Last Year's Export Amount Reached a Record High of $690 Million

Nearly $400 Million in Exports in the First Half of This Year

Exports Expected to Surpass 1 Trillion Won This Year

Kim Snacks Popular in Western Countries Including the US

Lunchbox Gim Favored in Southeast Asia Including the Philippines

Industry Differentiates to Secure Market Share

CJ CheilJedang Implements Regional Development Strategies

Dongwon F&B Expands Seasoned Gim Usage

[Asia Economy Reporter Eunmo Koo] Korean Gim is captivating the taste buds of people worldwide by emphasizing not only its flavor and nutrition but also its convenience for consumption. With global demand increasing and South Korea's Gim export value expected to surpass 1 trillion won this year, domestic food companies are accelerating their efforts to capture the market.

Last Year's Export Value Hits a Record High of $690 Million

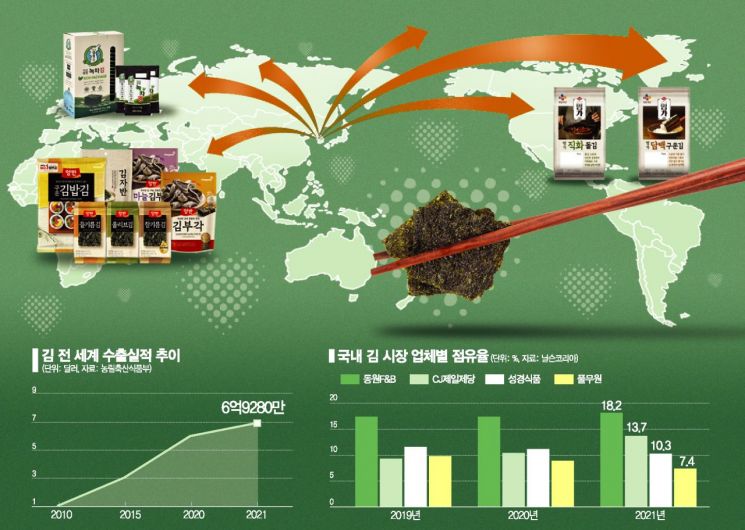

According to the Ministry of Agriculture, Food and Rural Affairs on the 27th, South Korea's Gim export value last year reached a record high of $692.8 million (approximately 908.5 billion won). This represents a 15.4% increase compared to 2020 ($604 million) and nearly a sixfold increase compared to 2010 ($152 million). By export destination last year, the United States led with $155.5 million, followed by China ($139.4 million), Japan ($114.1 million), and Russia ($46.99 million). This year, the export value for the first half reached $375.9 million (493 billion won), a 13.8% increase compared to the same period last year ($330.4 million), suggesting that this year's export performance will surpass last year's.

The industry is paying attention to the recent export growth occurring simultaneously not only in Asia but also in countries like the United States and Europe, where Gim consumption has not been traditional. Currently, Gim sold overseas is broadly divided into seasoned Gim for side dishes, known as Dosirak Gim, and chip-type Gim snacks. In Western countries, Gim snacks are more popular, whereas Dosirak Gim enjoys higher popularity in Southeast Asia. As of last year, the country with the highest share of Gim snack sales was the United States, followed by Germany and the United Kingdom in second and third place. Conversely, the Philippines had the highest share of Dosirak Gim sales, followed by Singapore and Vietnam.

The recent expansion of demand for Korean Gim in the global market is due to the growing perception of it as a healthy food that is low in calories yet rich in taste and nutrition. Amid heightened interest in health due to COVID-19 and other factors, consumers are focusing on the inherent strengths of the ingredient, such as its richness in protein and minerals. An industry insider explained, "Seaweed remains a relatively unfamiliar food in the global market, but as it becomes known that iodine contained in seaweed, including Gim, has benefits such as blood replenishment and wound healing, its recognition as a superfood is increasing."

Additionally, the adoption in 2017 of the 'Gim Product Standards' proposed by Korea as the Asian regional standard by the Codex Alimentarius Commission (CODEX) has contributed to raising the awareness and competitiveness of domestic Gim. Furthermore, increased consumption experiences through sushi restaurants and the flavor and aroma that appeal broadly across age and gender have also played a role.

Dongwon, CJ, and Others Employ Differentiated Strategies for Overseas Markets

As Gim gains attention in overseas markets, domestic companies are quickening their steps to secure market share. CJ CheilJedang has selected Gim as the next-generation K-food and plans to implement differentiated nurturing strategies by region. Since Western consumers perceive Gim as a superfood snack, the strategy is to use snack-type Gim as a platform, adding flavors familiar to locals to increase familiarity and expand the base. Conversely, in Asia, where Gim is relatively familiar, the plan is to introduce new forms of Gim snacks with different ingredients, textures, and appearances.

Dongwon F&B is aiming to expand the uses of seasoned Gim to capture diverse overseas consumer groups. While Gim is mainly consumed as a side dish domestically, overseas consumption focuses on convenience and snackability. A Dongwon F&B representative said, "Last year, we launched 'Yangban Gimbugak,' a modern reinterpretation of Gim bugak," emphasizing, "We will strive to expand uses and transform the image so that Gim becomes a snack for people worldwide."

Competition is fierce in the domestic market, where no absolute leader exists. According to market research firm Nielsen Korea, last year Dongwon F&B led the domestic Gim market with an 18.2% share, followed by CJ CheilJedang (13.7%), Seonggyeong Food (10.3%), Pulmuone (7.4%), and Gwangcheon Gim (5.0%).

Dongwon F&B believes that selecting and securing high-quality raw seaweed is crucial to Gim quality and plans to continuously enhance raw material quality. They operate a raw seaweed grader system, personally visiting production areas during harvest season to analyze and purchase raw materials. CJ CheilJedang is also strengthening branding for its integrated Gim brand 'CJ Myungga,' which combines 'Bibigo Gim' and 'Myungga Gim.' CJ Myungga's Gim products are segmented into three categories: 'Popular,' consisting of familiar products like traditional Gim; 'Premium,' made with high-quality raw seaweed such as Gamtae Gim and advanced technology; and 'Signature,' made with special raw seaweed like Chosari Gim.

Professor Eunhee Lee of Inha University's Department of Consumer Studies said, "There are surprisingly few foods made from seaweed that can be conveniently eaten at home. Gim is gaining attention as a health food and is being released in various processed forms that are easy to eat, so it is expected to continue growing steadily in both domestic and international markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)