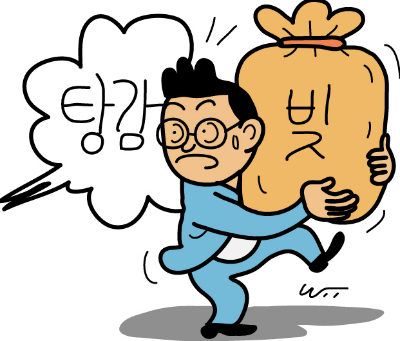

[Debt Relief Controversy①]

Financial Services Commission Announces 'New Start Fund' for Small Business Owners,

Becomes a Hot Topic in Debt Forgiveness Debate

Only Possible When 90-Day Delinquency and Proof of No Assets or Repayment Ability

Debt Relief Leaves Records and Limits Credit Score Recovery

Long-Term Installment Repayment with Commercial Banks Should Be Maximized Over Forgiveness

[Asia Economy Reporter Sim Nayoung] "It seems like the loans taken during COVID-19 will be forgiven."

"I took out a loan of 30 million won, but I wonder if that's really the case..."

"I heard only those who are over 90 days delinquent are eligible."

"Then we might as well become delinquent too."

These are comments posted on June 19th in the self-employed community 'Apeunikka Sajangida' (Because It Hurts, I'm a Boss). As the Financial Services Commission announced the creation of a 30 trillion won New Start Fund to provide principal reductions for self-employed and small business owners affected by COVID-19, debt forgiveness has become a hot topic among small business owners. From application conditions to the scale of forgiveness and concerns about moral hazard, to the frustration that only those who have repaid diligently are at a disadvantage, the unprecedented measure is stirring up the bosses.

An official from a commercial bank said, "Among small business owners, there seems to be a prevailing sentiment of 'the government will save us, so let's not repay for now and wait.'" He added, "Those self-employed who are still interested in repaying their debts are truly a very small minority compared to the total loan volume." This atmosphere can be inferred from the fact that the self-employed and small business owner soft-landing programs introduced early by commercial banks have had little presence.

Kookmin Bank introduced the 'COVID-19 Special Operation Long-Term Installment Conversion Program' last May to help small business owners repay loans more easily. This measure allows small business owners who have received special support such as maturity extension or interest payment deferral, which ends in September, to repay loans over a maximum of 10 years. However, although it has been almost two months since the product was launched, it is known that only a few dozen have signed up.

If Delinquent for 90 Days, All Financial Activities Halted... 90% Forgiveness Will Be Rare

On the 22nd, a business owner is updating the menu with increased prices at a restaurant in downtown Seoul, where self-employed individuals are struggling due to soaring inflation. Photo by Mun Ho-nam munonam@

On the 22nd, a business owner is updating the menu with increased prices at a restaurant in downtown Seoul, where self-employed individuals are struggling due to soaring inflation. Photo by Mun Ho-nam munonam@

The problem is that blindly hoping for debt forgiveness could lead to serious trouble. The government announced that the Korea Asset Management Corporation will establish a 30 trillion won 'New Start Fund' by the end of September to begin debt restructuring. One of the main functions of the New Start Fund is principal reduction ranging from a minimum of 60% to a maximum of 90%. Applications are accepted only from delinquent borrowers who have been overdue on principal or interest for 90 days, and during this process, the Credit Recovery Committee evaluates the delinquent borrower's assets, income, and repayment ability to select the final candidates.

An official from the Financial Services Commission said, "If a borrower is delinquent for 90 days, all banking transactions are suspended, so they cannot engage in any financial activities such as card issuance or additional loans." He added, "Among these small business owners in such a state, the reduction rate is determined by assessing assets, income, and repayment ability, so only a minority will actually receive up to 90% principal forgiveness." He continued, "If someone receives a 60% principal reduction and has to repay 40%, they cannot engage in normal financial activities until the 40% is fully repaid."

To receive principal reduction, it must be proven that assets are less than liabilities and that there is no repayment ability. A Credit Recovery Committee official explained, "To prevent moral hazard, documents from past periods, including local tax payment records for the past three years, must be submitted. Those who have assets and are engaged in income-generating activities are not eligible for support."

Forgiveness Leaves a Record and Credit Score Recovery Takes a Long Time

Even if one passes the screening and receives debt forgiveness, a stigma remains. Since this is a relief measure outside of normal financial transactions, a record remains that normal credit was not maintained. The financial delinquency record for 90 days is kept for seven years and can be accessed by all financial institutions, and it can also be confirmed that the principal reduction was obtained through policy measures. Those who receive forgiveness face restrictions such as a longer time to recover their credit score compared to those who have repaid their debts.

A Credit Recovery Committee official emphasized, "The most desirable method is to actively use the installment repayment system of commercial banks and repay slowly." The Financial Services Commission is considering measures to encourage banks to directly induce debt restructuring measures similar to the fund (repayment deferral period of 1 to 3 years, long-term installment repayment of 10 to 20 years) for borrowers excluded from the 'New Start Fund' support. This can be seen as an extension of Kookmin Bank's 'COVID-19 Special Operation Long-Term Installment Conversion Program.'

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "In the current period of rising interest rates, it is necessary to selectively support self-employed people in difficult situations with principal reductions, which also helps the financial system." He added, "However, expanding the scope of debt forgiveness should be approached with caution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)