KEPCO Selling Electricity at a Loss... Q2 Deficit Expected at 5.5 Trillion Won

Limits to Company Bond 'Rollovers'... 15.5 Trillion Issued in H1

Government to Raise Electricity Rates by 5 Won in Q3... Annual Maximum Adjustment Limit

Possibility of Q4 Increase Also Open... "Terms May Be Revised If Necessary"

KEPCO Reports Q1 Operating Loss of 7.8 Trillion Won, Record High... "Impact of High Oil Prices and Frozen Electricity Rates"

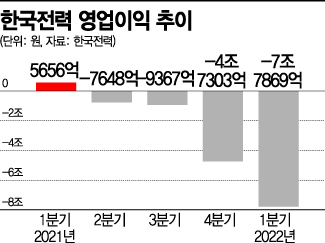

KEPCO Reports Q1 Operating Loss of 7.8 Trillion Won, Record High... "Impact of High Oil Prices and Frozen Electricity Rates"(Seoul=Yonhap News) Reporter Ryu Hyorim = Korea Electric Power Corporation (KEPCO) announced on May 13 that its consolidated operating loss for the first quarter of this year was 7.7869 trillion won, marking a turnaround from an operating profit of 565.6 billion won in the same period last year. Sales increased by 9.1% compared to the same period last year, reaching 16.4641 trillion won. Net loss also turned to a deficit of 5.9259 trillion won. The photo shows the KEPCO Seoul Headquarters in Jung-gu, Seoul. 2022.5.13

ryousanta@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, Unauthorized reproduction and redistribution prohibited>

[Asia Economy Sejong=Reporter Lee Jun-hyung] Korea Electric Power Corporation (KEPCO) is expected to post a loss exceeding 13 trillion won in the first half of this year alone. This is because the increase in electricity rates has been sluggish compared to the rising fuel costs such as international oil prices. Although the government raised the electricity rate hike to the maximum limit in the third quarter to reduce KEPCO's deficit, it is analyzed that a further electricity rate increase in the fourth quarter is inevitable.

According to financial information company FnGuide on the 23rd, KEPCO's operating profit consensus (forecast) for the second quarter of this year was recorded as a loss of 5.4836 trillion won. Considering that KEPCO posted a loss of 7.7869 trillion won in the first quarter, the operating loss for the first half of this year far exceeds 13.2 trillion won. Compared to last year's total deficit (about 5.9 trillion won), which was the largest operating loss on an annual basis in KEPCO's history, this is more than double the amount.

KEPCO fell into a 'deficit swamp' because it has been selling electricity at a loss. Since the Ukraine crisis, energy prices such as international oil prices have continued to soar, but electricity rates have not kept pace with the increase in fuel costs. This created a distorted structure where the more electricity KEPCO sells, the greater the loss becomes. According to the Korea Power Exchange and others, the wholesale electricity price (SMP), which is the price KEPCO pays to power producers for electricity, was 177.39 won per kWh from January to May this year, while the electricity selling price was only 108.2 won per kWh.

Corporate Bond Issuance Reaches Limit... The Second Half Remains Challenging

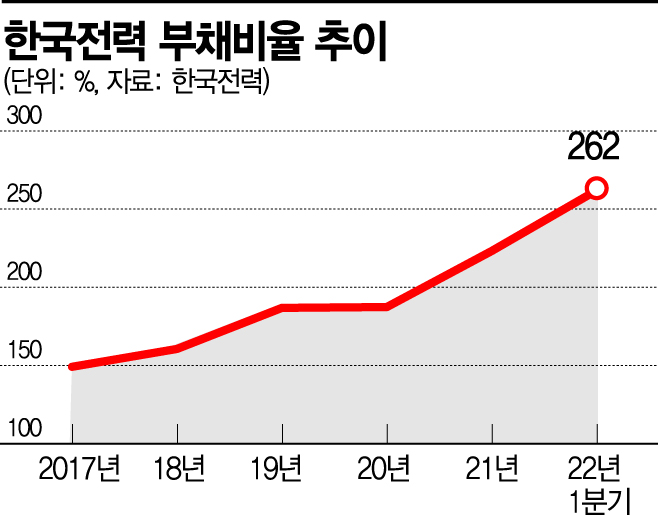

Issuance of corporate bonds has also reached its limit. KEPCO issued corporate bonds worth 15.5 trillion won in the first half of this year alone. The amount of corporate bonds issued in the past six months is about 1.5 times the total issuance of 10.43 trillion won last year. The power industry expects KEPCO's corporate bond issuance this year to exceed 30 trillion won. Since the issuance limit for KEPCO's corporate bonds is restricted to less than twice the capital and reserves, there is also a forecast that the 'rolling over' of operating funds through debt may soon reach a critical point.

This is why the government raised the fuel cost adjustment unit price by 5 won per kWh in the third quarter at the end of last month. The fuel cost adjustment unit price is one of the components of electricity rates and is adjusted quarterly to reflect fluctuations in fuel costs. Earlier, the government introduced a fuel cost linkage system at the beginning of last year and limited the increase in the fuel cost adjustment unit price to a maximum of 3 won per quarter for price stability. However, as KEPCO's deficit snowballed due to selling electricity at a loss, the government revised the existing regulations and raised the third quarter fuel cost adjustment unit price increase to the annual maximum adjustment limit of 5 won.

The problem is that there is little room for KEPCO's performance to improve in the second half of the year. Initially, KEPCO calculated that the third quarter fuel cost adjustment unit price increase should be 33.6 won per kWh. This means that to avoid selling electricity at a loss amid soaring fuel costs, electricity rates in the third quarter should be raised by at least 33.6 won. However, given the high inflation situation where the consumer price index rose to over 6% last month for the first time in 23 years, it is practically impossible for the government to raise electricity rates by 33 won, which directly affects the livelihood of low-income households.

Projected Deficit of '30 Trillion' This Year... Will Electricity Rates Rise in the Fourth Quarter?

There is also an analysis that KEPCO could post a deficit exceeding 30 trillion won this year. Hana Securities recently forecasted in a report that KEPCO's deficit this year could reach 30.2201 trillion won. The securities industry's consensus on KEPCO's operating loss this year is also estimated at 23.274 trillion won. This suggests that KEPCO is highly likely to post a deficit of at least 10 trillion won in the second half of this year alone.

Given this situation, there is growing support for an additional increase in the fuel cost adjustment unit price. The government has already revised the existing fuel cost linkage system regulations and raised the third quarter fuel cost adjustment unit price to the maximum annual limit. However, if the government revises the regulations again, the fuel cost adjustment unit price for the fourth quarter can be further increased.

The Ministry of Trade, Industry and Energy, the competent authority, is also keeping the possibility of a fourth-quarter electricity rate hike open. A ministry official said, "If it is judged that electricity rates need to be raised further while monitoring future fuel cost trends, the fuel cost linkage system regulations can be revised again," adding, "The revision process itself is not very complicated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)