KODEX WTI Wonyu Seonmul Inbeoseu(H) +2.35%

TIGER Wonyu Seonmul Inbeoseu(H) +2.53%

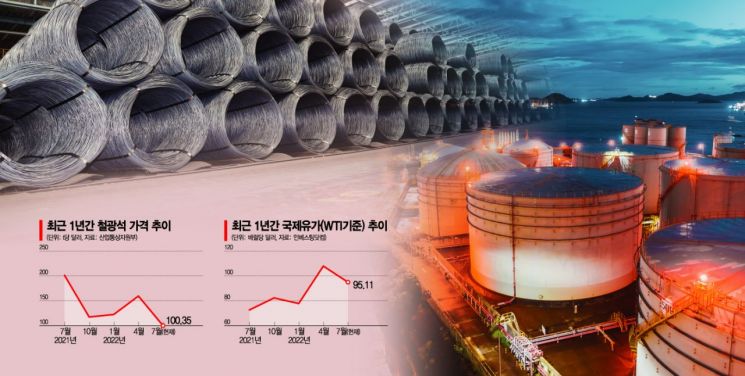

Oil Demand Expected to Decrease Due to Recession Risk

Falls Below 100 Dollars

[Asia Economy Reporter Hwang Yoon-joo] Investors who bet on a decline in crude oil prices have smiled after a month. As concerns over an economic recession emerged and crude oil prices fell from the $120 range per barrel to the $90 range, crude oil inverse exchange-traded funds (ETFs) recently turned to positive (+) returns over the past month.

According to the Korea Exchange on the 25th, the one-month return of ‘KODEX WTI Crude Oil Futures Inverse (H)’ recorded +2.35%. During the same period, ‘TIGER Crude Oil Futures Inverse (H)’ also posted +2.53%. The three-month returns of the two ETFs were -5.74% and -6.04%, respectively.

An inverse product generates profits when the index or price falls. The reason crude oil inverse ETFs turned to ‘+’ returns is that international oil prices slightly declined over the past month.

The price of West Texas Intermediate (WTI) crude oil steadily rose after the Russia-Ukraine war (February 25) and reached an annual high of $123.70 per barrel on March 8. In June, it was still in the $120 range (June 8: $122.11) but began to fall, dropping to $94.70 on July 22.

The background for the decline in international oil prices is attributed to concerns over an economic recession. As the possibility of a recession increases, crude oil demand is expected to shrink, causing oil prices to stall.

Reflecting this, ‘KODEX WTI Crude Oil Futures (H)’ and ‘TIGER Crude Oil Futures Enhanced (H)’, which bet on rising oil prices, recorded -4.51% and -4.50%, respectively.

However, there are differing views on whether the crude oil market has entered a bear market. Supply and demand forecasts from global investment banks (IBs) and energy agencies diverge, and the possibility of increased production is also limited.

In energy outlook reports released last week by the U.S. Energy Information Administration (EIA), the Organization of the Petroleum Exporting Countries (OPEC), and the International Energy Agency (IEA), all forecasted an increase in crude oil demand through 2023.

OPEC projected that crude oil demand would increase by 3.37 million barrels per day in 2022 and 2.7 million barrels per day in 2023, while the IEA expected increases of 1.7 million barrels per day and 2.1 million barrels per day, respectively. OPEC had a more optimistic outlook on the global economy compared to the IEA.

Above all, U.S. President Joe Biden did not receive a firm commitment from Saudi Arabia to increase crude oil production. Saudi Arabia’s crude oil production is currently 10.55 million barrels per day. It has already expanded to 12 million barrels per day and stated that there is no capacity for further increases.

Kim So-hyun, a researcher at Daishin Securities, analyzed, "Currently, the possibility of OPEC+ increasing production is limited, while the EIA and OPEC forecast that U.S. crude oil production will increase by 720,000 barrels and 1.29 million barrels in 2022, respectively. Recently, U.S. shale companies are also facing concerns over production disruptions due to supply chain issues and labor shortages. Considering the current crude oil supply and demand situation, it is premature to discuss the crude oil market entering a bear market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)