breath, watching closely to see if the direction of foreign investors' 'Sell Korea,' which plays a key role in the direction of the Korean stock market, will change.

According to the Korea Exchange on the 29th, foreign investors have net purchased stocks worth 2.2141 trillion won in the KOSPI during this month up to the 28th. This is the first time this year that the monthly net purchase amount has exceeded 2 trillion won. Last month, they sold stocks worth over 5 trillion won.

With the shift to net buying, the foreign investors' stock holdings based on market capitalization have sharply surpassed the 31% level, which they had not exceeded since the 15th of last month, starting from the 18th. The KOSPI index has also settled above the 2400 level since the 21st, supported by foreign investors' buying momentum.

The return of foreign investors coincides with the halt in the rising trend of the exchange rate. Due to the depreciation of the Korean won, the USD/KRW exchange rate surged to 1,323.7 won on the 18th but has fallen to 1,304 won as of the 29th.

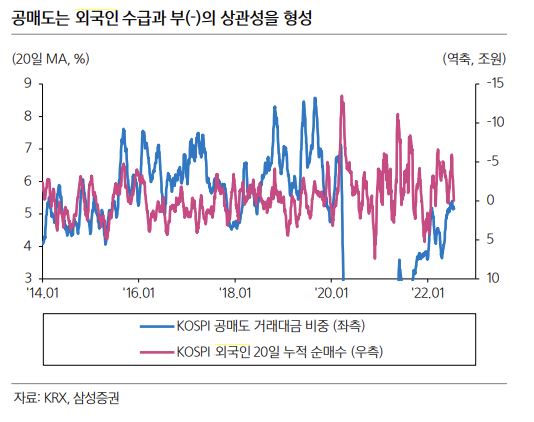

Additionally, there is analysis suggesting that, given the nature of foreign investors, they are likely to reduce short-selling transactions starting next month. Foreign investor supply and demand and short-selling transactions form a clear inverse correlation. However, short-selling transactions show a distinct seasonality, peaking in August and then trending downward until the end of the year.

Kim Yong-gu, a researcher at Samsung Securities' Global Investment Strategy Team, stated, "This pattern has been observed since 2008," adding, "It is analyzed that after August, there is an acceleration of buybacks and loan repayments related to short-selling." This phenomenon is attributed to foreign investors' supply and demand focus being aligned with the September futures and options simultaneous expiration, followed by stable position rollovers and early profit-taking (Book-closing). Furthermore, the need to secure voting rights and dividend rights before the shareholder registry closure in the second half of the year is also cited as a factor causing urgent changes in foreign investors' behavior.

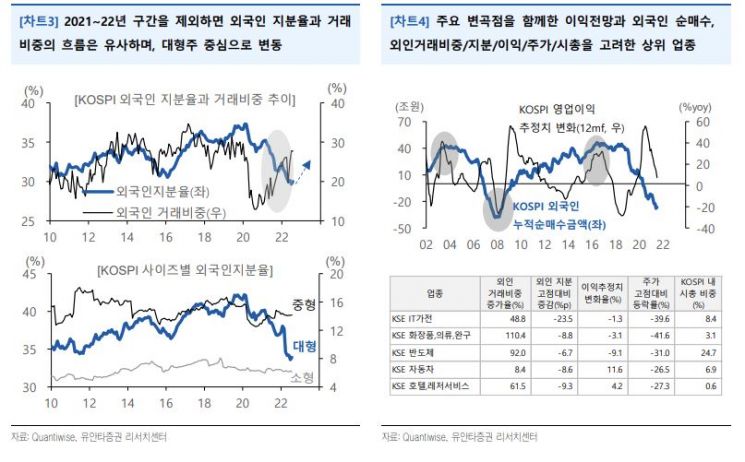

As foreign investors return, most of the stocks they have added to their portfolios are large-cap stocks. Since the 18th, foreigners have purchased LG Energy Solution (393 billion won), Samsung Electronics (303 billion won), SK Hynix (199 billion won), Hyundai Motor (107 billion won), and Samsung SDI (81 billion won). Notably, regardless of market conditions, they have increased holdings in defensive stocks like KT (66 billion won) as well as cyclical stocks like HMM (49 billion won). On the other hand, despite being large-cap stocks, they have avoided NAVER (-31 billion won) and Kakao (-14 billion won), likely due to a lack of confidence in growth stocks' prices.

Kang Daeseok, a researcher at Yuanta Securities, said, "It can be expected that foreign investors' shareholding ratio will recover mainly in large-cap stocks that were neglected by foreigners after COVID-19," adding, "Changes in foreign investors' shareholding ratios have always centered on large-cap stocks, and the stock prices followed the same trend." Considering foreign investors' trading volume, shareholding ratio, earnings forecasts, stock price levels, and market capitalization, Kang forecasted that IT electronics, cosmetics/clothing/toys, semiconductors, automobiles, and hotel/leisure sectors will be advantageous.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.