[Asia Economy Reporter Song Hwajeong] From now on, financial transactions using mobile driver's licenses will be possible at 14 banks.

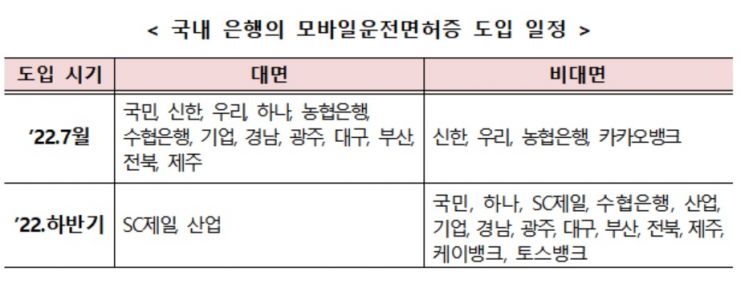

On the 28th, the Financial Services Commission announced that financial transactions using mobile driver's licenses can be conducted at the counters of 13 banks and through the smartphone apps of 4 banks. In the second half of this year, most of the remaining banks will also enable non-face-to-face financial transactions using mobile driver's licenses.

Starting today, financial transactions using mobile driver's licenses are possible at the branches of 13 banks including Kookmin Bank, Shinhan Bank, Woori Bank, Hana Bank, NongHyup Bank, Suhyup Bank, Industrial Bank of Korea, Kyongnam Bank, Gwangju Bank, Daegu Bank, Busan Bank, Jeonbuk Bank, and Jeju Bank. For non-face-to-face transactions, users can transact through the smartphone applications of Shinhan, Woori, NongHyup, and KakaoBank.

The mobile driver's license can be issued after the holder visits a driver's license examination office or a police station civil service office for face-to-face identity verification. It can be issued by replacing the existing driver's license with an IC driver's license and then issuing it on a smartphone, or it can be issued without replacing it with an IC driver's license. However, if the IC driver's license is not issued, the user must revisit the driver's license examination office to reissue the mobile driver's license in case of smartphone replacement or loss.

Bank users who have obtained a mobile driver's license can have bank staff at the branch present a QR code, then run the mobile ID app on their smartphone and scan the QR code. After completing the information provision consent and identity verification procedures, the user's identity information is transmitted to the bank, and account opening is completed through the identity verification process using the Ministry of the Interior and Safety's mobile ID system. In the case of non-face-to-face transactions, the mobile ID app is linked and called within the bank's smartphone app without the QR code presentation and scanning process.

A Financial Services Commission official said, "Consumers will find financial transactions more convenient as they can open accounts at banks with just their smartphones instead of physical driver's licenses," adding, "The mobile driver's license ensures safety through various security technologies and will contribute to preventing financial accidents caused by identity card forgery or alteration."

The Financial Services Commission and the Financial Supervisory Service plan to share the experience gained during the preparation process of the banking sector with the Korea Financial Telecommunications & Clearings Institute and the Financial Security Institute to support consumers using other financial companies to also use mobile driver's licenses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.