Delta Air Lines aircraft (Source: Delta Air Lines website)

Delta Air Lines aircraft (Source: Delta Air Lines website)

[Asia Economy Reporter Minji Lee] Delta Air Lines is expected to continue its performance improvement in the third quarter due to a rapid recovery in boarding rates. However, it is analyzed that in order for the stock price to rise, supply capacity that can meet demand and normalization of oil prices must be achieved.

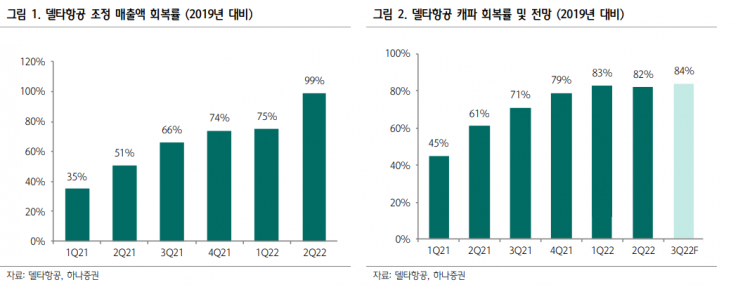

On the 16th, Delta Air Lines reported second-quarter revenue of $13.82 billion and adjusted EPS of $1.44, marking a 94% growth and a return to profitability compared to the same period last year. Revenue slightly exceeded market expectations, while adjusted EPS fell short. Strong travel demand led to a 10% increase in revenue compared to 2019.

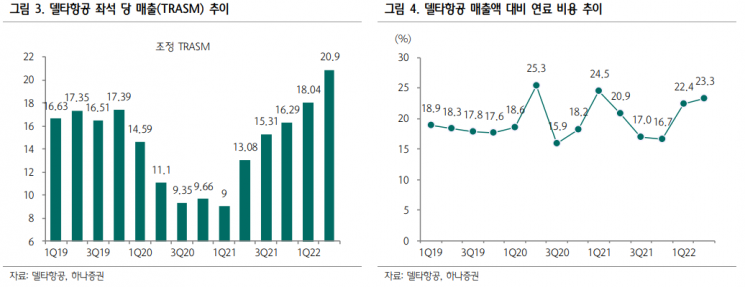

Jaeyim Kim, a researcher at Hana Securities, said, "Although higher-than-expected jet fuel prices and temporary costs caused by six weeks of operational disruptions in the latter part of the quarter negatively impacted profits, strong top-line growth led to a return to profitability," adding, "The recovery rate of operating capacity was about 82%, slightly below the guidance of 84%."

Compared to 2019, adjusted revenue was -15% in March but rose to 4% in June. Domestic passenger revenue in the second quarter was 3% higher than in 2019, and domestic business travel revenue recovered to 80% of 2019 levels. Overseas business travel revenue recovered to 65%, with the Atlantic region showing a recovery level comparable to domestic. Domestic premium seat revenue increased rapidly to 10% compared to 2019, outpacing economy seats. For international routes, Latin America and Atlantic revenues exceeded 2019 levels in June. Researcher Jaeyim Kim analyzed, "Many companies plan more overseas business trips in the third and fourth quarters, so despite it being a relatively off-season, strong business travel and international demand recovery will continue to drive top-line growth."

The third-quarter revenue guidance is projected at $12.6 billion to $13.1 billion, with an operating margin of 11-13%. Revenue is expected to increase by 1-5% compared to the third quarter of 2019. Operating capacity is forecasted at around 84%. The annual capacity outlook was lowered by 5 percentage points to 85% from the previous guidance. This is attributed to the reduction of flight schedules to minimize delays caused by current labor shortages following workforce cuts due to COVID-19. Many employee hiring processes are currently underway, and full normalization is expected around mid-next year.

For a stock price rebound, recovery of supply capacity sufficient to meet demand is essential. Earlier, the company announced plans at the end of May to reduce about 100 flights per day, accounting for 2% of total flights, from July through August. Wonju Lee, a researcher at Kiwoom Securities, said, "Despite fare increases and concerns over worsening economic outlook, solid travel demand continues, and corporate business trip booking rates are increasing in the second half, so demand prospects are positive. However, capacity constraints and cost issues due to labor shortages are acting as obstacles to performance improvement," adding, "Regarding jet fuel prices in the third quarter, based on Brent crude prices of $107 per barrel in early July, prices were set at $3.45 to $3.60 per gallon, and normalization of oil prices will also influence the stock price direction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)