CJ Freshway expects 47% YoY increase in Q2 operating profit

Shinsegae Food and Hyundai Green Food also forecast recovery

Performance improvement expected in the second half of the year

[Asia Economy Reporter Eunmo Koo] As social distancing measures are lifted and the long tunnel of COVID-19 is behind us, the recovery of the dining-out market is gaining momentum, raising expectations that the three major food ingredient companies?CJ Freshway, Hyundai Green Food, and Shinsegae Food?will all benefit in the second quarter of this year.

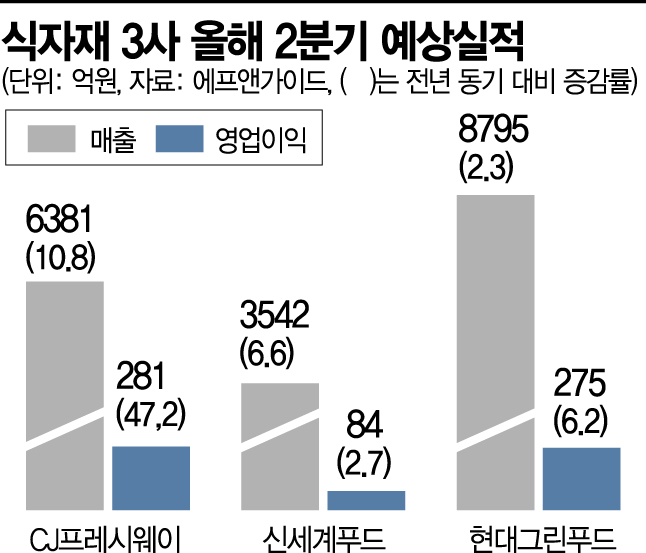

According to financial information provider FnGuide on the 25th, CJ Freshway's second-quarter sales are estimated to reach 683.1 billion KRW, a 10.8% increase compared to the same period last year. Operating profit is also expected to rise by 47.2% to 28.1 billion KRW. During the same period, Shinsegae Food's sales are projected to increase by 6.6% to 354.2 billion KRW, with operating profit rising 2.7% to 8.4 billion KRW. Hyundai Green Food is also forecasted to see sales and operating profit grow by 2.3% and 6.2%, respectively, reaching 879.5 billion KRW and 27.5 billion KRW compared to the previous year.

With the lifting of social distancing and the easing of the prolonged impact of COVID-19, food ingredient companies are showing signs of a solid performance recovery. As the dining-out market rebounds, demand from various channels such as restaurants and pubs is surging, driving up food ingredient sales. Group catering, which had declined due to the prolonged pandemic, is also returning to pre-pandemic levels as remote work restrictions are lifted after the second quarter.

Notably, CJ Freshway's growth rate stands out. While most food companies are negatively affected by rising raw material prices, CJ Freshway is evaluated to potentially benefit from inflation. Jiwoo Oh, a researcher at Ebest Investment & Securities, analyzed, "The overall price increase in groceries directly translates into margin gains, allowing the company to enjoy a windfall profit. Being a business-to-business (B2B) company, it is relatively better positioned to defend profitability compared to business-to-consumer (B2C) companies." Additionally, the completion of divesting underperforming businesses such as overseas catering and meat processing over the past two years since 2020 has contributed to improving the company's structure.

The positive trend in food ingredient companies' performance is expected to continue into the second half of the year. As reopening accelerates, outdoor activities and floating populations are increasing, and demand for leisure and concession businesses (food and beverage consignment operations) is also expected to grow. Furthermore, government policies are gradually strengthening transparency in food ingredient distribution transactions and tightening regulations related to food quality, which is leading to an increasing share of corporate-type players in the food ingredient distribution market?an encouraging factor for large food ingredient companies.

New businesses such as plant-based food ventures also provide reasons to look forward to the second half. Earlier this month, Hyundai Green Food launched ‘Greeting,’ its own care food specialty brand, with a new vegetarian convenience meal product called ‘Vege Life.’ Alongside this, the company plans to distribute its self-developed B2B alternative meat ingredients, ‘Vege Meatball’ and ‘Vege Hamburg Steak,’ to its food ingredient supply clients. Shinsegae Food recently opened ‘The Better,’ Korea’s first plant-based meat deli, and plans to nurture its alternative meat brand ‘Better Meat’ as a market-leading brand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.