Stock Price Rises 10% in Last Month

Factory Production Capacity Increased, Securing 1.9 Million Units

Profitability Expected to Improve in Second Half... "Investment Appeal Increases"

[Asia Economy Reporter Minji Lee] Tesla dispelled concerns about its earnings by announcing solid results for the second quarter, and there are opinions that attention should be paid to the increased valuation attractiveness due to the lowered valuation.

On the 25th, Tesla's stock price stood at $816.73. Over the past month, Tesla's stock price rose by 10.80%, seemingly driven by improved investor sentiment toward tech stocks and expectations for earnings.

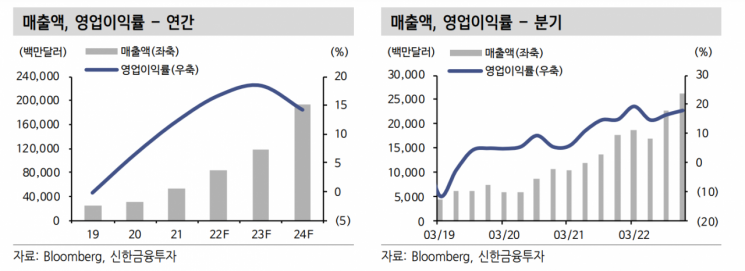

In the second quarter, Tesla recorded revenue of $16.93 billion and an EPS (earnings per share) of $1.95, representing growth of 41.6% and 56.6% respectively compared to the same period last year. These figures exceeded market expectations of $16.88 billion and $1.83 by 0.3% and 24%, respectively. Despite the impact of the Shanghai Gigafactory shutdown, global supply chain constraints, and inflation, increased vehicle deliveries and higher average selling prices drove the strong performance.

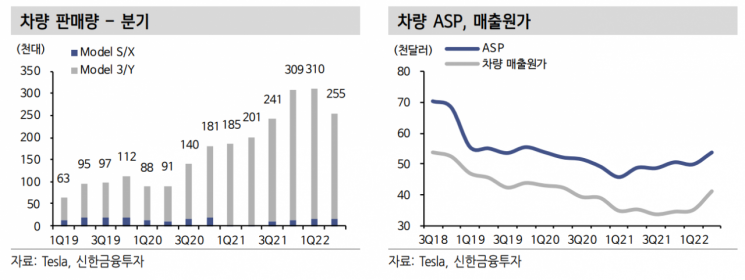

The automotive segment posted revenue of $14.602 billion, with a gross profit margin (GPM) of 27.9%. Electric vehicle production grew significantly year-over-year, with Model S and X increasing by 601%, and Model 3 and Y by 25%, totaling 258,580 units. Deliveries rose by 753% for Model S and X and 20% for Model 3 and Y, reaching 254,695 units. Although the new factories in Texas and Berlin began operations in Q2, electric vehicle sales decreased by 17.9% quarter-over-quarter due to the COVID-19 impact on the China factory. However, the rise in average selling prices helped maintain an operating margin of 14.6%. The energy division recorded revenue of $866 million. Sales of solar and ESS (energy storage systems) increased by 121% and 68% respectively compared to the previous quarter, resulting in a GPM of 11% for the first time in 10 quarters.

Despite supply chain constraints, Tesla's annual sales forecast remains at 1.4 million units, representing a 50% increase compared to the previous year. This is expected to be influenced by expanded production capacity and optimized manufacturing processes. Soohong Cho, a researcher at NH Investment & Securities, stated, "The main issue between electric vehicle demand and supply is supply. The lead time for electric vehicles is still delayed by several months, so resolving supply to meet excess demand is the key issue."

Regarding production capacity, with the resumption of operations at Gigafactory Shanghai and the full-scale operation of new factories, Tesla currently has a production capacity of approximately 1.9 million units. Gigafactory Shanghai is expanding from 500,000 to 1 million units annually, and it is expected that by the end of this year, an annual production capacity of 2.5 million units will be possible. Heeseung Cho, a researcher at Hi Investment & Securities, analyzed, "Considering the large sites of Gigafactory Berlin and Texas, it is highly likely that after the utilization rate reaches a certain trajectory, each will expand to 1 million units. Gigacasting reduces 171 parts to 2, and the number of robots in the new factories is reduced by more than 70%, leading to time and cost savings in vehicle production."

The FSD (Full Self-Driving) beta has been distributed to more than 100,000 customers, and over 35 million miles of autonomous driving data have been collected. Before expanding the beta service across North America by the end of this year, Tesla is considering a price increase. However, with expected profitability improvements, momentum in the stock price is anticipated to continue until the AI Day scheduled for the end of September. Growth in the energy sector is also expected, with demand surging due to the seasonal peak in solar and ESS sales in the second half of the year and extreme heat caused by abnormal weather.

In the securities industry, it is viewed that Tesla's recent stock price has fallen excessively compared to its earnings, so buying should be considered. Tesla's valuation has significantly declined compared to before, compounded by Bitcoin volatility and issues related to the Twitter acquisition. It is estimated that the risk of stock price volatility has been partially alleviated by selling 75% of its Bitcoin holdings.

Hyungdo Ham, a researcher at Shinhan Financial Investment, said, "With the decline in global raw material prices, Tesla's cost increase rate has slowed since the second quarter, and momentum in the stock price is expected to continue until AI Day at the end of September. The greater the uncertainty over fossil fuel prices, the more we should keep open the growth potential for solar + ESS," he added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.