Included in the National Task Implementation Plan

Trading Computer System Excluded

[Asia Economy Reporter Ji Yeon-jin] The decisive reason why Korea Investment & Securities was fined 1 billion won this year for violating short-selling regulations was that it did not specify the bid price when placing short-selling orders. The Enforcement Decree of the Capital Markets Act stipulates that investors must inform securities firms whether the transaction is a short sale when trading stocks. Korea Investment & Securities indicates short selling by specifying the bid price. Some securities firms have systems that mark 'short sale' when placing orders, so the methods of short-selling transactions vary greatly among securities firms. In particular, borrowing stocks for short selling is done manually. This is one of the reasons why individual investors distrust short selling.

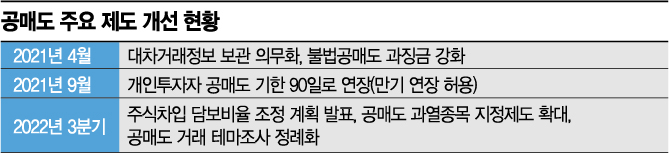

According to the Financial Services Commission on the 27th, the recently announced national task implementation plan in the capital market sector includes adjusting the difference in collateral ratios required when borrowing stocks for short selling between individual investors and institutions. Currently, the collateral ratio for individual investors is 140%, while for institutions it is 105%. The collateral ratio is the value obtained by dividing the debt amount by the stock valuation amount. If the agreed collateral ratio in short selling is not maintained, the held stocks are forcibly liquidated through forced sale. The Financial Services Commission also plans to expand the designation system for overheated short-selling stocks, which temporarily suspends short selling of stocks with a high short-selling ratio by the third quarter of this year, regularize thematic investigations on long-term and large-volume short-selling transactions, and periodically announce investigation results to detect illegal short selling early.

However, the recent national task plan excluded the computerized system for short-selling transactions that individual investors have long demanded. Most short selling detected by financial authorities so far has been due to foreigners' mistakes, and there remains distrust that intentional illegal short selling is practically difficult to detect and thus goes unpunished. It is difficult to detect because repayment can be made before the settlement date (T+2) after short selling. For this reason, there have been many calls for a computerized system for short-selling transactions, like those in the US, Canada, and the UK, which use automated systems when concluding securities lending agreements. Currently, in Korea, negotiation, confirmation, and input stages of lending transactions utilize messengers, phone calls, and emails.

The Financial Services Commission stated that since April last year, the system has been improved to require storing securities lending transaction information for short-selling purposes for five years and imposing fines of up to 10 million won for violations, so they intend to observe the effectiveness of this measure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.