KEPCO Accelerates Sale of KEPCO Engineering & Construction... Advisory Firm to Be Selected by Next Month

Approximately 400 Billion KRW for 14.77% Stake... Sale to Begin in September

Block Deal Likely Considered as Sale Method to Minimize Market Impact

KEPCO Reports Q1 Operating Loss of 7.8 Trillion Won, Record High... "Impact of High Oil Prices and Frozen Electricity Rates"

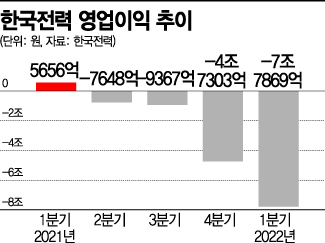

KEPCO Reports Q1 Operating Loss of 7.8 Trillion Won, Record High... "Impact of High Oil Prices and Frozen Electricity Rates"(Seoul=Yonhap News) Reporter Ryu Hyorim = Korea Electric Power Corporation (KEPCO) announced on May 13 that its consolidated operating loss for the first quarter of this year was 7.7869 trillion won, marking a turnaround from an operating profit of 565.6 billion won in the same period last year. Sales increased by 9.1% compared to the same period last year, reaching 16.4641 trillion won. Net loss also turned to a deficit of 5.9259 trillion won. The photo shows the KEPCO Seoul Headquarters in Jung-gu, Seoul. 2022.5.13

ryousanta@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, Unauthorized reproduction and redistribution prohibited>

[Asia Economy Sejong=Reporter Lee Jun-hyung] Korea Electric Power Corporation (KEPCO), which is mired in deficits, plans to sell its stake in its subsidiary Korea Electric Power Technology (KEPCO Tech) starting this September. Given the limited scope for electricity rate hikes, KEPCO has determined that accelerating asset sales is necessary to resolve its financial difficulties. The likely method of sale is a block deal (off-hours large-volume trading).

According to related government departments on the 25th, KEPCO recently began selecting an advisory firm for the sale of its KEPCO Tech shares. KEPCO is selling a 14.77% stake in KEPCO Tech, valued at approximately 400 billion KRW. KEPCO plans to select an advisory firm by next month and to officially begin the sale of KEPCO Tech shares starting in September.

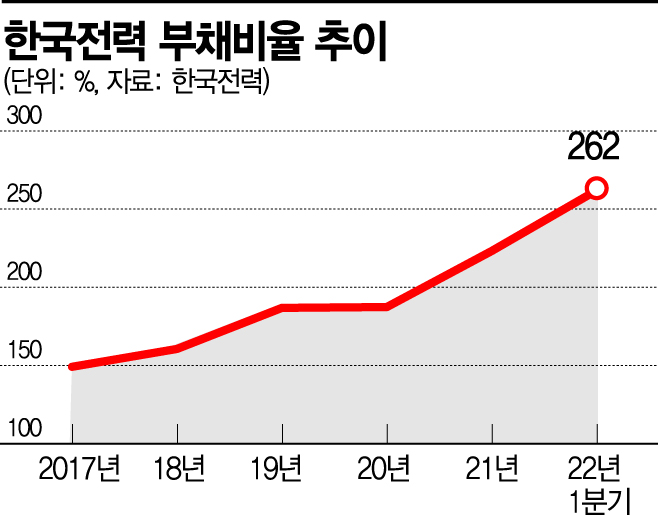

The reason KEPCO is pushing for the sale of KEPCO Tech shares is simple: selling electricity at a loss has caused deficits to balloon like a snowball. KEPCO already posted a deficit of 7.7869 trillion KRW in the first quarter alone. Industry insiders expect KEPCO’s deficit to exceed 13 trillion KRW in the first half of this year. Although the government revised existing regulations and raised electricity rates by 5 KRW per kWh in the third quarter, there are projections that KEPCO could face a deficit exceeding 30 trillion KRW this year.

In response, KEPCO decided in May to implement a high-intensity self-rescue plan, including the sale of its KEPCO Tech shares. Currently, KEPCO holds a 65.77% stake in KEPCO Tech. Selling the 14.77% stake it owns would reduce its shareholding to 51%, but it would still retain management control. From KEPCO’s urgent perspective, selling KEPCO Tech shares worth 400 billion KRW was an unavoidable part of its self-rescue measures to secure funds.

The block deal method is being strongly considered for the sale. A block deal is a transaction method where shares are sold in large volumes after market hours at a discounted price to minimize market impact. KEPCO also attempted a block deal sale of a 5.34% stake in KEPCO Tech in 2016 to reduce market shock, but the sale was ultimately canceled.

KEPCO is reportedly aiming to complete the sale of KEPCO Tech shares by next year at the latest. There is a high possibility that the shares KEPCO offers could be sold within this year. KEPCO Tech’s value has risen since the current government took office because it possesses nuclear power plant design technology. KEPCO Tech is recognized for its world-class technology, having designed the Barakah Nuclear Power Plant in the United Arab Emirates (UAE).

However, some view the sale of KEPCO’s equity stakes, including KEPCO Tech, as merely a temporary fix. They argue that fundamental measures such as electricity rate hikes are necessary to reduce KEPCO’s deficits.

This is why the Ministry of Trade, Industry and Energy, the main government department in charge, has left open the possibility of raising electricity rates in the fourth quarter. A ministry official stated, "If it is judged necessary to raise (electricity rates) further based on future fuel cost trends, the fuel cost linkage system regulations can be revised again," adding, "The revision process itself is relatively straightforward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.