The Financial Supervisory Service Announces 'Progress of Bank Inspections Related to Large Overseas Remittances'

[Asia Economy Reporter Song Seung-seop] According to an investigation by the Financial Supervisory Service (FSS), suspicious foreign currency remittance transactions in the banking sector have been identified to exceed 4 trillion KRW. This amount is about 2 trillion KRW more than what the banks initially reported. Upon examining the relationships between the companies involved in the fund flows, some remittance representatives were found to be cousins or even the same individuals.

According to the "Progress of Bank Inspections Related to Large Overseas Remittances" data released by the FSS on the 27th, the total amount of suspicious foreign currency remittance transactions confirmed at Shinhan Bank and Woori Bank is 4.1 trillion KRW (3.37 billion USD). Suspicious foreign currency transactions refer to cases where newly established small-scale corporations repeatedly remit large sums of foreign currency within a short period. Excluding duplicate companies, there are 22 related firms.

The transaction volume increased compared to the amounts initially self-reported by the banks. Shinhan Bank reported suspicious transactions amounting to 1.6 trillion KRW from 3 companies, and Woori Bank reported 900 billion KRW from 5 companies. However, the FSS determined that the suspicious transaction volume through Shinhan Bank reached 2.5 trillion KRW, and Woori Bank's was 1.6 trillion KRW. At Shinhan Bank, 1,238 suspicious remittances were handled over 17 months, and at Woori Bank, 931 suspicious remittances over 13 months.

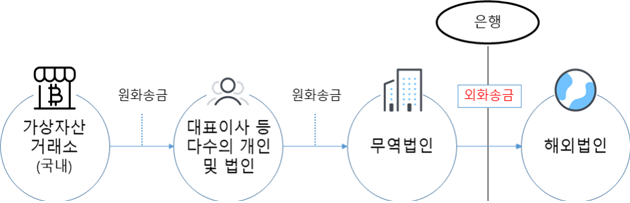

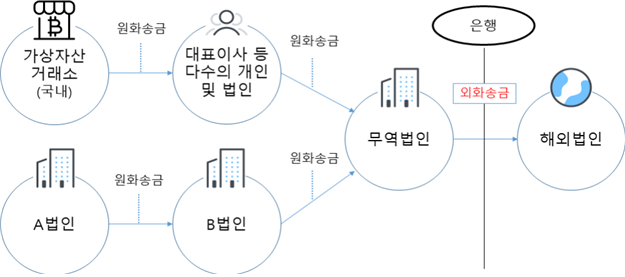

The method of foreign currency remittance was also disclosed. Most remittance transactions originated from domestic virtual asset exchanges. Funds transferred through the exchanges flowed through multiple personal and corporate accounts, including representatives of various trading corporations, before reaching the trading corporations. These funds were then remitted overseas under the name of "import payments." The overseas entities were confirmed to be regular corporations, not virtual asset exchanges.

Notably, there were cases where the representatives of the corporations were the same person or cousins. Instances were also detected where one person concurrently served as an executive for multiple corporations, indicating a special relationship. During the fund flow process, money moved from one corporate account to another corporation's representative account, from the same account to two different corporations, and remittances were made by companies considered to have special relationships at different times.

Some transactions involved a mixture of funds flowing in from domestic virtual asset exchanges and funds coming through regular commercial transactions. At Woori Bank, two companies, and at Shinhan Bank, one company used this type of remittance method.

This fact was revealed during on-site inspections conducted after the FSS received reports from Shinhan Bank and Woori Bank at the end of last month. Starting from the 1st of this month, all banks were instructed to conduct self-inspections to check for similar transactions and submit the results by the end of July. The inspections are currently being carried out in coordination by the Foreign Exchange Supervision Department, the General Bank Inspection Department, and the Anti-Money Laundering Office, and are expected to be completed after the 5th of next month. The total transaction volume under review by the FSS amounts to 5.37 billion USD.

Based on the inspection and the banks' self-inspection results, the FSS plans to notify the prosecution and the Korea Customs Service if additional suspicious foreign currency remittance companies are identified. If further analysis is deemed necessary from the banks' self-inspection results, additional inspections will be conducted. Banks that fail to properly perform foreign exchange operations and anti-money laundering duties will be strictly sanctioned according to laws and procedures based on factual findings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.